Biosimilars are becoming increasingly popular with pharmaceutical companies; however, knowing which markets have been saturated with biosimilars and which are open to appropriate is vital for companies to make economically viable decisions.

The deal activity can provide a useful indication of which drugs have biosimilars in development. This article will focus on the strategic alliance deals that have been completed for biosimilars.

Figure 1 shows the top six biosimilar drugs measured as a percentage of the total deal value of strategic alliance deals for biosimilar drugs in the past five years. All the top drugs, with the exception of etanercept, are monoclonal antibodies and they are all used to treat either autoimmune diseases or cancer. The rituximab biosimilar is the top drug in terms of the highest deal value; however, adalimumab has been involved in the highest number of deals.

Three of the top six biosimilars were involved in the highest valued strategic alliance in the past five years. The $275M co-development agreement between Epirus and Orygen Biotecnologia in 2013 allowed Epirus to market Orygen Biotecnologia’s biosimilars for infliximab, rituximab, and trastuzumab in Brazil.

Sanofi’s co-development with JHL Biotech in 2016 was the second most valuable deal and involves the most drugs of any other deal in the past five years. Sanofi acquired the rights to the rituximab biosimilar, as well as its pipeline adalimumab, bevacizumab, and trastuzumab biosimilars. JHL Biotech is to lead the development, registration, and manufacturing activities while Sanofi will lead commercialization in China.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData

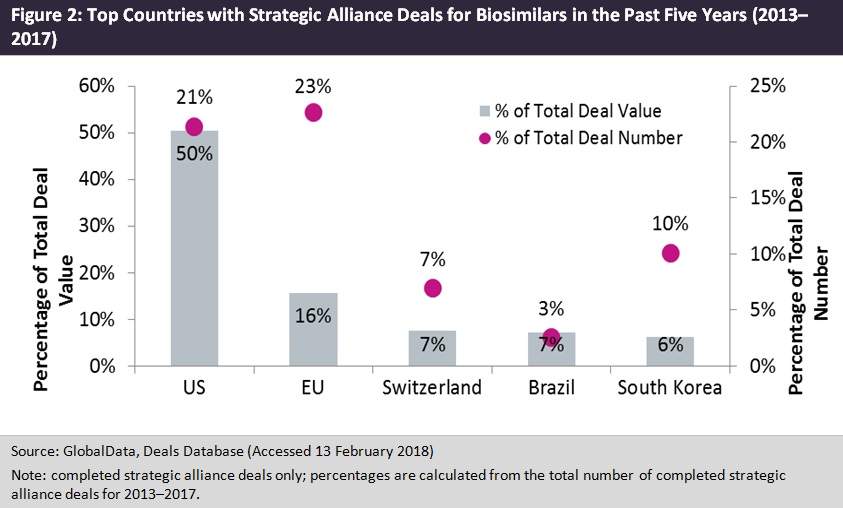

Figure 2 shows the countries with the highest deal values and the highest number of deals as a percentage of the total number of completed strategic alliance deals for biosimilars in the past five years. The US is dominating biosimilar activity. It has the highest total deal value and highest percentage of deals for an individual country. The EU as a whole has a larger proportion of deals compared to the US and these are predominately made up of Germany and the UK. Brazil and South Korea are also active in the biosimilar market. The partnership between Epirus and Orygen Biotecnologia was Brazil’s most notable deal. The South Korean company Celltrion entered into a co-marketing agreement with Teva Pharmaceutical Industries to commercialise its pipeline biosimilars for rituximab and trastuzumab in the US and Canada. This shows that, although the US is likely to dominate future biosimilar activity, emerging markets are beginning to get a foothold in the market, as shown by the Brazil and South Korea deals.

The recent strategic alliance deals show that future marketed biosimilars are likely to be monoclonal antibodies to treat cancer or autoimmune diseases. Emerging markets, such as Brazil and South Korea, have been involved in a growing number of deals for the development or commercialisation of biosimilars. This shows they are likely to gain a strong foothold in the future of the biosimilar market.