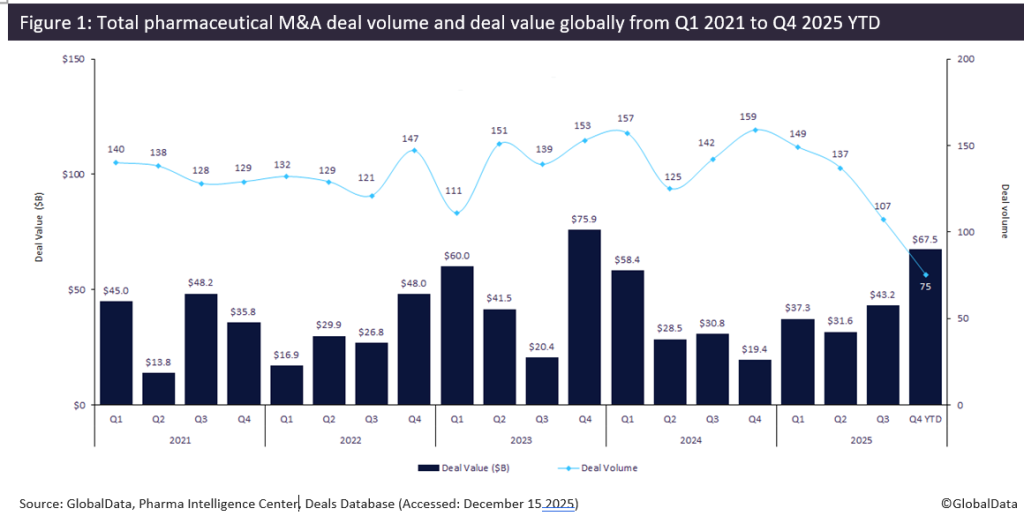

Mergers and acquisitions (M&As) in the pharmaceutical industry already witnessed a 31% increase in total deal value from $137.1 billion in 2024 to $179.6 billion in 2025 year-to-date (YTD), following a previous year characterised by smaller, bolt-on transactions, according to GlobalData’s Pharma Intelligence Center Deals Database.

In the first half (H1) of 2025, uncertainty surrounding US President Trump’s policies heightened the perceived risk of large-scale M&A. This led to drug manufacturers limiting their M&A activity to transactions valued under $5 billion, with exceptions including Johnson & Johnson’s $14.6 billion acquisition of Intracellular Therapies and Sanofi’s $9.5 billion acquisition of Blueprint Medicines.

As large pharmaceutical companies adapted to Trump’s tariffs and drug pricing policies, deal-making uncertainty began to ease. In addition, Federal Trade Commission (FTC) deregulation under the Trump administration, combined with recent interest rate cuts by the Federal Reserve, alleviated challenges hindering pharmaceutical companies from signing larger deals. As a result, the third quarter (Q3) of 2025 witnessed an uptick in large M&A transactions exceeding $5 billion, which were unseen in 2024. These mega-deals drove a 36.7% increase in total M&A deal value from the previous quarter, totaling $43.2 billion in Q3 2025, according to GlobalData’s M&A Trends in Pharma – Q3 2025 report. The pace of large-scale M&A has continued into Q4 2025, already surpassing Q3 2025 levels with $67.5 billion in total deal value to date.

Large deals announced in H2 2025 included Novartis’ $12 billion acquisition of RNA therapeutics developer Avidity Biosciences, Merck & Co’s purchases of Verona Pharma and Cidara Therapeutics for $10 billion and $9.2 billion respectively, and Genmab’s $8 billion buyout of Merus, a developer of bispecific antibodies targeting oncology indications. Meanwhile, bidding wars emerged in November 2025 between Pfizer and Novo Nordisk for obesity and metabolic diseases drug developer Metsera, and between Alkermes and Lundbeck for sleep disorder biotech Avadel, including its marketed narcolepsy drug Lumryz (sodium oxybate).

The flurry of large M&A transactions and bidding wars for Metsera and Avadel announced in H2 2025 reflects a need for large pharmaceutical companies to replenish their pipelines through M&A ahead of looming patent cliffs. While this signals renewed optimism for pharmaceutical M&A activity going into 2026, acquirers have demonstrated increased selectivity in 2025, concentrating available capital into a smaller number of acquisitions — particularly involving near-commercial-ready drugs targeting large addressable markets, such as oncology and obesity.

For further insights into M&A activity globally in Q3 2025 in the pharma sector, please see GlobalData’s M&A Trends in Pharma – Q3 2025 report.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData