Immuno-oncology (IO) agents have transformed the cancer therapeutics landscape, driving long-term remissions in a subset of patients who historically had limited options. IO agents include the classes of immune checkpoint modulators, cell therapies, bispecific antibodies, oncolytic viruses, therapeutic vaccines, and cytokines. The most widely utilised IO class is immune checkpoint inhibitors (ICIs), which work by blocking the inhibitory interactions between tumour cells and T-cells, facilitating an anti-tumour immune response. There are more than 20 marketed ICIs with approvals across a very wide spectrum of solid tumour indications. While initially only approved for metastatic disease, ICIs have now moved into earlier disease settings, reducing the risk of disease progression and relapse. In contrast to ICIs, which are utilised against solid tumours, cell therapies and bispecifics have been transformational in the haematological cancer settings, with approvals across a range of leukaemias and lymphomas. Chimeric antigen receptor T-cell (CAR-T) therapies are the only genetically modified cell therapies to have received regulatory approval, and they are currently utilised in relapsed/refractory settings. All currently approved CAR-Ts are autologous, with the patient’s T-cells being genetically engineered to target antigens expressed by the cancerous cells. Marketed bispecific antibodies are largely bispecific T-cell engagers (BiTEs), which work by directing T-cells to antigen-expressing tumour cells. Oncolytic viruses, cytokines, and therapeutic vaccines currently play a very minimal role in oncology treatment, with substantial efficacy still to be demonstrated for these classes.

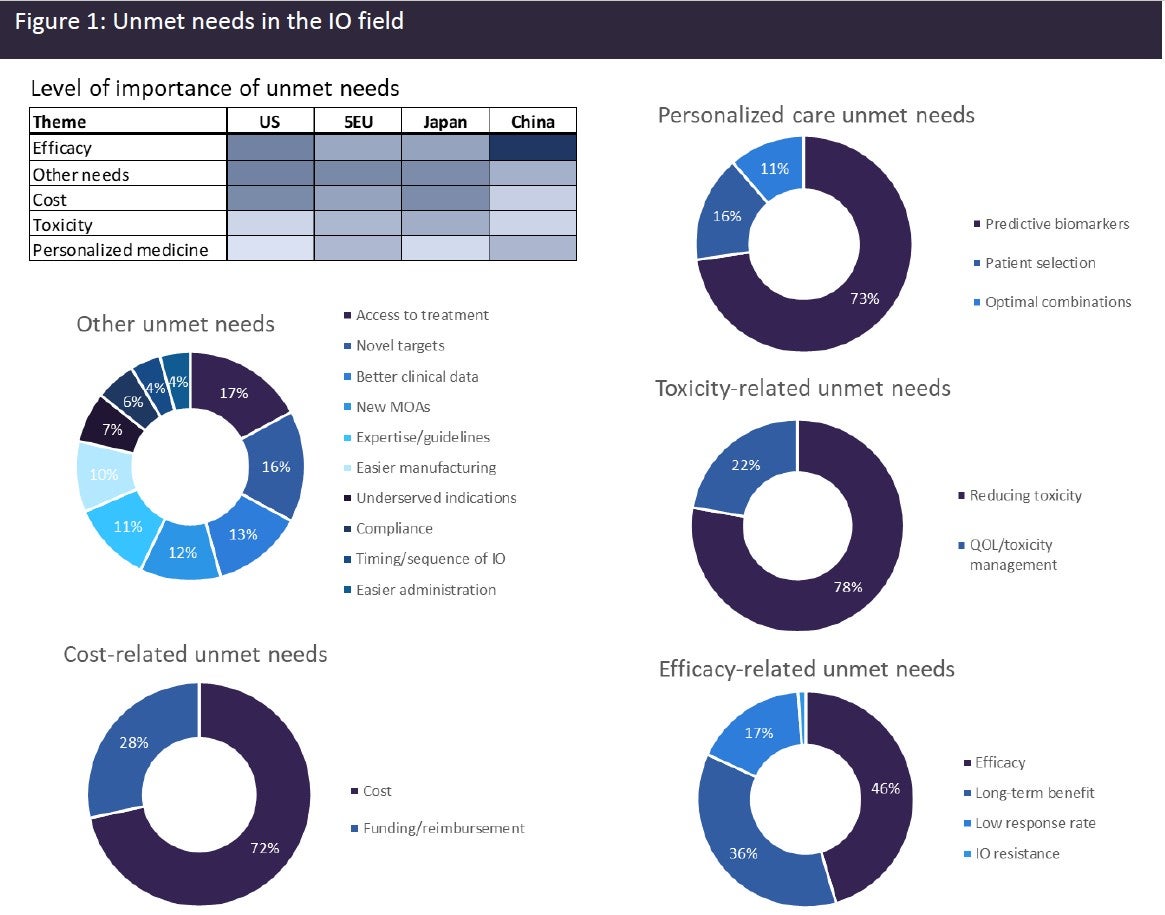

Despite the significant advances that have been made in the IO field, a huge level of unmet need remains. High-prescribing physicians surveyed by GlobalData across eight major markets (8MM: US, France, Germany, Italy, Spain, UK, Japan, and China) identified a broad range of unmet needs in the IO space (see Figure 1). The unmet needs can be grouped into the broad categories of efficacy-related needs, cost-related needs, toxicity-related needs, personalised care-related needs, and “other” needs. Combining data from all markets, efficacy-related needs were identified as the most important unmet needs category. Efficacy-related unmet needs included the need for a greater long-term benefit, higher response rates, and mechanisms for overcoming resistance to IO therapies. Although a subset of patients derives long-term benefits from IO therapies, a high percentage of patients still fail to respond or develop resistance to IO therapy. Cost-related unmet needs also scored highly. IO therapies come with a hefty price tag, with ICI therapies in the US typically exceeding $100,000, while cell therapies can exceed $400,000.

Patients and healthcare facilities across markets often experience difficulties getting these agents reimbursed. Toxicity-related unmet needs were also identified by a large number of physicians and included the need to reduce the toxicities associated with IO therapies, in particular cytokine release syndrome and neurological toxicities. They also require better mechanisms for managing IO-related toxicities and improving patients’ quality of life (QOL). There were also personalised care-related unmet needs identified, and this included the need for better predictive biomarkers. Given the high cost of IO therapies and the associated toxicities of some IO therapeutics, it is particularly important to be able to identify those patients who are most likely to benefit from therapies. A broad range of other unmet needs was also identified, such as easier manufacturing and administration, which would lead to better access for patients; identification of new targets and mechanisms of action (MOAs), so that the diversity of IO therapies can be increased; and better clinical trial data and improved guidelines and training, so that clinicians and patients can make informed choices and sequence therapies appropriately.

There is currently a rich and diverse IO pipeline that aims to address these unmet needs, with 703 IO products currently in clinical trials. Cell therapies make up the largest chunk of the pipeline with 304 agents in development, followed by checkpoint modulators with 146 agents in development, and bispecific antibodies and cancer vaccines with 100 and 90 products, respectively, in development. Many of these agents have novel MOAs, are directed to novel targets, or have simplified manufacturing processes, with the aim of increasing clinical efficacy, reducing toxicity, and increasing access for patients. It is hoped that IO therapies, which currently only give a subset of patients long-term benefit, will expand to give a much wider patient population long-term remissions and ultimately cure.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData