The Trump administration announced Pfizer has agreed to provide all of its medicines at Most Favored Nation (MFN) pricing in Medicaid, becoming the first pharma company to agree with implementing international reference pricing (IRP) in the US. The deal means Pfizer has committed to pricing current and any new medicines in all state Medicaid programs to the same prices in other developed countries. During the release on 30 September, US Centers for Medicare & Medicaid Services (CMS) deputy administrator and director of Medicare Chris Klomp implied that CMS received confidential pricing data from other countries from Pfizer, and will base the Medicaid discounts on a basket of prices from other reference countries. Further terms or details of the deal were not disclosed. Therefore, it is not known what the official basket of reference countries will be that will be used to price match Pfizer’s drugs.

Pfizer to use newly launched TrumpRx to sell directly to consumers

Earlier this year, the Trump administration announced the MFN executive order to align drug prices in the US to other developed countries. The Trump administration has been directly engaging with the pharma industry to implement MFN pricing since the announcement in May. In July, Trump had letters delivered to 17 pharma companies, giving a deadline of 29 September to meet the demands of the executive order. Pfizer became the first to publicly announce an agreement. Alongside with agreeing to MFN pricing, Pfizer will offer its products on the new federally operated direct-to-consumer (DTC) website, TrumpRx. Consumers will be able to directly access Pfizer’s drugs on TrumpRx at an average of 50% discount, with some discounts on drugs ranging as high as 85%. At the time, Trump did not offer further details in how the website would work. Pfizer also announced an additional $70bn investment in onshoring drug manufacturing production and R&D over the next few years. As part of agreeing to the MFN deal and its commitments to onshore manufacturing, Pfizer will have a three-year grace period where it will not be subject to pharma tariffs that result from the Department of Commerce’s Section 232 investigation.

Full details of the deal and how MFN works are still scarce. It is clear that Trump is easing IRP into the US by introducing MFN pricing into Medicaid first. Trump may introduce IRP into other government programmes in the future, and may reach the private market, though there are still several uncertainties in the announced deal. This includes uncertainty around how the MFN discounts in Medicaid will compare to the current discounts the program already gets, or how insurance will work on the TrumpRx website. The Trump administration hopes to launch TrumpRx and implement MFN pricing for Medicaid by early 2026. Pfizer CEO Albert Bourla had hailed the deal with the Trump administration and called it a win-win situation for Americans and Pfizer. Bourla pointed out he satisfied all four of Trump’s requests to lower drug costs in the US, based on the letter the Trump administration sent out in July.

Trump claims more pharma companies to announce deals soon

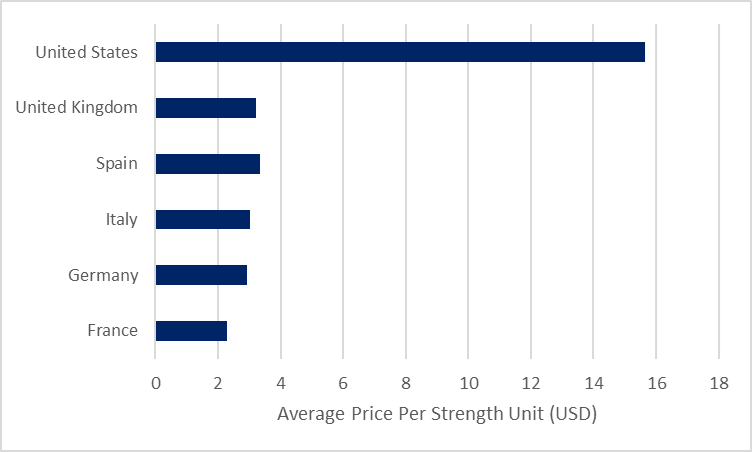

While there have been mixed responses to MFN, Trump claims that other pharma companies will be announcing similar pricing deals soon and that Pfizer’s is the first in a series of deals it intends to secure for the US. This suggests more products in the US will be subject to IRP and also be more accessible to consumers through the TrumpRx website. It is not clear if all the pharma companies that received a letter in July will comply with MFN pricing, though the pharma companies have been more receptive in implementing DTC programs and several announced DTC discount programs for their products, ahead of the 29 September deadline. However, DTC programs may not help the average consumer achieve overall lower healthcare costs as most order prescription drugs through insurance plans, which provide discounts already. Purchasing through a DTC website like TrumpRx may mean paying out of pocket (OOP) to gain the discounts, rather than through insurance, which may not be a significant improvement for consumers with insurance. For example, the Trump administration pointed out Xeljanz (tofacitinib) will receive a 40% discount on TrumpRx, but a 40% discount on its $6,000 list price would mean patients will still pay thousands OOP and patients with insurance will likely pay less in co-pays. For further context, the average price per strength unit of Xeljanz (one of Pfizer’s drugs to receive discounts) in the 5EU is 80% lower than that of the US (based on wholesale acquisition cost [WAC] price).

Figure 1: Average price per strength unit of Xeljanz across the 5EU and US

The MFN deal with Pfizer comes a few days after Trump announced 100% tariffs on branded pharma products would come into effect on October 1, giving exemptions to companies that have a manufacturing presence in the US, or are currently building a manufacturing plant. However, White House officials have put the 100% tariffs on pharma products on hold, as it continues to finalize MFN negotiations with pharma companies. This means the 100% levy will not take effect yet and instead, the Trump administration is reported to begin preparing tariffs from 1 October. White House officials continue to explain that tariffs will apply to those that do not onshore manufacturing to the US and to those that do not participate in the MFN pricing policy, suggesting more pharma companies may fall in line to avoid the tariffs. The three-year grace period on tariffs is also attractive given that the grace period will end near towards the end of Trump’s second administration and the next US administration may not employ tariffs against pharma products.

This article is produced as part of GlobalData’s Price Intelligence (POLI) service, the world’s leading resource for global pharmaceutical pricing, HTA and market access intelligence integrated with the broader epidemiology, disease, clinical trials and manufacturing expertise of GlobalData’s Pharmaceutical Intelligence Center. Our unparalleled team of in-house experts monitors P&R policy developments, outcomes and data analytics around the world every day to give our clients the edge by providing critical early warning signals and insights. For a demo or further information, please contact us here.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData