On 26 October, Takeda announced that in its ongoing Phase I review of the proposed acquisition of Shire, discussions with the European Commission (EC) are underway in regards to the potential overlap in its inflammatory bowel disease (IBD) portfolio between Takeda’s anti-integrin biologic Entyvio (vedolizumab) and Shire’s Phase III candidate SHP647.

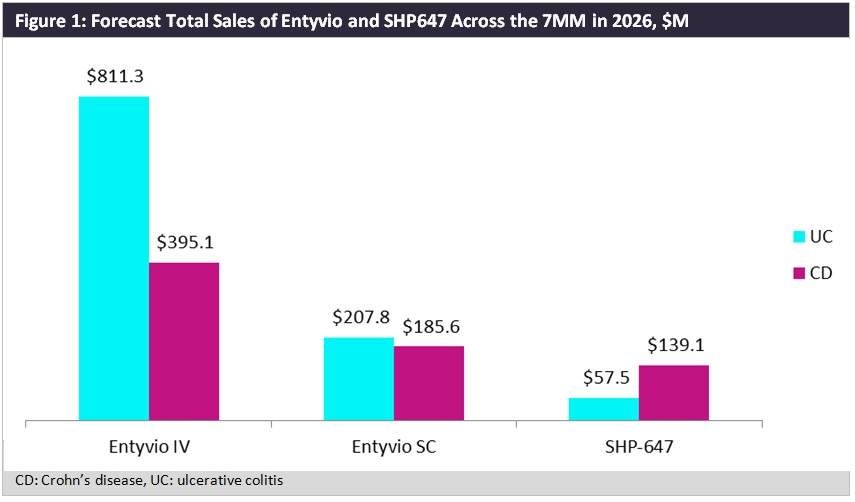

Takeda commented that it remains committed to Entyvio, which is forecast by GlobalData to generate sales of just under $1.6bn in 2026 across the seven major markets (7MM – US, France, Germany, Italy, Spain, the UK, and Japan) for subcutaneous (SC) and intravenous (IV) formulations in IBD, marking a smart play by Takeda to prioritise the commercialisation of Entyvio.

Entyvio IV is currently marketed in more than 60 countries for ulcerative colitis (UC) and Crohn’s disease (CD), making it an established therapy in the IBD space. GlobalData estimates Entyvio IV alone will bring in sales of over $1.2bn in CD and UC across the 7MM in 2026. Entyvio SC is currently in Phase III development and is anticipated to launch as early as 2019.

Shire’s SHP647 is being developed as an SC formulation, and key opinion leaders (KOLs) interviewed by GlobalData have indicated it will compete with Entyvio, but are uncertain if it will hold efficacy benefits. SHP647 is forecast to launch in 2023, four years after the launch of Entyvio SC, leaving little room for the former in an already established biologic market space. If not differentiated from Entyvio, GlobalData anticipates Takeda will look to license or fully divest SHP647, turning the company’s full attention to Entyvio in the IBD biologic space.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData