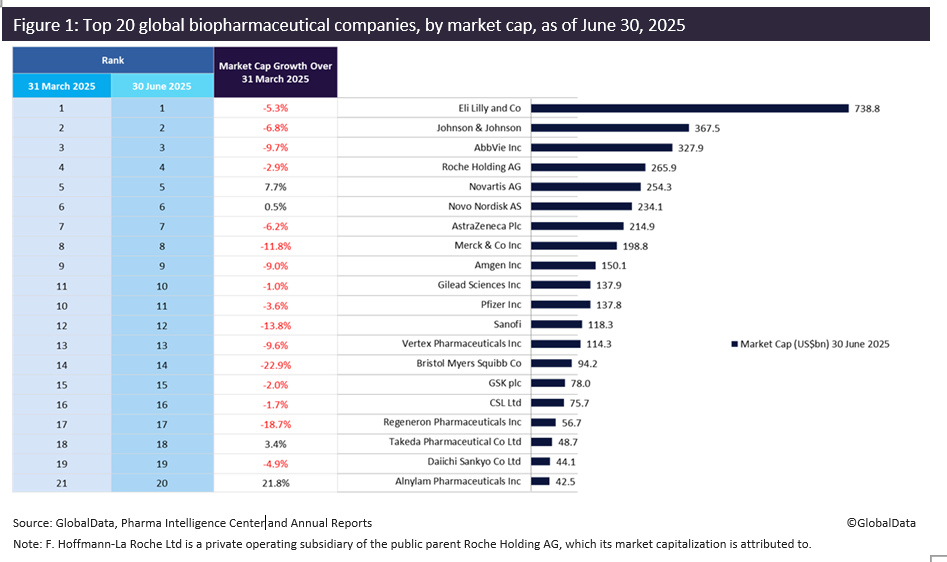

The biopharmaceutical industry faces headwinds from the Trump administration’s ongoing tariffs and drug pricing pressures in the US. As a result, the top 20 global biopharmaceutical companies have reported a downturn of 5.7% in their combined market capitalisation, from $3.92 trillion on 31 March 2025 to $3.70 trillion on 30 June 2025, according to leading data analytics and research company, GlobalData.

Alnylam witnessed the largest market capitalisation growth, up 21.8% to $42.5 billion, and secured a spot as a new entrant in the top 20 players. The company’s growth was largely driven by the strong performance of its RNA interference (RNAi) therapeutic Amvuttra for transthyretin amyloidosis cardiomyopathy (ATTR-CM), which saw a 59% year-on-year (YoY) increase in global sales to $310 million in the first quarter (Q1) 2025.

Novartis reported a 7.7% increase in market capitalisation in Q2 2025 due to strong financial performance, with blockbuster drug sales growth, including Entresto, Cosentyx, Kesimpta and Kisqali in 2024. The acquisition of Regulus Therapeutics in June 2025, valued at $1.7 billion, strengthens Novartis’ renal disease portfolio. The acquisition includes farabursen, an miRNA17-targeting antisense oligonucleotide, due to enter pivotal Phase III trials in Q3 2025, with positive results for its Phase Ib MAD study in polycystic kidney disease announced in March 2025.

However, the majority (16) of the top 20 players registered a decrease in market capitalisation in Q2 2025. Bristol Myers Squibb saw the largest market capitalisation decline of 22.9%, following the announcement of a mixed Q1 2025 financial performance and negative trial results. Notably, the company’s Phase III ARISE trial investigating Cobenfy as an adjunctive therapy to atypical antipsychotics for schizophrenia did not meet its primary endpoint of change in the Positive and Negative Syndrome Scale (PANSS).

Regeneron at -18.7% and Sanofi at -13.8% saw declines in market capitalisation due to the failure of itepekimab, their partnered IL-33-targeting monoclonal antibody, to meet its primary endpoint in the Phase III AERIFY-2 trial, which aimed to achieve a reduction in moderate or severe exacerbations of chronic obstructive pulmonary disease. This represents a setback for itepekimab since Sanofi planned to file for US and EU regulatory approval in the second half of 2025. However, analyst consensus forecasts itepekimab to achieve global sales exceeding $1 billion by 2031, according to GlobalData’s Sales and Forecast database.

Regeneron’s market capitalisation decline was further driven by Eylea and Eylea HD headwinds, including the US Food and Drug Administration’s rejection in April 2025 of extended dosing intervals of Eylea HD. Moreover, US sales of Eylea and Eylea HD saw a 26% YoY decline totaling $1.04 billion due to competitive pressures from other VEGF inhibitors such as the off-label use of Roche’s cancer drug Avastin (bevacizumab) in retinal diseases, which is seen as more cost-effective. Biosimilar competition from Sandoz’ Enzeevu (marketed as Afqlir in Europe), which received US and EU marketing approval in August and November 2024, respectively, is anticipated to further impact Eylea’s market share in retinal diseases.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataMeanwhile, Merck & Co witnessed an 11.8% decline in market capitalisation in Q2 2025, primarily driven by concerns over the performance of its Gardasil vaccine in China, which contributed to a 40% decline in global sales to $1.3 billion in Q1 2025.

Investor sentiment has been impacted by the US tariff announcements, with US plans to impose 250% tariffs on pharmaceutical imports expected to further impact share prices over Q3 2025. Biopharmaceutical companies are beginning to experience mounting pressures related to drug pricing in the US, as seen with Regeneron’s Eylea, leading to significant declines in market capitalisation in Q2 2025. Nonetheless, some companies, such as Alnylam and Novartis, have shown resilience amid these challenges by demonstrating strong financial performance.