On Wednesday 17 January, the US Patent Trial and Appeal Board (PTAB) invalidated Johnson & Johnson’s (J%J) ‘438 patent, which the company hoped would protect its blockbuster prostate cancer drug, Zytiga (abiraterone acetate), from generic threat until 2027. This represents a major setback for J&J, which recently obtained a key label extension for Zytiga in the prostate cancer space, allowing the drug to move away from the crowded castration-resistant setting and into the profitable hormone-sensitive setting.

The label expansion was granted based on the results of the company-sponsored LATITUDE trial. The trial results showed that Zytiga, in combination with either prednisone or prednisone + androgen deprivation therapy, is able to significantly reduce the risk of death in men with metastatic hormone sensitive prostate cancer by 38% compared with androgen deprivation therapy, the current standard of care.

Following Wednesday’s ruling, the launch of generic versions of Zytiga is expected as early as October 2018 in the US. The primary patent on Zytiga expired in December 2016, but the FDA issued a 30-month stay to allow the company to solve the ongoing patent litigation with generic manufacturers.

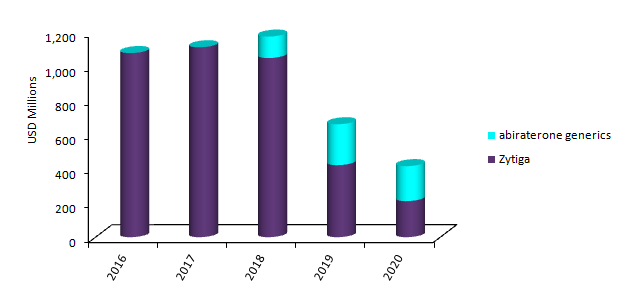

Zytiga and abiraterone generics US sales, 2016-2020

Source: GlobalData

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataAs a result, the key label extension will not allow for the full potential of earnings for J&J’s oncology segment in the US. GlobalData anticipates that the quick generic erosion will negatively affect Zytiga sales in the next three years. To date, 11 companies have filed an Abbreviated New Drug Application (ANDA), seeking approval for generic versions of Zytiga. This will result in a fierce pricing competition and is expected to quickly bring down the price of abiraterone generics. Among patients treated with Zytiga, less than 10% are expected to be on the original product by 2020 in the US, with sales declining from $1.1bn in 2016 to $200m in 2020.

J&J tried to delay the entry of abiraterone generics in the US market using the ‘438 patent, which describes methods for treating hormone sensitive cancers with CYP17 inhibitors, such as Zytiga, in combination with steroids, such as prednisone or dexamethasone. The FDA label currently requires Zytiga to be prescribed at a dose of 1,000mg (four 250mg tablets) orally once daily in combination with 5mg of prednisone orally twice daily. However, this method of treatment (co-administration with prednisone) was deemed insufficient to protect Zytiga’s exclusivity by the PTAB, which ruled that the process described by the ‘438 patent was obvious.

Since the ruling, J&J announced that it is going to fight against the PTAB’s decision and stated its intention to request a rehearing or appeal to the Court of Appeals for the Federal Circuit. Nonetheless, GlobalData expects that J&J will still be able to profit from the label expansion in the hormone-sensitive setting, as approximately 50% of Zytiga’s sales come from Europe and Japan, where J&J filed for label expansion last year and the drug remains protected until 2021 in Europe and 2022 in Japan. In Europe, the drug license was extended to include hormone-sensitive prostate cancer in November 2017, and the application is still under review in Japan.

Related Reports

GlobalData (2017). PharmaPoint: Prostate Cancer – Global Drug Forecast and Market Analysis to 2026, November 2017, GDHC163PIDR