The pharmaceutical services industry is undergoing both innovation and consolidation – trends that are redefining competition and opening new strategic fronts for clinical technology vendors and contract research organizations (CROs).

A recent example is Thermo Fisher Scientific’s $8.87bn acquisition of Clario Holdings, which exemplifies that shift, ranking among 2025’s largest pharma deals. Clario is an endpoint data solutions provider, which includes electronic Clinical Outcome Assessment (eCOA), Medical Imaging and Cardiac Solutions. Such moves reveal and accelerating wave of integration that shows no signs of slowing.

Understanding how consolidation can impact existing relationships, and which companies work together creates competitive opportunities and determines who captures market share. The companies that thrive in this landscape are those armed with real-time insights on competitive positioning and sponsor preferences, enabling them to act decisively when windows of opportunity occur.

Other recent deals between clinical trial vendors include ICON’s acquisition of KCR, PCI Pharma Services and Ajinomoto Althea, and PCM’s recent acquisition of EmVenio. For clinical technology vendors and CROs navigating an increasingly competitive market, acquisitions such as the recent Thermo Fisher deal raise critical strategic questions: Who’s next? And more importantly, how should suppliers position themselves in this rapidly consolidating landscape?

Strategic implications: the competitive domino effect

The Thermo Fisher Scientific-Clario acquisition creates a formidable integrated offering; the company already owns PPD, one of the world’s largest CROs, and now adds Clario’s digital endpoint platform. This vertical integration gives Thermo Fisher end-to-end support through the clinical trial value chain, from trial design and execution through PPD to sophisticated data capture and analysis with Clario.

This naturally raises the question: will other life science conglomerates follow suit? Danaher, McKesson, and even diagnostic giants like Quest and Labcorp may view independent eCOA providers as attractive targets to build comparable integrated offerings. The rationale is compelling: as clinical trials become increasingly decentralised and data-intensive, controlling both the trial execution—with a CRO, and the digital infrastructure—like eCOA and endpoint data—offers significant competitive advantages.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe CRO perspective

GlobalData’s proprietary clinical data indicates that that PPD has been the CRO of choice on 9.6% of Clario’s clinical trial business, making it Clario’s largest CRO partner. This data is based on publicly disclosed relationships between sponsors, CROs and vendors, so the volume of trials is lower than actual engagements, however, the percentages should be proportionate. Labcorp Drug Development follows at 9.2%, with IQVIA at 8.5% and ICON at 8.2% as the CRO on clinical trials in which Clario has been a vendor.

These CROs now face a strategic dilemma. Will they continue purchasing eCOA services from a competitor’s subsidiary? History suggests they may seek alternative vendors or pursue their own acquisitions to maintain competitive. This creates immediate opportunities for competing eCOA vendors to position themselves as independent, conflict-free alternatives to pharma sponsors and CROs concerned about feeding their competitor’s revenue stream.

Targeting the window of opportunity

For clinical technology vendors, timing is everything. According to GlobalData’s proprietary clinical trial intelligence, Clario’s most engaged sponsor clients include Merck & Co, Johnson & Johnson, Novartis, Sanofi, and many other major players. These relationships represent years of integration, workflow optimisation, and institutional knowledge. However, acquisition-driven transitions invariably create uncertainty, which can be seen as an opportunity to other suppliers.

GlobalData’s Sales Intelligence platform tracks which pharmaceutical companies and CROs work with which specific clinical vendors and include estimated spend and outsourcing frequency—intelligence that becomes critically valuable during market disruptions and acquisitions.

Proprietary research reveals market gaps

Major deals also drive the need for further innovation and differentiation across the industry. GlobalData’s recent survey of 126 clinical trial executives—spanning both biopharma sponsors and clinical service suppliers—reveals a striking disconnect between what vendors think matters and what sponsors actually prioritise.

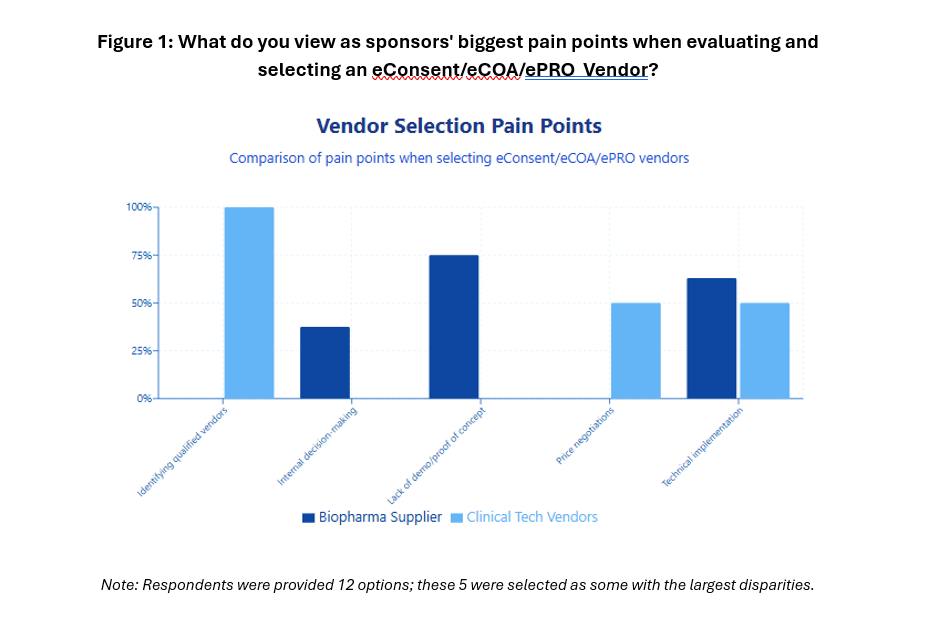

Surveyed eCOA vendors cited “identifying potential vendors” as what they believed to be a sponsor’s primary pain point during eCOA, eConsent and ePRO supplier evaluation. Yet not one biopharma company in our survey cited vendor identification as an issue.

Instead, biopharma companies most frequently cited “Lack of desired features or integrations” as a pain point during eCOA vendor evaluation. This was followed by “Technical cost of implementing a new system” as the second most cited issue they experienced during vendor evaluation.

This disconnect is profound: vendors are focused on improving visibility while sponsors are struggling with capability gaps and implementation friction.

What drives decisions

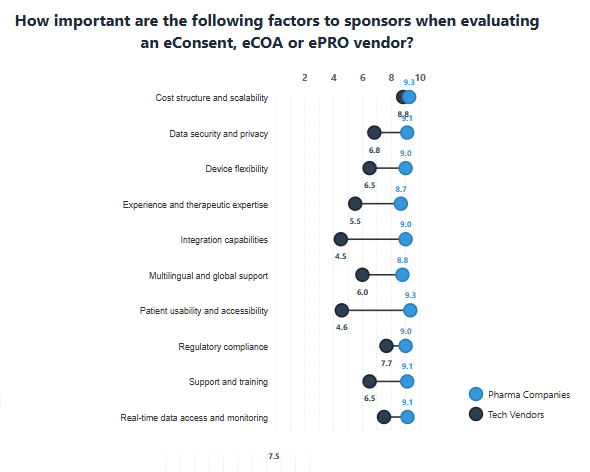

When asked to rate which factors are most important while evaluating an eCOA, eConsent or ePRO system on a scale of 1-10, sponsors consistently gave maximum importance (10/10) ratings to to a number of factors indicating a very high expectations of vendors across the board. Pharma companies consistently rate nearly all factors as more important than tech vendors do, with some dramatic gaps in perception.

The most significant disconnect occurs around “Patient usability and accessibility” – pharma companies rank it at 9.3, while eCOA vendors rate it only 4.6. “Integration capabilities” shows a similarly large gap (9.0 vs 4.5). This data reveals that clinical technology vendors may be significantly underestimating the importance sponsors place on user experience and system integration and may need innovations or partnerships to meet sponsors’ expectations.

How intelligence drives strategy

Recent acquisition announcements in this sector exemplify why market intelligence matters. Gaining a real-time understanding of unfolding events, the companies affected, and the decision criteria that matter to sponsors is a strategic advantage.

GlobalData’s Sales Intelligence solution provides exactly this visibility: detailed data on which vendors serve which pharmaceutical companies and CROs, enabling precise targeting and positioning. GlobalData’s ongoing primary research across the clinical outsourcing and technology landscapes also provides surface insights that shape winning strategies.

As the industry continues consolidating, the winners will be those who can identify opportunities quickly and understand buyer priorities deeply enough to differentiate meaningfully.

Amanda Murphy is the head of Digital Product Management at GlobalData. To learn how GlobalData’s Sales Intelligence solution can help you capitalise on market opportunities and to book a demo, click here.