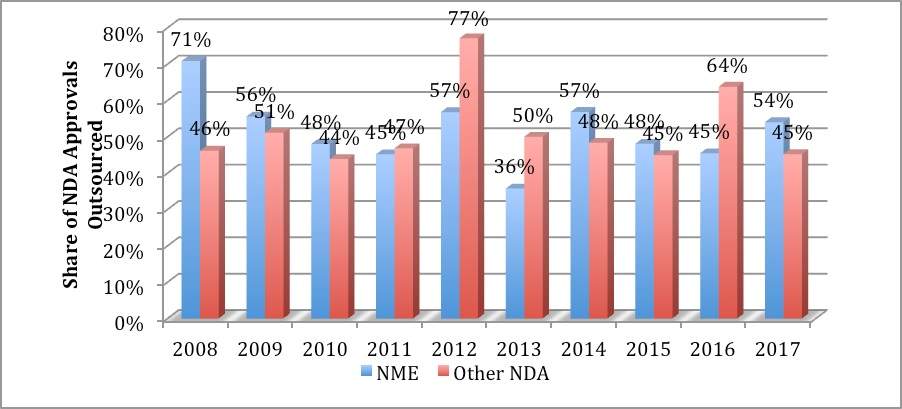

In 2017, outsourced dose manufacturing of new molecular entities (NMEs) reached its highest level since 2014. Coupled with the well-documented increase in overall new drug applications (NDAs) approved by the FDA (both NMEs and non-NMEs), 60 products in all were outsourced compared to an average of 52 in the five-year period from 2012–2016 (see figure below).

Image: Share of NDA approvals outsourced 2008–2017. Credit: PharmSource, analysis of FDA data.

However, the good news for the sector needs to be tempered as the change in willingness to outsource between the differing sponsor types became ever more marked. For example, emerging bio/pharma companies used third-party manufacturing for all 15 of their NME approvals. By contrast, the established global bio/pharma sector continued to prioritize its internal manufacturing network, outsourcing just, five out of 20 new approvals in 2017 and six out of 34 in all.

The results also confirmed another long-standing trend that is likely to have significant consequences for the industry: namely, that biologics are far more likely to be manufactured in-house than small molecule drugs are. Last year, just 36% of large molecule API NMEs were outsourced, a figure that marginally exceeded that of 2016 but was nevertheless significantly down from the 86% of biologics outsourced in 2008.

By comparison, almost two-thirds of chemically synthesized NMEs were externally manufactured, a figure that has remained pretty static in recent times. The data attest to the significant investment in biologics manufacturing that has taken place over the past several years as the largest companies upgrade their networks.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataAround 40% of new injectable products were outsourced, which is consistent with the long-term average. However, the trend of formulating NMEs in solution as opposed to a freeze-dried powder intensified, as freeze-drying accounted for just four of the 24 injectables launched last year. Outsourcing of drugs requiring special handling reached a peak in 2017, exceeding 70% for the first time, buoyed by the approval of eight kinase inhibitors.

The CDMO approval list was headed by the usual suspects, Catalent, including its recent acquisition Cook Pharmica, and Patheon (now part of ThermoFisher). Together these two companies garnered more than 40% of all NME approvals while no other company managed more than two.

For additional insight into the PharmSource suite of services for the outsourcing sector, please contact your GlobalData sales representative.