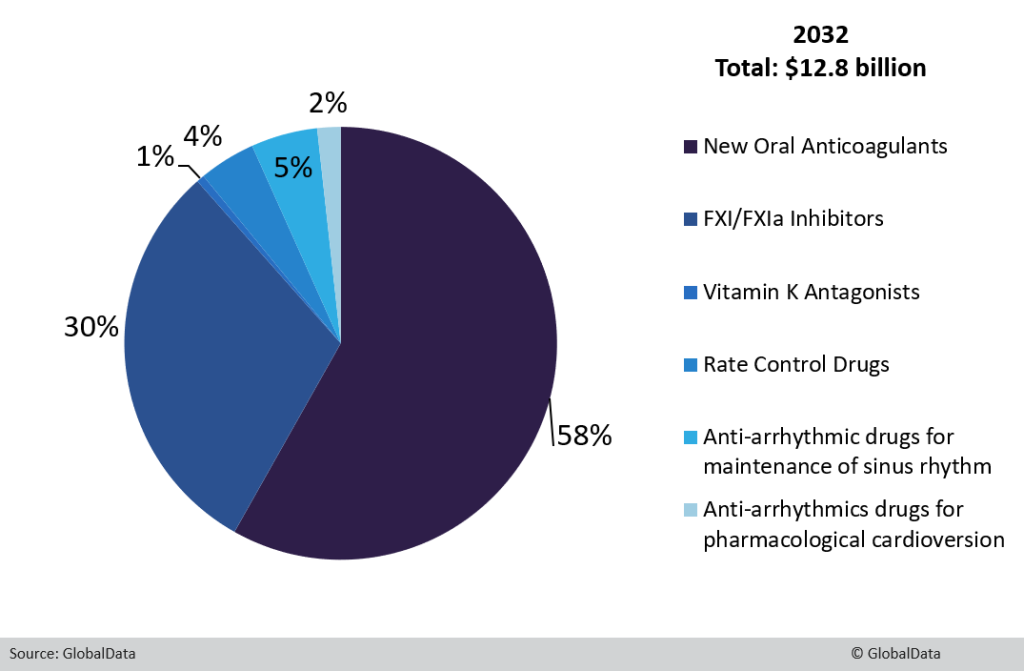

The atrial fibrillation (AF) market is expected to decline from global sales of $14.53 billion in 2022 to $12.8 billion in 2032, according to GlobalData’s recently published Atrial Fibrillation: Global Drug Forecast and Market Analysis report, which covers the eight major markets (8MM) (the US, France, Germany, Italy, Spain, the UK, Canada and Japan).

This decline in sales can be largely attributed to the patent expiration of the novel oral anticoagulants (NOACs). The patents of all four NOACs — Bristol Myers Squibb’s Eliquis (apixaban), Bayer’s Xarelto (rivaroxaban), Boehringer Ingelheim’s Pradaxa (dabigatran) and Daiichi Sankyo’s Savaysa/Lixiana (edoxaban) — are set to expire during 2022–2032. NOACs are the current standard of care (SoC) for stroke prevention in AF. Generic erosion is therefore expected to have a significant impact on the trajectory of the AF market from 2022 to 2032. GlobalData forecasts that NOAC sales across the 8MM will decline from $13.35 billion in 2022 to $7.45 billion in 2032 at a compound annual growth rate (CAGR) of 5.7%.

Global sales will nevertheless be partially recouped by the uptake of novel Factor XI (FXI)/FXIa inhibitors, Bayer’s asundexian and Bristol Myers Squibb’s milvexian, which are expected to launch across the 8MM during the forecast period. Cadrenal Therapeutics’ vitamin K antagonist, tecarfarin, and InCarda Therapeutics’s pharmacological cardioversion agent, InRhythm, will also launch across the forecast period. However, according to GlobalData, these agents will not be key drivers of growth due to their higher annual cost of therapy (ACOT) and lack of superiority in terms of safety and efficacy compared to the current SoC, thus hindering their market uptake.

The figure below summarises AF market growth across the 8MM from 2022 to 2032.

At the end of 2032, the US will retain its market-leading position and contribute approximately 74% of AF sales in the 8MM. This is mainly due to the large prevalent AF population in the US, early adoption of the NOACs and higher prices for AF medications in this market.

Major drivers of the AF market during the forecast period will include the following:

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData- A total of five pipeline products, including four anticoagulants and one cardioversion agent, will launch during the forecast period, each of which will have a higher ACOT when compared with the cost of generic NOACs and the commonly used pharmacological agents.

- FXI/FXIa inhibitors, including Anthos Therapeutics’ abelacimab, asundexian and milvexian, will be welcomed by the many AF patients who are not treated with the currently available anticoagulants due to bleeding concerns.

- In the 8MM, the number of 12-month total prevalent cases of AF treated is expected to increase during the forecast period, which will drive sales.

- Continued increases in AF awareness will improve diagnosis rates.

The major barriers to growth in the AF market during the forecast period include the following:

- The NOACs will face generic erosion as their patents expire over the forecast period.

- The AF market is crowded with inexpensive generic products for the maintenance of rate and rhythm control. The high use of these products is expected to continue throughout the forecast period, presenting a stiff barrier to entry for pipeline drugs.

- The high cost of FXI/FXIa inhibitors compared to the NOAC generics will likely hinder patient uptake.