Systemic lupus erythematosus (SLE) is a systemic, inflammatory, chronic autoimmune disease that can affect multiple organs simultaneously or sequentially, with a relapsing and remitting nature. While SLE can affect multiple major organ systems in the body, one of its most severe manifestations is renal (kidney) involvement, known as lupus nephritis (LN). The term LN refers to a major predictor of poor prognosis in SLE patients, with inflammation of the kidney that encompasses diverse patterns of renal disease, including glomerular and vascular pathology. The management of SLE and LN consists largely of treatment options that are based on highly efficacious steroids or immune-suppressive therapy with an undesirable safety profile, which includes accrued organ damage, infections and cancer.

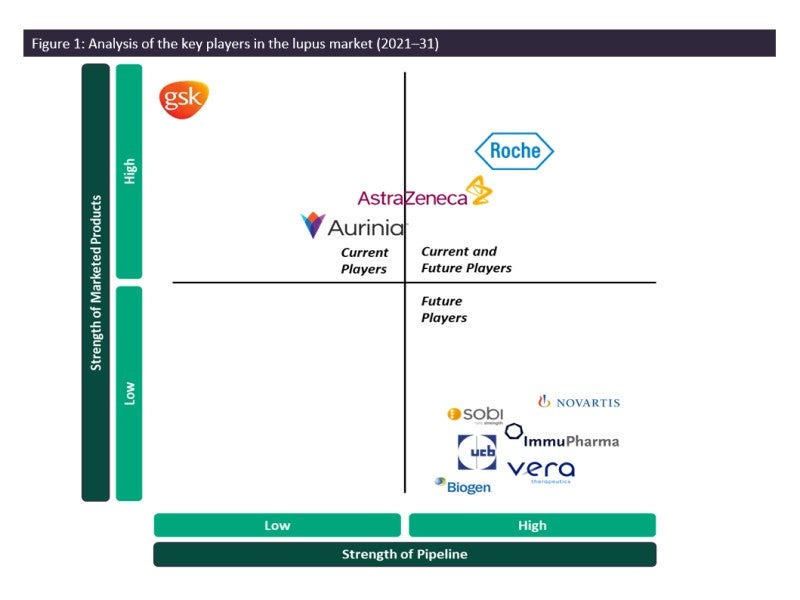

As such, the SLE and LN marketplace is dominated by generics, and GSK’s Benlysta and AstraZeneca’s Saphnelo are the only drugs that have gained marketing approval specifically for SLE in more than 50 years. In previous years, Benlysta has managed to grow the lupus market in terms of value, having generated approximately $492.9m in revenue across seven major markets (7MM: US, France, Germany, Italy, Spain, UK and Japan) in 2018, and also was the first approved biologic therapy for LN in the US, having gained approval in 2020. However, the 2021 approval of AstraZeneca’s Saphnelo in the US will mean increasing competition for Benlysta in the coming years. Furthermore, similar to GSK’s strategy with Benlysta, AstraZeneca initiated the Phase III TULIP subcutaneous (SC) trial in SLE using subcutaneous delivery of Saphnelo in June 2021. The results of this trial, if positive, are expected to be sufficient to grant approval in the US and EU through a supplemental new drug application and label expansion, respectively.

The second highest-grossing drug in the SLE and LN market in terms of value is Roche/Biogen Idec’s Rituxan, which GlobalData estimates generated approximately $228.6m in 2018 across the 7MM despite being an off-label therapy for lupus. Furthermore, Roche’s Gazyvaro, currently in Phase III trials, is expected to take the LN market by storm, once approved, as it is a fully humanised version of Rituxan. Additionally, Roche also markets MMF (under the brand name CellCept), an off-label immunosuppressive agent that is commonly prescribed to SLE and LN patients, although generic versions of MMF are also available throughout the 7MM.

Another key player in the LN market is Aurinia Pharmaceuticals’s Lupkynis, having gained market approval in the US in 2021 and in the EU (licensed to Otsuka Pharmaceutical Co) in 2022.

A major trend in the lupus treatment landscape is that many companies with approved therapies in other autoimmune diseases are testing them for efficacy in SLE and LN, as some of the symptoms are similar. Novartis’s Cosentyx, with primary indications in psoriasis and axial spondyloarthritis, is now being tested in LN, and Swedish Orphan Biovitrum AB’s Gamifant, indicated for hemophagocytic lymphohistiocytosis, is being tested in SLE. There is also high research and development (R&D) activity for the development of new therapies for lupus, with more than three monoclonal antibody (mAB)-based therapies that could potentially enter the SLE and LN market during the forecast window from 2023 to 2031, with Vera Therapeutics’s fusion protein atacicept being among the most promising pipeline drug for SLE and LN, according to GlobalData’s primary and secondary research. The introduction of new first-in-class biological therapies will further increase therapy options for SLE and LN patients, and it remains to be seen if any of these products will have superior efficacy and safety profiles to currently available Benlysta, Rituxan, Lupkynis and Saphnelo.

However, due to the nature of biologic drugs, there will always be room in the market for these products, as patients become unresponsive to a specific biologic after chronic use or develop allergic reactions, or due to the need for alternative biologics for unresponsive patients. GlobalData believes the overall use of biological therapies will increase in patients with lupus, and the introduction of new biologic drugs will further drive growth in the SLE and LN markets. Currently, GSK, AstraZeneca, Roche and Aurinia Pharmaceuticals are the key players in the lupus marketplace, and GlobalData anticipates all four companies to have a strong position in this space due to their current product offerings.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData