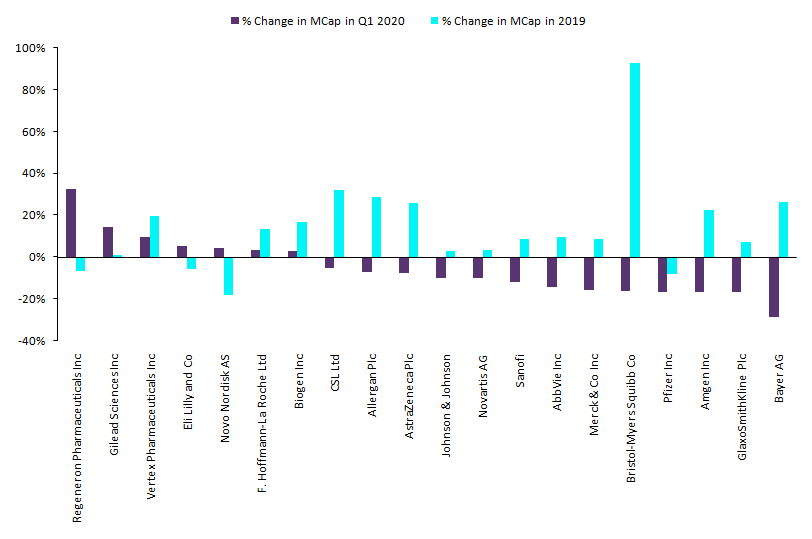

More than half of the top 20 global innovative pharma companies saw a decrease in their market cap (MCap) in the first quarter (Q1) of 2020. Even more worrisome is that nearly all of these pharma companies saw an increase in their MCap over 2019 (Q1 to Q4 2019). The top 20 pharma companies witnessed an overall 7.9% decrease in MCap over Q1 2020 equivalent to $2.2 trillion, in contrast to the 9% increase aggregate MCap of approximately $2.8 trillion over 2019. The reversal of fortune of the companies on this list due to Covid-19 may seem dramatic due to their long-term growth. As all eyes turn to the pharma companies, in particular, those with Covid-19 drugs in clinical trials are somewhat better placed to withstand the impact of the coronavirus pandemic. Johnson & Johnson continues to maintain the top position in the list, though it suffered a 10% decline in its quarter-on-quarter (QoQ) MCap.

| Table 1: Top 20 Global Pharma Companies’ Drugs for Coronavirus Disease (COVID-19) | |||||

| Drug Name | Company Name | Therapy Area | Indication | Development Stage | Drug Geography |

| emtricitabine + tenofovir disoproxil fumarate | Gilead Sciences Inc | Infectious Disease | Coronavirus Disease 2019 (Covid-19) | Unknown | Global |

| secukinumab | Novartis AG | Infectious Disease | Coronavirus Disease 2019 (Covid-19) | Unknown | Global |

| tofacitinib citrate | Pfizer Inc | Infectious Disease | Coronavirus Disease 2019 (Covid-19) | Preclinical | Global |

| imatinib mesylate | Novartis AG | Infectious Disease | Coronavirus Disease 2019 (Covid-19) | Unknown | Global |

| canakinumab | Novartis AG | Infectious Disease | Coronavirus Disease 2019 (Covid-19) | Unknown | Global |

| baricitinib | Eli Lilly and Co | Infectious Disease | Coronavirus Disease 2019 (Covid-19) | Preclinical | Global, US |

| sarilumab (Kevzara) | Regeneron Pharmaceuticals Inc | Infectious Disease | Coronavirus Disease 2019 (Covid-19) | Phase III | Global, Japan, US |

| acalabrutinib maleate | AstraZeneca Plc | Infectious Disease | Coronavirus Disease 2019 (Covid-19) | Phase I | Global |

| hydroxychloroquine | Sanofi | Infectious Disease | Coronavirus Disease 2019 (Covid-19) | Phase I | Global |

| remdesivir | Gilead Sciences Inc | Infectious Disease | Coronavirus Disease 2019 (Covid-19) | Inactive | China |

| remdesivir | Gilead Sciences Inc | Infectious Disease | Coronavirus Disease 2019 (Covid-19) | Phase III | EU, Global, Japan, South Korea, UK, US |

| BMS-986253 | Bristol-Myers Squibb Co | Infectious Disease | Coronavirus Disease 2019 (Covid-19) | Phase I | Global |

| LY-3127804 | Eli Lilly and Co | Infectious Disease | Coronavirus Disease 2019 (Covid-19) | Preclinical | Global |

| Coronavirus Disease 2019 (COVID-19) vaccine | Sanofi | Infectious Disease | Coronavirus Disease 2019 (Covid-19) | Preclinical | Global |

| Coronavirus Disease 2019 (COVID-19) vaccine | Johnson & Johnson | Infectious Disease | Coronavirus Disease 2019 (Covid-19) | Preclinical | Global |

| Coronavirus Disease 2019 (COVID-19) vaccines | Johnson & Johnson | Infectious Disease | Coronavirus Disease 2019 (Covid-19) | Discovery | Global |

| Drugs for Coronavirus Disease 2019 (COVID-19) | Pfizer Inc | Infectious Disease | Coronavirus Disease 2019 (Covid-19) | Discovery | Global |

| Drugs for Coronavirus Disease 2019 (COVID-19) | Johnson & Johnson | Infectious Disease | Coronavirus Disease 2019 (Covid-19) | Discovery | Global |

| Drugs for Coronavirus Disease 2019 (COVID-19) | Novartis AG | Infectious Disease | Coronavirus Disease 2019 (Covid-19) | Discovery | Global |

| Monoclonal Antibodies for Coronavirus Disease 2019 (COVID-19) | Regeneron Pharmaceuticals Inc | Infectious Disease | Coronavirus Disease 2019 (Covid-19) | Discovery | Global |

| Monoclonal Antibodies for Coronavirus Disease 2019 (COVID-19) | AstraZeneca Plc | Infectious Disease | Coronavirus Disease 2019 (Covid-19) | Discovery | Global |

| Source: GlobalData, Companies Database Pharma Intelligence Center, 27 April 2020 © GlobalData | |||||

The MCap of the majority of the companies in the list fell in the period due to the outbreak of the Covid-19 pandemic, which has led to a global economic slowdown. Among the 13 pharma companies on the list that suffered MCap decline in Q1 2020, Bayer AG registered more than 25% QoQ decline, followed by GlaxoSmithKline Plc, Amgen Inc, Pfizer Inc, Bristol-Myers Squibb Co, and Merck & Co Inc, each recording a more than 15% drop in their MCaps.

Among positive performances, Regeneron Pharmaceuticals Inc and Gilead Sciences Inc were the only companies that registered more than 10% growth in their MCaps. Regeneron recorded a 32.5% QoQ growth in its MCap due to stepping into the coronavirus fight with the evaluation of anti-inflammatory drug Kevzara, currently marketed for rheumatoid arthritis. Companies are adapting drugs originally developed as follow-on drugs for chronic autoimmune disorders to mitigate the cytokine storm syndrome (CSS) of the immune system that is associated with the worst cases of Covid-19. Kevzara is in Phase II/III clinical study targeting severe cases of Covid-19 along with an anti-inflammatory cocktail therapy. Interestingly, Regeneron’s development partner for Kevzara, Sanofi, suffered more than 10% MCap decline in Q1 2020.

Gilead recorded MCap growth of 14.5% due to compassionate use of its anti-inflammatory drug remdesivir, currently in Phase III for patients hospitalised with severe Covid-19. The recent Phase III clinical trials have shown promising results for remdesivir, as endorsed by Dr. Anthony Fauci, the head of the National Institute of Allergy and Infectious Diseases. Roche has only seen mild gains of 3.9% in its MCap, despite having an anti-inflammatory, tocilizumab, currently in Phase III for Covid-19, which in partnership with the Biomedical Advanced Research and Development Authority (BARDA) has contributed to the drug’s sales and given Roche a solid first quarter.

Vertex Pharmaceuticals and Eli Lilly and Co registered QoQ MCap growth of more than 5% even in the ongoing market downturn, with several positive late-stage drug candidates and new pipeline assets. Vertex expanded its MCap by 9.6% to $61.7B, at the back of a new regulatory approval and label expansions for its cystic fibrosis drugs. In March, Eli Lilly completed its agreement with AbCellera Biologics Inc. to co-develop antibody products for the treatment and prevention of Covid-19. Furthermore, it announced an exclusive global licensing and research collaboration with Sitryx Therapeutics Ltd. to develop disease-modifying therapeutics in immuno-oncology and immuno-inflammation. Eli Lilly reported a strong fiscal first-quarter; in addition, its two Phase III and one Phase I drugs for Covid-19 seem to set the company in good stead for the near future at least.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataMergers have also been delayed due to Covid-19 such as the $63B takeover of Allergan by AbbVie, which is now aimed to take place in Q2 instead of Q1. While Allergan’s Botox drugs may not be enough to see this merger through, there are also concerns about upcoming biosimilar competition to AbbVie’s Humira with patent expiry in 2023. Allergan has over 70% of its pipeline drugs in Phase III and II clinical trials, with the largest being the latter. The impact of the Covid-19 pandemic goes even further in delaying ongoing clinical trials and also causing delays to the regulatory authorities. This is bad news for Allergan; as each day passes, their late-stage drugs become even less valuable. Most of these are already marketed drugs for multiple indications, meaning their patent exclusivity draws even closer to expiry. In addition, the failure of AbbVie’s drug Kaletra (Aluvia), a combination of antiviral drugs lopinavir and ritonavir, in a trial to treat hospitalised patients with severe Covid-19, has also hindered the company’s progress as a game-changer in these unprecedented times.

According to GlobalData’s Pharma Intelligence Center Deals Database, GlaxoSmithKline, Gilead, Sanofi, Pfizer, Amgen, Biogen, and Regeneron are all already involved in partnership deals for early-stage discovery or preclinical Covid-19 drugs, which if successful to progress brings some hope for their future.

Pharma continues to maintain its place during the Covid-19 pandemic; however, unfortunately, according to GlobalData’s Coronavirus (Covid-19) Executive Briefing – 20 April 2020, other sectors continue to take a hit, such as Oil and Gas, Aerospace, Automotive, and Consumer sectors.

For the most up-to-date information on how Covid-19 is shaping other industries, please contact covid@globaldata.com for the latest copy of GlobalData’s biweekly Covid-19 Executive Briefing.