CAR-Ts are revolutionising the treatment of blood cancers such as B-cell acute lymphocytic leukaemia. However, their success has not yet extended to the realm of solid tumours, as no CAR-T therapy has advanced beyond Phase II in one of these indications. Overcoming current limitations and expanding the reach of CAR-T therapeutics could unlock promising new treatment possibilities for solid tumour patients.

CAR-T therapeutics are a leading type of T-cell immunotherapy, accounting for over half of the approvals in the oncology cell and gene therapy landscape. This therapeutic modality involves genetically engineering autologous or allogeneic T-cells to express a chimeric antigen receptor so they actively recognise and destroy cancerous cells. In total, 13 CAR-T therapies have received regulatory authorisation, including the 2025 approval of Immuneel Therapeutics’ Qartemi (varnimcabtagene autoleucel), according to the recent report, ‘T-Cell Immunotherapy Landscape: Comprehensive Analysis of Current Drugs and Dynamics’. In terms of sales, Gilead’s Yescarta is the leading CAR-T. Having received FDA approval in 2017, this product generated $1.6bn worldwide in 2024. Similar to all other CAR-Ts on the market, Yescarta treats blood cancers and is redefining treatment paradigms for indications such as B-cell acute lymphocytic leukaemia.

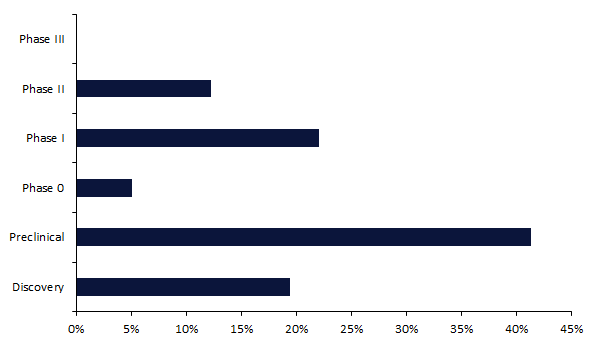

Solid tumours represent roughly 90% of all adult human cancers, including breast, lung, and pancreatic cancer. Despite significant success in the field of blood cancers, CAR-Ts have not experienced a similar level of success in solid tumours, as there have been no CAR-T approvals in related indications. So far, the most advanced stage for a CAR-T in a solid tumour is Phase II (Figure 1).

Figure 1: Development stage percentage split for active CAR-Ts in solid tumour indications

Currently, over 650 CAR-Ts are in active development for a solid tumour indication. Over 40% of these are in the preclinical stage, and only 80 (12%) products are in the most advanced stage, Phase II.

There are a variety of challenges associated with developing CAR-Ts to treat solid tumours. The heterogeneity of solid tumours and the absence of specific tumour antigens, alongside the immunosuppressive tumour microenvironment, make it difficult for CAR-Ts to infiltrate and persist within the tumour. These challenges limit the efficacy of CAR-Ts when treating solid tumours, which is confirmed by GlobalData’s Drugs Intelligence database, as no CAR-T has ever completed a Phase II trial and entered Phase III for a solid tumour.

Bristol Myers Squibb (BMS), which is a frontrunner in the CAR-T landscape, accounts for two of the 13 marketed products: Abecma (idecabtagene vicleucel) and Breyanzi (lisocabtagene maraleucel). It is also a joint leader in the solid tumour landscape, with 12 CAR-Ts in development. BMS is looking to extend the label for Breyanzi to solid tumours, as this product is currently in Phase II for primary and secondary central nervous system (CNS) lymphoma.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataElsewhere, China-based Shenzhen Geno-Immune Medical Institute is matching BMS in the solid tumour pipeline, with 12 CAR-Ts in development. However, Shenzhen’s portfolio is more advanced, with 11 Phase II products, compared to only one for BMS; as such, Shenzhen may overtake BMS as the front-runner in this area.

CAR-Ts have demonstrated remarkable potential, but so far, their success has remained confined to blood cancers with little success in other indications. Given the prevalence of solid tumours, overcoming the limitations of CAR-Ts in these indications is crucial, and as such, there is a strong focus on the CAR-T market in this area. Success could transform cancer treatment, providing new hope for patients and proving commercially beneficial for drugmakers.