The ever-increasing prevalence of diabetes, along with the anticipated launch of a novel wound healing agent, will lead to significant growth of the US Diabetic Foot Ulcer (DFU) market through 2025.

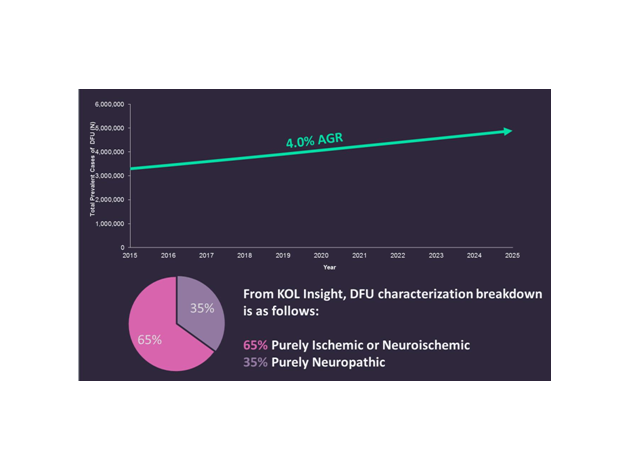

DFUs are characterized by ulceration, destruction of the deep tissues of the foot, and/or infection, constituting one of the most significant end-stage complications of diabetes. DFUs can be characterized as either purely neuropathic, purely ischemic, or neuroischemic, with the latter two warranting the restoration of adequate blood flow. With the increasing prevalence of diabetes in the US, the number of patients suffering from DFUs is also expected to rise, growing approximately at an Annual Growth Rate (AGR) of 4.0% from 2015 to 2025.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Figure 1: Total Diagnosed Prevalent DFU Cases in the US (Ages >20Years , Both Sexes, 2015–2025), and Classification of DFU Prevalence

For the past two decades, Smith & Nephew’s Regranex (becaplermin) has been the only pharmacological wound-healing agent approved for neuropathic DFUs in the US. However, Regranex is rarely used due to efficacy and safety concerns. As such, there is a large need for additional drug options to treat DFUs.

FirstString Research’s DFU drug candidate, Granexin (aCT1 peptide), which is currently in Phase III clinical trials, might be able to fill this gap. Compared to standard of care, Phase II studies with Granexin revealed a significant percentage of patients achieving 100% ulcer closure and reduced times to ulcer closure at 12 weeks. If Granexin gains FDA approval, it will be the only wound healing agent other than Regranex to be approved for the treatment of neuropathic DFUs. Granexin is expected to be launched in the US by 2020, and effectively become the market leader in DFU drug sales, excluding other non-pharmacological therapies.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataGlobalData believes that the US DFU market, excluding antibiotic sales for diabetic foot infections, reached $46M in 2015, and is forecast to generate $552M by 2025 at a Compound Annual Growth Rate (CAGR) of 28.1%.

Figure 2: US Total DFU Sales (2015–2025)

The US is expected to be among the most lucrative markets for DFUs. Despite a scarce number of DFU drugs in the pipeline, the increasing prevalence of diabetes and resulting DFUs, along with the anticipated launch of Granexin, will be the top growth drivers impacting the US DFU market through 2025.