Pharma supply chains are under enormous pressure globally, with geopolitical tensions and the issue of tariffs requiring careful management by CDMOs.

Traditionally, moving production offshore was a way to save costs and increase efficiency, with China being a major location for outsourcing, especially for active pharmaceutical ingredients (APIs).

However, as we enter 2026, trade tensions, particularly between the US and China, have put a considerable strain on international options. Additionally, Covid-19 exposed the risks of overreliance on international partners, prompting greater adoption of nearshoring to enhance supply chain resilience. While in an increasingly divided world, the trend of friendshoring has increased as countries partner with closer allies.

Issues impacting supply chains for CDMOs

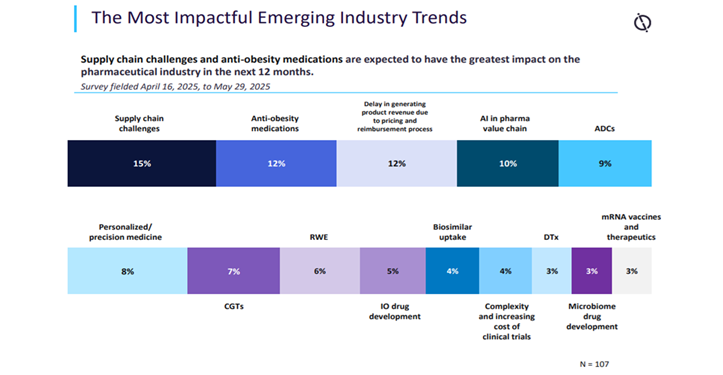

In its mid-year update, GlobalData’s State of the Biopharmaceutical Industry 2025 includes a survey of 107 GlobalData pharma clients and prospects, fielded from 16 April 2025 to 29 May 2025. When asked to identify the most impactful emerging industry trends expected to have the greatest impact on the pharma sector in the next 12 months, the largest proportion of respondents, 15%, selected supply chain challenges. This was up from 8% in the previous survey, just six months earlier[i].

This shift is likely due to risks of new US tariffs and the tensions with China, creating uncertainty within manufacturing bases. In December 2025, the BIOSECURE Act was strongly expected to become law in the US after being passed by both the House of Representatives and the Senate and is now awaiting final presidential approval.

Earlier drafts took a harsher line on China. Chinese CDMO WuXi AppTec was formerly targeted in an earlier version of the act, along with four other China-based life sciences companies. Yet none have been named the version of the legislation recently passed. It remains to be seen what impact the legislation will have in reality. Developments will be closely monitored by the industry.

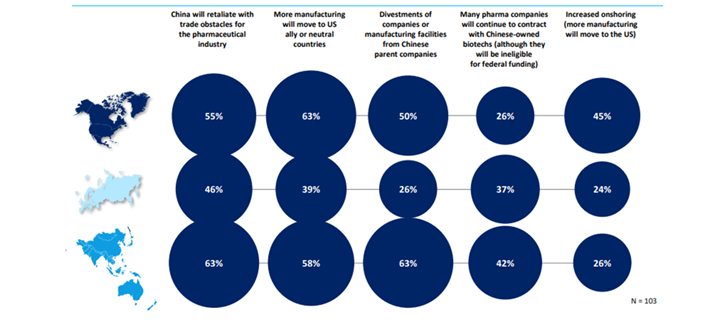

Nevertheless, the BIOSECURE Act aims to prevent Chinese manufacturers from accessing US federal funding, specifically targeting major Chinese biotech and genomics companies. The act affects manufacturing and supply of several clinical-stage drugs by US biopharmaceutical companies. According to the GlobalData survey, many pharma companies were concerned about potential disruption to their supply chains if the act became law. While some regions such as India could benefit from increased business if customers move away from Chinese partners. US pharma relies heavily on Chinese contract manufacturers for active pharmaceutical ingredients (APIs) and raw materials due to the low costs and large production capacity in China. When asked about the wider implications of the BIOSECURE Act, the largest proportion of respondents said that they expected more manufacturing to move to US-friendly or neutral countries. There were also high numbers of respondents concerned about China retaliating.

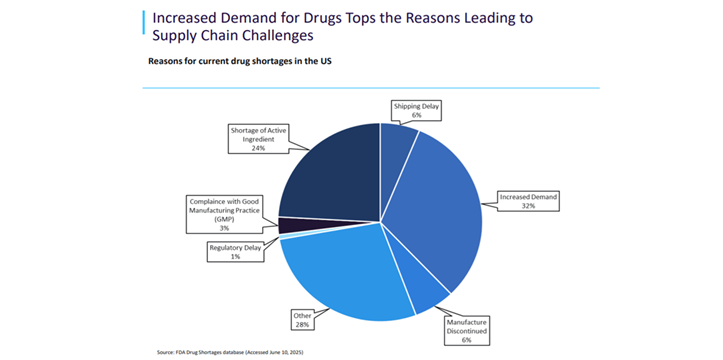

Meanwhile, drug shortages are leaving patients without access to essential medications and healthcare providers struggling to find alternatives[ii]. Shortages are impacting both high and low-value drugs such as antibiotics, with demand especially high for anaesthetics and oncology drugs. Many manufacturers blame low generic drug prices for shortages, prompting some governments to raise prices to encourage production.

At the same time, with the approval of the BIOSECURE Act, US pharma manufacturers are likely to face increasing pressure to reshore production facilities, strengthen supply chain security, and lessen their reliance on overseas suppliers.

Why China continues to be vital for pharma manufacturing

China leads the world in chemical manufacturing facilities for APIs and is also a powerhouse in generic drug manufacturing. According to GlobalData, China has the most API chemical manufacturing facilities and API companies in the world. It is estimated that the US sources approximately 80% of its API imports from China and India. There are also concerns growing among US policymakers that China could use this dependency as an economic weapon to hurt US businesses[iii].

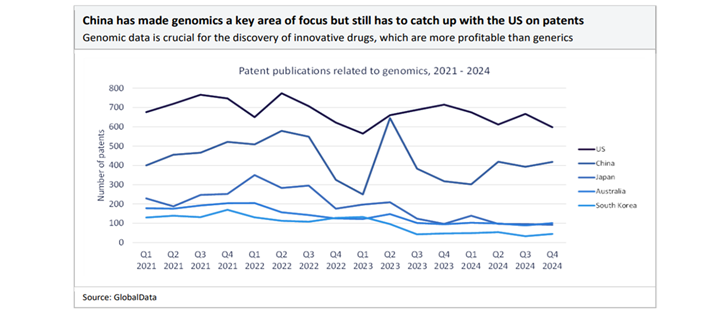

In recent years, China has also focussed on innovative drug development. With strong state support for R&D, policy incentives, and investment in biotechnologies, China’s pipeline for drug innovation is growing rapidly. There was a rise in licensing deals between Chinese biotechs and foreign pharma during 2025, including some of the largest deals over the last five years taking place in the first nine months of the year[iv].

China now accounts for one fifth of all drugs in development, with 28% of the world’s licensed drugs in 2024[v]. The total deal value of innovator drug licensing agreements involving Chinese biopharma licensors has surged 66%, from $16.6bn in 2023 to $41.5bn in 2024, reaching a five-year high, according to GlobalData’s Pharma Intelligence Center Deals Database[vi].

Although geopolitical risks and the “China+1” strategy – diversifying manufacturing to other countries such as India – are gaining attention, China’s existing infrastructure, supply chain integration, and policy support still make the country a prime global pharma manufacturing hub. China is also improving its regulatory environment, driving quality and efficiency gains. The country’s pharmaceutical sector is globally recognised, not only for cost but also for increasing quality and innovation – boosting confidence among multinational partners.

Despite moves to diversify supply chains, China’s dominance in low-cost, large-scale APIs and generics manufacturing, rapid innovation progress, substantial government support, and a considerable domestic market mean the country will continue to remain vital for global pharma manufacturing.

The advantages of onshoring and friendshoring in pharma manufacturing

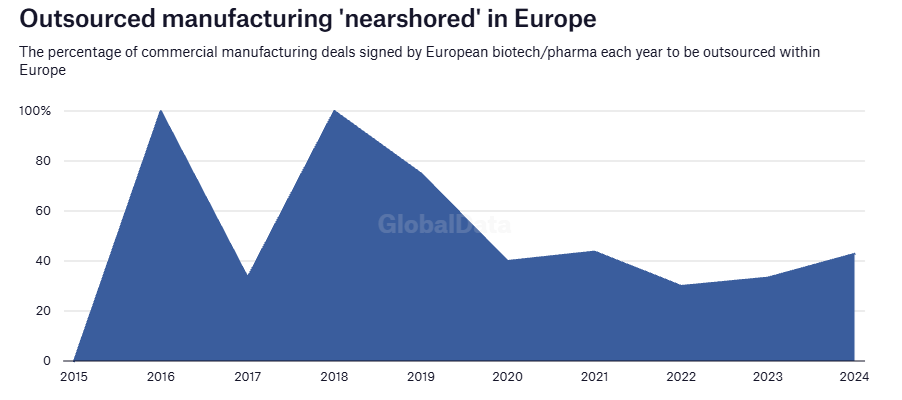

Recent developments in the international landscape have prompted many companies to reconsider their supply chain strategies, with a growing preference for nearshoring and domestic operations over traditional outsourcing abroad. While this shift is partly driven by evolving regulatory and geopolitical pressures, and the perceived need for greater supply chain resilience, some experts suggest this regionally focused approach may prove to be temporary[vii]. Competitive pressures continue to present a strong incentive for companies to maintain international collaboration and operational flexibility.

