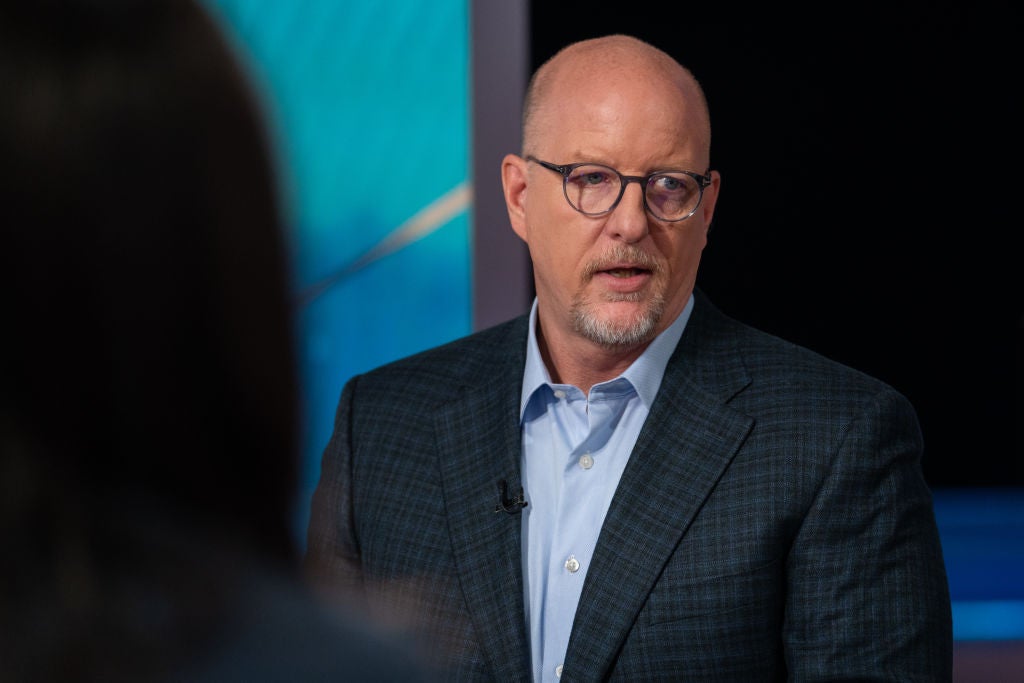

Johnson & Johnson (J&J) expects continued growth in 2026, bolstered by recent and new product launches within the immunology space, primarily Tremfya and Icotyde, according to CEO Joaquin Duato speaking at the J.P. Morgan Healthcare Conference 2026.

Excluding Stelara (ustekinumab), J&J Innovative Medicine grew 16% in Q3 2025, said Duato. Stelera, which peaked at around $11bn in revenue in 2023, has seen its market dominance eroded by biosimilar competition. Flexing assets that are picking up the lost revenue, performance in 2026 is expected to exceed the previous year for J&J, building “sustainable and deeper” growth via a broad portfolio that spans innovative medicine and medical technology.

Duato highlighted Tremfya (guselkumab) as the company’s most important asset within immunology, having had a successful launch in irritable bowel disease (IBD). The interleukin-23 (IL-23) blocking biologic is approved in indications in plaque psoriasis, active psoriatic arthritis, ulcerative colitis, and Crohn’s disease. With access to large patient populations, Duato predicts Tremfya will be “bigger than Stelara” and worth more than $10bn.

According to consensus forecasting by GlobalData, annual global sales for Tremfya are predicted to be $9bn in 2031.

GlobalData is the parent company of Pharmaceutical Technology.

Another key growth driver in 2026 will be the launch of icotrokinra, known under the brand name Icotide, said Duato. The oral IL-23 inhibitor is currently under review by the FDA and EMA for approval in moderate to severe plaque psoriasis.

J&J filled for approval in 2025 based on data from four pivotal Phase III trials, ICONIC-ADVANCE 1 and 2 (NCT06143878 and NCT06220604), ICONIC-LEAD (NCT06095115), and ICONIC-TOTAL (NCT06095102) studies.

If approved, Icotyde would be the first oral peptide that selectively blocks the IL-23 receptor. “It's going to be the first oral medicine that has a profile and an action like an injectable biologic,” explained Duato.

AbbVie’s Skyrizi (risankizumab) and J&J’s Tremfya are top-selling drugs in the plaque psoriasis market. There’s still space for new drugs however, with currently only 30% to 40% of the market penetrated according to Duato, providing "a lot of room" for expansion. An oral option would offer access to patients who are afraid of injectables, he added. Beyond psoriasis and psoriatic arthritis, Icotide is being investigated in moderate to severe active ulcerative colitis in the Phase III ICONIC-UC study (NCT07196748), with primary completion expected in 2028, as per ClinicalTrials.gov.

There is room for both Tremfya and Icotyde in the market and neither will be prioritised over the other, said Duato. Preference between an oral and injectable will be left to the physician and the patient to decide, he explained.

Impact of wider US policy changes

J&J recently secured a drug pricing deal with the US Government under the Most Favoured Nation policy, reported on 9 January 2026.

Duato said that policy changes in the US are “a step in the right direction” and will have a positive impact on the industry. Agreements made will allow pharma to focus on “what we do best”, which is developing, manufacturing and commercialising medicines and medical devices, he added.

Sign up here to receive daily updates on the latest healthcare industry trends emerging from the JP Morgan Healthcare Conference 2026. Sign up here to receive a comprehensive report after the conference.

Editor's note: This article was updated on 15 January to correct the spelling of Icotyde. A pervious version had spelt this as "Icotide".