During the 10th Annual Immuno-Oncology 360° (IO360) Conference on 27–29 February, 2024, much of the focus was on new data for programmed cell death protein 1 (PD-1) inhibitors and viral oncolytic immunotherapy programs. Updates from PD-1 inhibitor clinical trials were presented, including for GSK’s Jemperli (dostarlimab) in high microsatellite instability (MSI-high) rectal cancer and Merck & Co’s Keytruda (pembrolizumab) in non-small cell lung cancer (NSCLC), as was promising preclinical data on KaliVir Immunotherapeutics’s oncolytic virotherapy, VET3-TGI.

Jemperli data update for MSI-high rectal cancer

Approximately 5–10% of rectal cancers exhibit deficient mismatch repair (dMMR), a molecular phenotype associated with resistance to conventional chemotherapy. Emerging immunotherapeutic strategies, notably checkpoint blockades, offer promising avenues for treatment. Among these, Jemperli, a monoclonal antibody targeting the PD-1 pathway, has shown considerable efficacy in dMMR rectal cancer.

Initial findings from the GARNET trial indicate the sustained effectiveness of Jemperli as a standalone treatment in patients with advanced or recurring solid tumours characterised by dMMR, MSI-H, or altered polymerase epsilon (POLE). These patients typically have limited treatment options. This open-label Phase I study enrolled 363 patients with dMMR, MSI-H, or POLE-altered tumours, who had undergone at least one prior treatment. Preliminary analysis revealed an overall response rate (ORR) of 44.0% in the dMMR rectal cancer subgroup, with a median duration of response (mDOR) not yet determined (ranging from 1.18 months to 47.21 months). The median follow-up period was 27.7 months. Similar outcomes were observed for the entire efficacy population, which included patients with dMMR and either MSI-H or POLE-altered tumours, with a median follow-up of 29.1 months. Notably, 72.2% of responders with dMMR exhibited sustained responses lasting 12 months or more. Median progression-free survival (PFS) was seven months for dMMR patients and the efficacy population, while median overall survival (OS) was not reached across all patient groups.

Such results signify the possibility of Jemperli bringing about a transformation in the standard of care, offering hope to MSI-H rectal cancer patients and an alternative to patients who progress after front-line treatment. Jemperli commands a strong market position, as the first-line MSI-H rectal cancer treatment market is relatively sparse. GlobalData’s analyst consensus forecast estimates Jemperli to reach $727 million in global sales across all cancers by 2030.

Progress update on KEYNOTE-671: a perioperative treatment for NSCLC

Surgical resection remains the primary approach for managing early-stage NSCLC. Nevertheless, there is an unmet demand for effective adjuvant and neoadjuvant therapies in this patient cohort. Conventional chemotherapy has demonstrated limited efficacy in these settings for NSCLC, resulting in only marginal improvements of 5.4% for adjuvant therapies and 5% for neoadjuvant therapies in the five-year survival rate. However, recent advancements in targeted therapy and immunotherapy have significantly enhanced the survival prospects for individuals with advanced NSCLC, including Merck & Co’s anti-PD-1 therapy Keytruda.

After receiving FDA approval in October 2023, the EMA’s Committee for Medicinal Products for Human Use (CHMP) recommended the approval of neoadjuvant Keytruda combined with platinum-based chemotherapy, followed by adjuvant Keytruda monotherapy for treating adult patients with high-risk, resectable NSCLC. This recommendation is based on the Phase 3 KEYNOTE-671 trial, which is a randomised, double-blind, placebo-controlled clinical study involving patients with previously untreated and surgically resectable stage II, IIIA, or IIIB NSCLC. The trial demonstrated a significant improvement in OS and event-free survival (EFS) compared to placebo in this patient cohort. The median OS was yet to be reached in the Keytruda combination arm (n = 397) versus 52.4 months in the placebo arm (n = 400), resulting in a 28% reduction in the risk of death. Additionally, the median EFS was not yet reached in the Keytruda arm based on investigator assessment, compared to 17 months in the placebo arm. The safety profile of the combined regimen was consistent with the safety profiles of individual medications, with no new safety signals identified.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataKeytruda will face fierce competition in the NSCLC space. Last year, Bristol Myers Squibb’s Opdivo (nivolumab), in combination with chemotherapy, received FDA approval as a neoadjuvant therapy, excluding the post-surgery adjuvant element, for resectable NSCLC following results from the CheckMate-816 trial. The interconnected utilisation of Keytruda in both neoadjuvant and adjuvant contexts imposes constraints on clinicians’ prescribing latitude compared to Opdivo, which benefits from a more versatile approval status. However, Keytruda’s approval extends to patients with stage IIIb NSCLC, a demographic outside of Opdivo’s approval scope. GlobalData’s NSCLC patient-based forecast estimates 2029 sales for Keytruda to reach $7.8 billion in the eight major markets (US, France, Germany, Italy, Spain, UK, Japan, and China).

Development of VET3-TGI

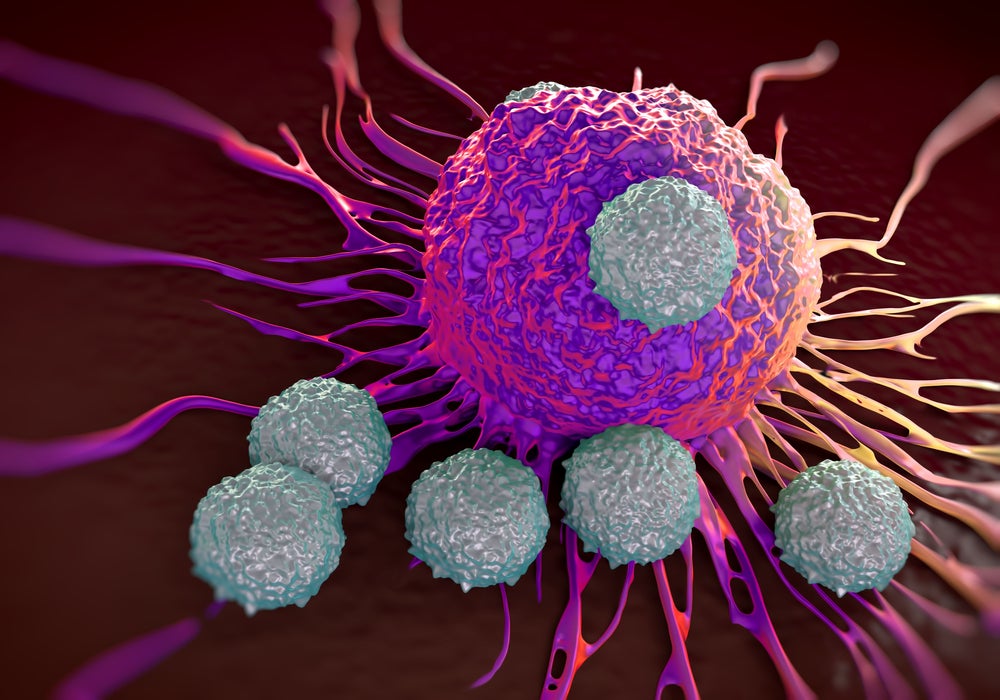

KaliVir Immunotherapeutics presented data on its leading preclinical candidate, VET3-TGI. VET3-TGI stands out due to its unique ability to be administered systemically while specifically targeting the tumour microenvironment through the inhibition of transforming growth factor-beta (TGF-beta), overcoming the traditional limitations of intratumour delivery for this modality.

The therapeutic efficacy of VET3-TGI was evaluated across various in vivo mouse tumour models, encompassing melanoma, colorectal cancer, renal cancer, and breast cancer. VET3-TGI demonstrated robust therapeutic activity, achieving complete responses in multiple models, even at doses significantly lower than anticipated clinical doses. Post-mortem analysis revealed significant alterations in the tumour microenvironment following VET3-TGI treatment, characterised by heightened infiltration of CD3+ and CD8+ T cells, polarisation towards a type-1 immune response, and concurrent reduction in TGF-beta 1-associated gene expression. These results justify further clinical development of the candidate, as advancements in technologies facilitating precise intravenous delivery to tumour sites determine the future success of the oncolytic viral therapies.