The prevalence of nonalcoholic steatohepatitis (NASH), a more advanced stage of nonalcoholic fatty liver disease (NAFLD), with no FDA-approved therapies, continues to increase. In May 2023, two companies led the race to commercialisation: Intercept Pharmaceuticals and Madrigal Pharmaceuticals.

However, in June 2023, Intercept dropped out of the race following the receipt of a complete response letter (CRL) from the FDA for obeticholic acid (OCA) as a treatment for NASH. As a result, the company announced restructuring and the discontinuation of all NASH-related investments. Recall, this is the company’s second attempt for approval, following the receipt of its first CRL from the FDA in June 2020.

As such, Madrigal’s resmetirom (selective thyroid hormone receptor-β agonist; THR-Beta agonist) will most likely be the first drug candidate approved for NASH in both the US and EU. For context, on 17 July 2023, the company announced the completion of its rolling submission of its New Drug Application (NDA) to the FDA for resmetirom for the treatment of adults with NASH with liver fibrosis. Of note, Madrigal has also requested a priority review of the resmetirom NDA.

Even though the NASH market remains a lucrative one based on its increasing prevalence and need for approved therapies, data from GlobalData’s Deals database reveals a different level of sentiment and one that represents a modest outlook. This article will discuss deal activity within the NASH space between 2018 and 2022 and what it reflects for the wider NASH space.

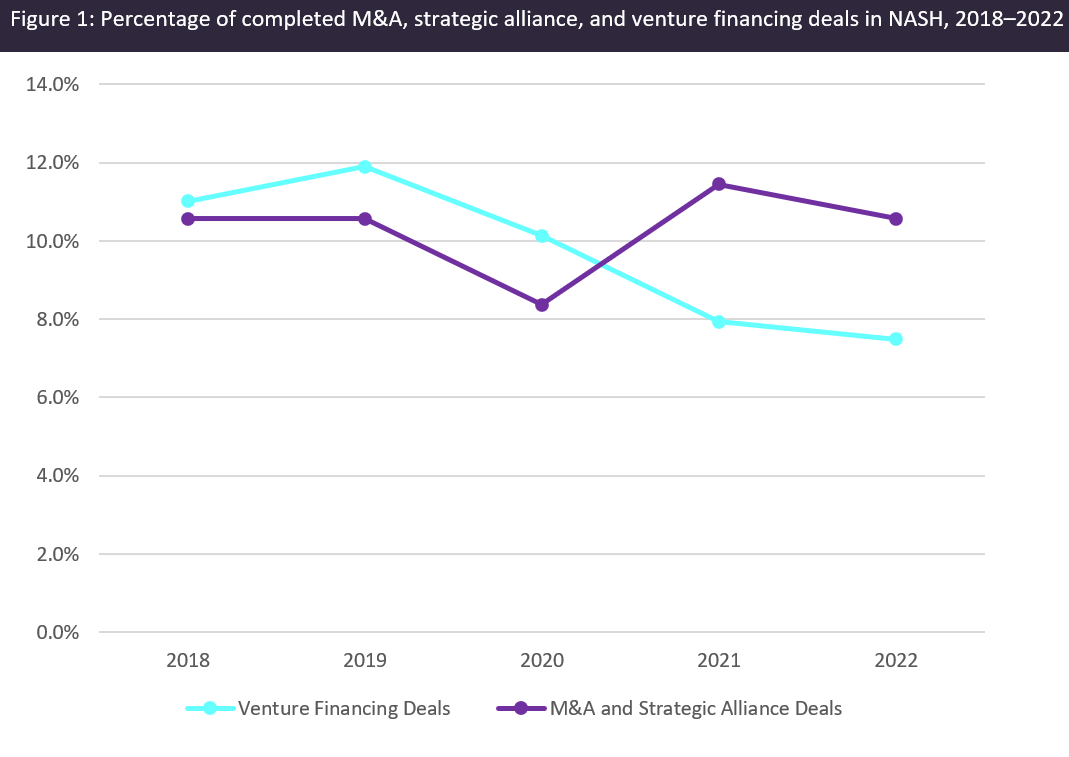

Figure 1 (above) provides an overview of completed mergers and acquisitions (M&A) and strategic alliance deal activity for NASH, as well as venture financing activity for NASH in seven major markets (7MM: US, France, Germany, Italy, Spain, UK, and Japan). The lack of FDA-approved therapies coupled with the emergence of research highlighting the benefits of combination treatments has continued to attract several big pharmaceutical and biotech companies (e.g., Gilead Sciences, Novo Nordisk, Eli Lilly, and AstraZeneca) to try their hand at developing a successful asset for NASH. While most assets have suffered the same fate as Intercept’s OCA, these attempts have fueled a certain degree of M&A and strategic alliance deal activity between 2018 and 2022. However, as seen in Figure 1, M&A and strategic alliance deal activity remained relatively flat from 2018 to 2022, potentially due to the high proportion of agents in the early stages of development.

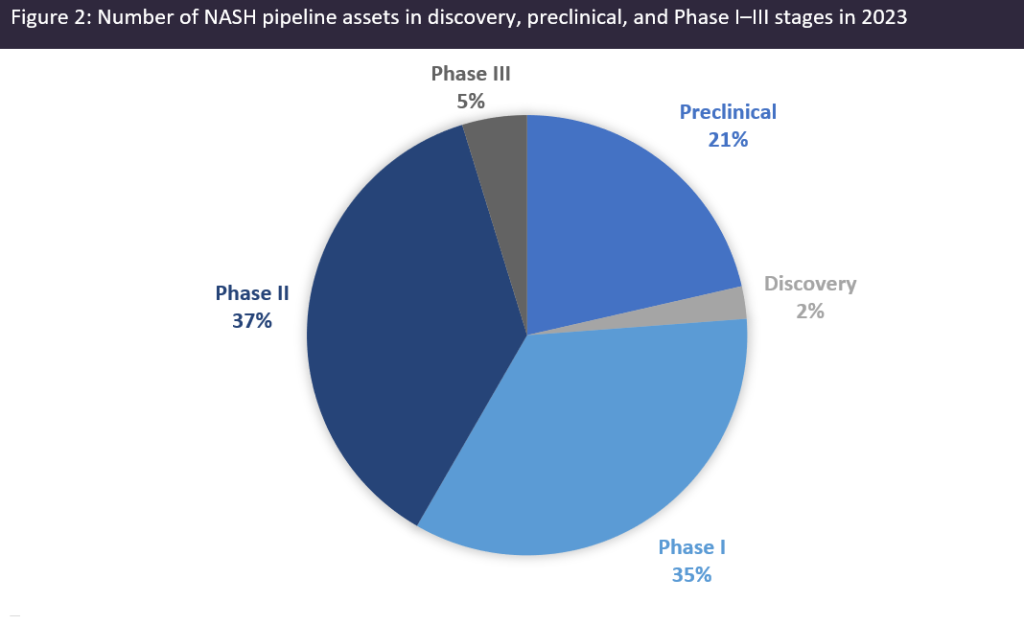

Specifically, Figure 2 shows that only 5% (4) of the total number of NASH pipeline assets (84) are in Phase III development, with slightly more than 50% of these assets in the discovery, preclinical, and Phase I stages of development. On a slightly diminishing note, it appears that venture financing deals have been decreasing, most likely due to the current macroeconomic environment factors such as the impact of the Covid-19 pandemic, and increasing inflation and cost of capital, leading to less-risky investments.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData

With the slow recovery of the pharma/biotech markets, in addition to the increasing therapeutic potential of combination treatments, it is possible that investments in the pharma/biotech space may continue to decrease in the short term. However, it is anticipated that the trend may be reversed with ongoing developments within the NASH pipeline landscape. Established companies may look to develop combination therapies to target the multiple stages of NASH progression to develop a successful treatment to increase their chance of success in the NASH market. Notably, Novo Nordisk is currently developing its glucagon-like peptide-1 receptor agonist (GLP-1RA), semaglutide, as a monotherapy for patients with Stage F2/F3 NASH (NCT04822181), while exploring semaglutide and cilofexor + firsocostat as a combination therapy for patients with Stage F4 NASH with cirrhosis (NCT04971785), in partnership with Gilead Sciences. Therefore, as the market becomes more saturated and companies are able to capitalize on clinical trial data, it is likely that late-stage partnering activity will begin to rise.