Over the past two decades, there has been a marked increase in obesity rates among US adults, with projections indicating a continuing upward trend. Two blockbuster drug launches within the last few years—Novo Nordisk’s Wegovy (semaglutide) and Eli Lilly’s Mounjaro (tirzepatide)—have highlighted the lucrative potential offered by this market. Encouraged by the performance of these drugs, companies are racing to commercialise their alternative obesity treatments, as a prodigious 13 drug launches are projected over the next five years in the US market.

Obesity is characterised by an abnormal or excessive fat accumulation, which is commonly caused by an imbalance of energy intake (diet) and energy expenditure (physical activity). The condition poses health risks for chronic diseases, such as heart disease and stroke, which are the leading causes of death worldwide, according to the World Health Organization (WHO). In the US, obesity rates rose from 31% in 1999 to 42% in 2020. These rates are forecast to continue, as 50% of US adults are expected to be obese by 2030.

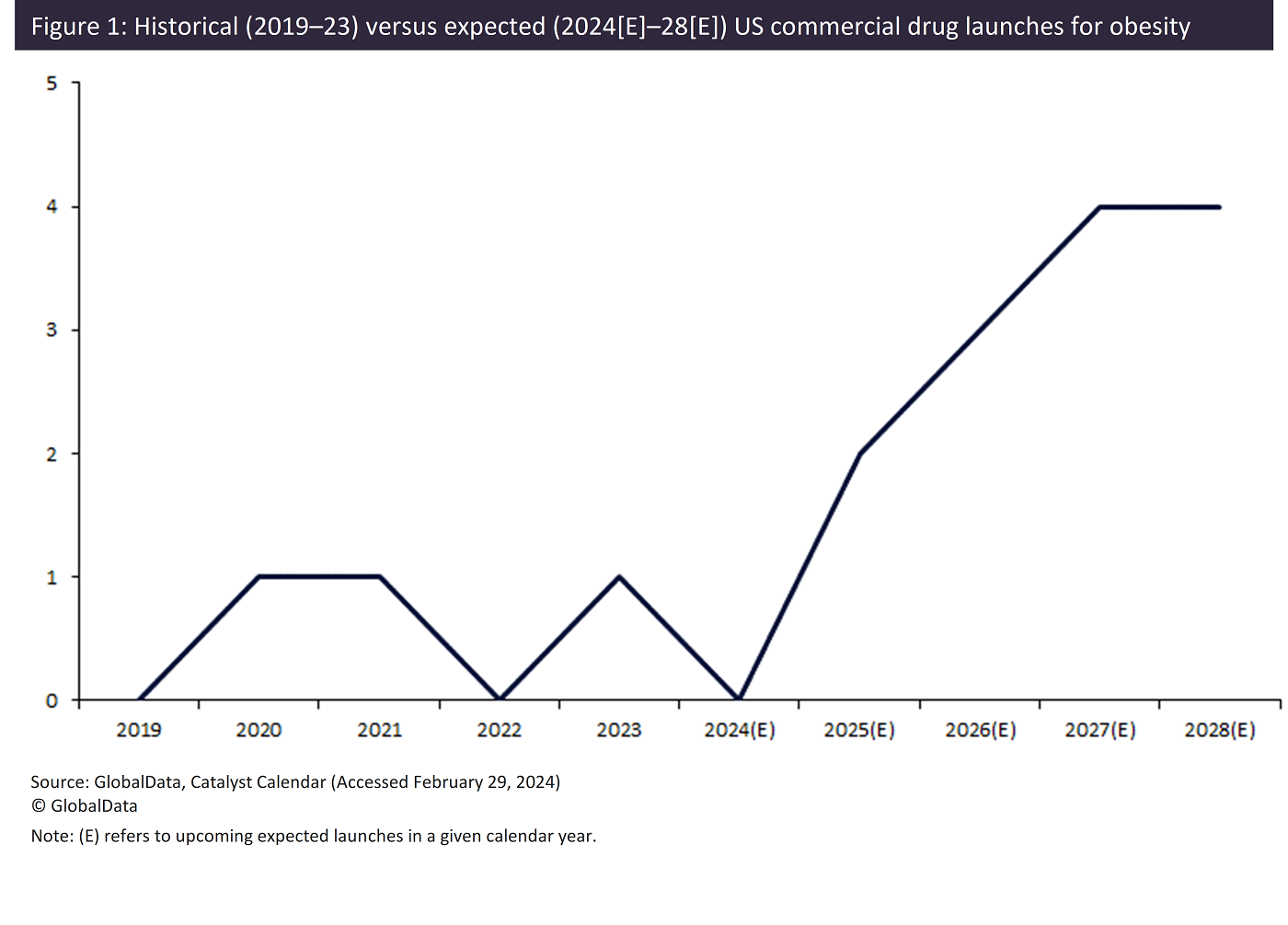

The increasing target population emphasizes the lucrative potential offered by obesity drugs. Drug developers have identified the immense potential for revenue in this market, and as such, GlobalData’s Catalyst Calendar forecasts 13 novel drug launches in the US from 2024 to 2028 (Figure 1).

In addition to this growing patient base, Novo Nordisk’s Wegovy and Eli Lilly’s Mounjaro generated $9.7bn globally in 2023, following their 2021 and 2023 launches, respectively. This value represents a 239% increase from the total revenue generated from all obesity drugs in 2022. These products have uncovered and highlighted the viability offered by this market, setting the trend for drug developers to seek approval for their obesity drugs.

From 2024, significant increases in the number of launches are expected per year, culminating in a peak of four launches in both 2027 and 2028. This surge in commercial launches over the next five years represents a 333% increase in comparison to the three launches over the preceding five-year period (2019–2023).

Novo Nordisk is looking to cement its position as an obesity frontrunner, as it will account for six of the 13 estimated launches. Its lead pipeline drug, Cagrisema (semaglutide + cagrilintide), is currently in Phase III for obesity. This product is expected to launch in the US by the end of 2025, where it is forecast to generate $7.4bn by 2029.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataRecent blockbuster drugs have shown the viability of obesity drugs, encouraging drug developers to commercialise their products. The US market is set to rapidly expand over the next five years, with 13 products forecast to enter the market. Per the increasing patient population, several companies manufacturing these later entrants will likely receive great returns for their efforts.