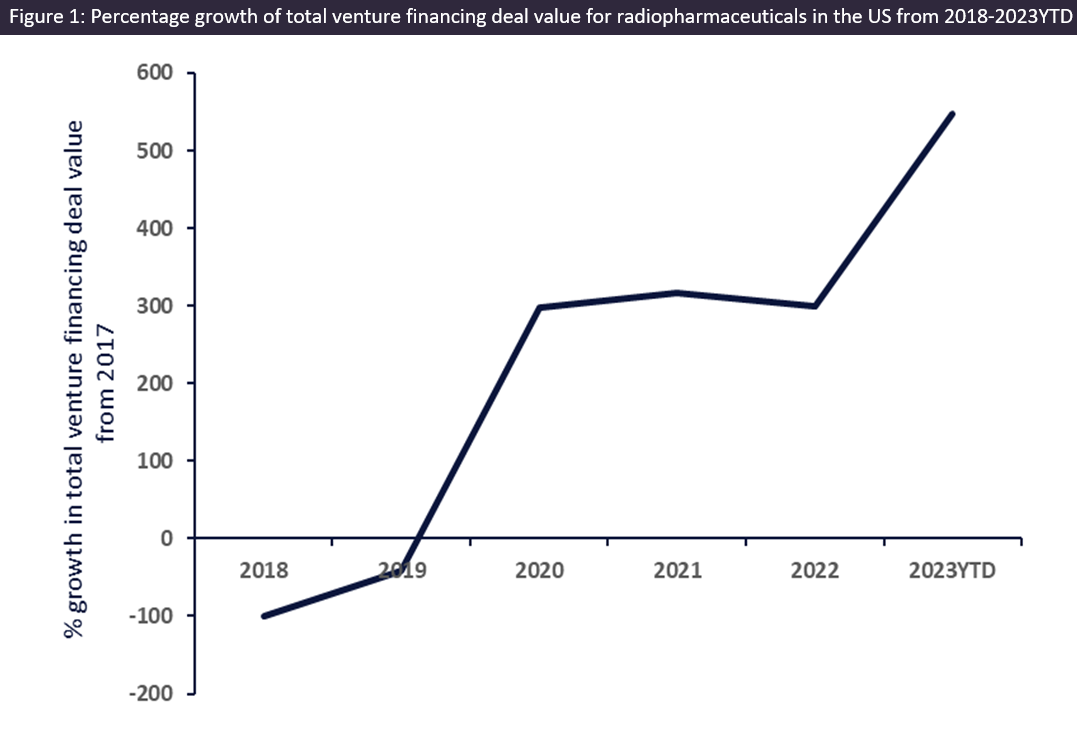

Venture financing for innovative radiopharmaceutical drugs witnessed an approximately 550% increase from $63m in 2017 to $408m in 2023 YTD (year-to-date) total deal value in the US, according to GlobalData’s Pharma Intelligence Center Deals Database. In September 2023, Eli Lilly (Lilly) invested $175m in a Series B financing round for US-based biotech, Mariana Oncology, for their lead preclinical drug for small cell lung cancer, MC-339, and anticipate their drug to enter clinical trials next year.

Radiopharmaceutical drugs have a radioisotope bound to a drug or monoclonal antibody to enable precise detection through nuclear imaging and target directly towards the tumour cells. Since radiopharmaceuticals present fewer side effects than traditional radiation therapy and effectively target cancer cells, this has sparked considerable investor venture funding. There are a growing number of companies developing early-stage radiopharmaceutical drugs with the majority in discovery and preclinical stages of development seeing boosted interest from investors.

According to GlobalData’s Pharma Intelligence Center Deals Database, venture financing for US-based companies with radiopharmaceutical drugs between 2018-2023YTD saw a total deal value of $1.2bn. Notably, investor confidence increased in radiopharmaceutical drugs from 2020, reaching a peak of $262m total deal value in 2021, all of which were in the preclinical and discovery stages of development.

Radiopharmaceutical drugs in preclinical and discovery stages secured the highest total venture funding out of all other stages of development between 2018 to 2023YTD. There were eight preclinical stage deals with a total deal value of $565.5m and six discovery stage deals with a total deal value of $523m, demonstrating strong interest among investors.

Last year, RayzeBio raised $160m in a Series D round to advance their targeted radiopharmaceutical portfolio with their most advanced pipeline drug, RYZ101, currently in Phase III trials for treating neuroendocrine gastroenteropancreatic tumours. Since 2020, the company has raised a total of $418m across four rounds of venture financing in radiopharmaceuticals.

Furthermore, last month, Lilly announced their acquisition of POINT Biopharma for $1.4bn, strengthening the company’s oncology pipeline for developing next-generation radiopharmaceutical drugs. This transaction stands as one of the biggest deals in the radiopharmaceutical field.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataSince the first radiopharmaceutical drug, Lutathera (lutetium Lu 177 dotatate) by Novartis subsidiary Advanced Accelerator Applications, was approved for market authorization by the EMA in 2017 and FDA in the US in 2018 for neuroendocrine gastroenteropancreatic tumours, radiopharmaceuticals are gaining recognition as a viable targeted approach for cancer demonstrating both safety and high efficacy. However, biopharmaceutical companies face challenges including supply chain issues whereby the short half-life of a radioisotope requires some consideration along with the selection of radioisotope, efficacy, and logistics for transportation. Nonetheless, as radiopharmaceutical companies are expanding their portfolios with more entering clinical trials, it is expected that investor interest will continue to grow.