Earlier this month, the South Korean biosimilar giant, Celltrion, received European Medicines Agency (EMA) approval for its trastuzumab biosimilar product, Herzuma. This marks the second EU approval for a copycat of Roche’s Herceptin (trastuzumab), a biologic product approved for use in human epidermal growth factor receptor 2 (HER2) overexpressing breast and gastric cancers.

Oncology biosimilars have been gaining approval rapidly since their first US and EU approvals in 2017, and this momentum is expected to continue into 2018. Here, GlobalData will discuss the biosimilar market for trastuzumab and the expectations for this market in the coming year.

Approvals across major markets

The US and five major European markets (5EU: France, Germany, Italy, Spain, and the UK) are expected to have an influx of approvals throughout 2018. The US currently has one approved biosimilar trastuzumab product, Mylan’s Ogivri, and there are currently an additional three products with biologic license applications (BLAs) under review by the FDA.

Notably, Herceptin will not lose its patent protection until 2019 in the US, so approved products may not be available until this time. However, Hospira (a subsidiary of Pfizer and major player in the biosimilars market) has filed challenges to several Herceptin patents. Therefore, biosimilar products may be approved ahead of time, offering a head-start to biosimilar developers who have a ready-to-stock product as soon as the courts allow. This could potentially lead to quick and significant erosion of the originator product upon its patent expiry in the US.

Herceptin’s patent expired in 2014 in the 5EU, but the first trastuzumab biosimilar approvals did not occur until late 2017; this situation is not unusual in the biosimilar space for oncology or immunology products. Although Roche was able to enjoy a few extra years without biosimilar products, the company can expect intensifying competition in the coming year.

In addition to Celltrion’s Herzuma and another product, Merck/Samsung Bioepis’ Ontruzant (which was approved by the EMA in November 2017), an additional three products have been filed with the EMA. Although Roche will not gain a reprieve from the erosion of Herceptin in the EU, biosimilar development has been slower in Japan where, to date, there have been no approvals, only one product listed as pre-registration, and another product in Phase II clinical development.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataBiosimilar development

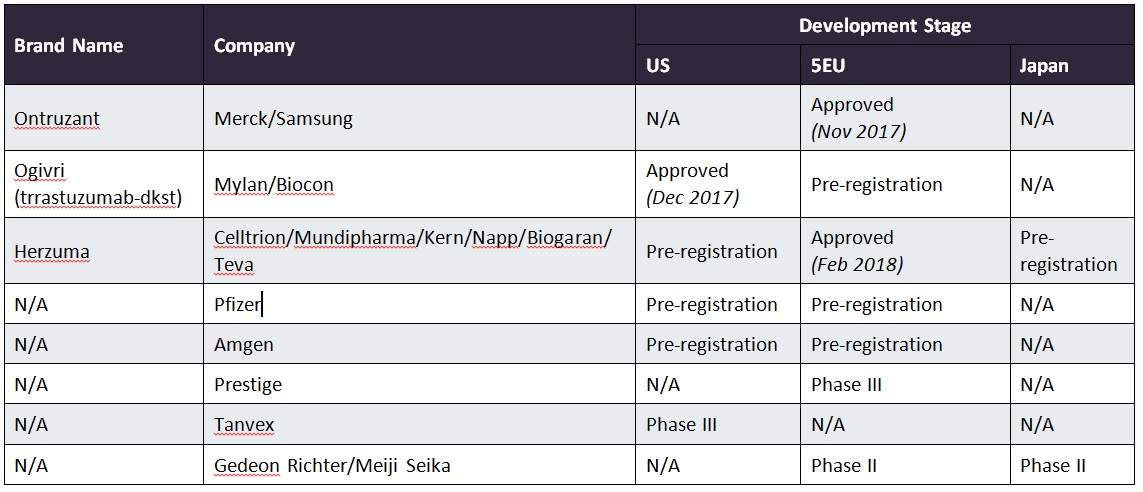

The table below outlines the details of product development for trastuzumab biosimilars in the seven major markets (7MM: US, 5EU, and Japan).

Image: 7MM, clinical development stage of trastuzumab biosimilars. Credit: GlobalData, Pharma Intelligence Center.

Roche’s blockbuster breast cancer product brought in $7.3B globally in 2017, with roughly 38% ($2.8B) of sales coming from the US and 30% ($2.2B) from Europe.

Although US sales will likely be protected until 2019, GlobalData expects that there will be erosion within the 5EU this year as up to five products trickle into the European markets. Erosion in the US may occur faster, as multiple copycats are set to hit the market simultaneously.