Another trend emerging is friendshoring where countries and companies switch their supply chains to nations that share either similar political views or security interests. Friendshoring is another way to reduce risks from future geopolitical tensions. However, while this approach may offer increased security, it also carries the potential for increased costs and inefficiencies when compared with a fully globalised model, with possible price hikes further down the line.

Friendshoring has recently become more significant due to drivers such as the US BIOSECURE Act and wider supply-chain realignments post-pandemic. Companies are shifting toward trusted countries with strong regulatory frameworks and talent pools. One country the stands to benefit from ‘China+1’ strategies is India, which is becoming a preferred destination for CDMO services. This is enabling biopharma sponsors to diversify risk, access specialised resources, and increase the speed of new therapies to market while ensuring a robust, reliable supply chain.

Risk mitigation strategies delivering successful outcomes

In terms of risk mitigation, the focus is on broad geographic diversification, ensuring suppliers and operations are distributed across stable and ‘friendly’ regions. The China+1 strategy, for instance, has made India particularly attractive to sponsors owing to its competitive pricing, highly skilled workforce and agility. Shifting manufacturing closer to primary markets in North America and Europe reduces regulatory and logistical risks and circumvents uncertainties associated with legislation impacting foreign suppliers – such as the BIOSECURE Act. In anticipation of potential future disruptions, US and European CDMOs are expanding their capacity to serve clients looking to avoid China-related supply chain risks.

The BIOSECURE Act prohibits US firms from partnering with certain Chinese biotechnology companies. To mitigate the impact of this legislation, industry experts recommend that companies incorporate termination rights and technology transfer provisions within their contracts. Additionally, advanced planning is essential, with companies encouraged to develop backup plans that establish relationships with non-Chinese CDMOs and to invest in scaling up US or European operations. The thinking is that this will ensure business continuity and regulatory compliance[viii].

CDMOs are also fortifying their supply chains through a series of practical measures. These include establishing contracts with multiple suppliers to secure material availability and maintaining inventory buffers to manage disruptions. While digital monitoring tools allow for real-time supply network oversight.

Piramal Pharma Solutions (PPS)

Piramal’s supply chain strategy is based on client needs, supported by agile processes and modern technology that facilitate oversight across the entire value chain. With facilities spanning India, the UK, and the US, Piramal is strongly positioned to respond to any disruptions that might affect specific regions. The company’s broad portfolio ranges from KSMs and APIs to finished dosages and specialised programmes such as ADCelerate. These specialist services support clients in addressing diverse therapeutic requirements.

For example, Piramal was tasked with fulfilling a rush order of a critical raw material in four months. The customer became aware at the last minute of patent restrictions, which meant a Chinese supplier was not authorised to sell a critical raw material. Piramal switched to a major specialised chemicals supplier, which transferred the product to India and supplied the required quantity within three months – all without any patent issues.

Piramal’s supply chain approach – rooted in agile, technology-driven oversight and a global, diversified footprint – provided a rapid, compliant response to an unexpected disruption. The result was safeguarding the client’s timeline and regulatory requirements.

To strengthen resilience amid global supply chain shifts, CDMOs such as Piramal are adopting agile strategies – including nearshoring and supplier diversification – to ensure continuity and compliance, while reducing risk whatever the geopolitical disruptions.

To learn more about the company’s services, download the document below.

References:

i. GlobalData: The State of the Biopharmaceutical Industry 2025 Edition, January 2025.

ii. https://www.bbc.co.uk/future/article/20251021-why-youre-having-trouble-getting-your-meds

iii. GlobalData: Strategic Intelligence Technology: China Tech, April 15, 2025 (page 33).

iv. https://www.pharmaceutical-technology.com/news/chinas-drugs-offer-lifeline-for-global-pharma-as-it-peers-over-the-patent-cliff/

v. https://www.pharmaceutical-technology.com/news/china-accounts-for-one-fifth-of-global-drugs-in-development/

vi. https://www.pharmaceutical-technology.com/analyst-comment/large-pharma-drug-licensing-china-2024/

vii. https://www.pharmaceutical-technology.com/features/are-european-biopharma-manufacturers-nearshoring/

viii. https://pharma.globaldata.com/News/biosecure-act-companies-turn-to-us-manufacturers_218816