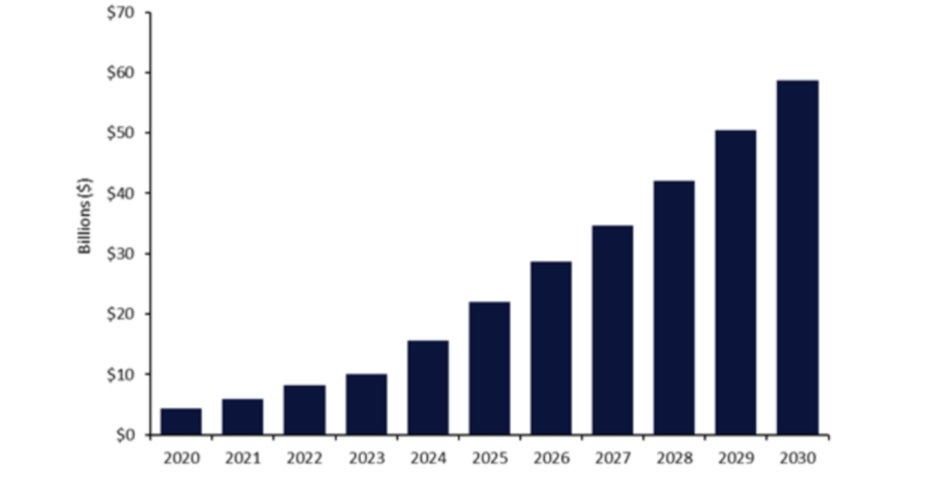

Pharmaceutical companies and manufacturers, including MilliporeSigma (Burlington, US), Simtra BioPharma Solutions (Parsippany, US), Carbogen AMCIS (Bubendorf, Switzerland), and BioNTech (Mainz, Germany), have recently invested to meet growing demand for antibody drug conjugates (ADCs) as targeted cancer treatments. The global ADC market was $10bn in 2023 and is anticipated to exceed $58bn by 2030 (Figure 1).

According to leading data and analytics company GlobalData, ADCs are expected to lead as the largest growing group of medicines in the innovation pipeline for 2025, as the industry has seen an increase in deals to develop and manufacture ADCs. Last week, MilliporeSigma and Simtra BioPharma Solutions announced a five-year partnership to offer ADC manufacturing services to pharmaceutical companies. MilliporeSigma will offer bioconjugation manufacturing at its ADC production facility in St. Louis, Missouri, US, while Simtra will offer drug product formulation and fill-finish services. Both companies will cover the analytical work for ADC production. MilliporeSigma has a history of prioritising ADC production – the company invested $76m into its St. Louis facility in 2024, in addition to the $65m spent five years ago to build its ADC active pharmaceutical ingredient (API) site in Madison, Wisconsin, US. Last year, Simtra announced a $14m investment to expand its ADC conjugation and purification capabilities.

Earlier this month, Carbogen AMCIS, an API manufacturer, along with an unnamed Japanese partner, shared that they would invest $31m to prepare two facilities in Switzerland for the commercial production of linkers by the first quarter (Q1) and Q3 2027. Another Swiss contract development and manufacturing organisation (CDMO), Lonza (Basel, Switzerland), also revealed plans to increase its ADC production capabilities last year, with the addition of two manufacturing suites to its Visp, Switzerland, site.

Last month, BioNTech announced that it was preparing to file for US Food and Drug Administration (FDA) approval in second-line endometrial cancer later this year for its next-gen human epidermal growth factor receptor 2-targeted ADC, BNT323. Currently, the company is “reliant on a China-based CDMO” to supply BNT323. However, the company shared plans to diversify its supply chain and decrease dependence on its Chinese partner by adding multiple BNT323 ‘supply nodes’.

With impending tariffs on pharmaceuticals under the current government, there has been a rise in deals and investment to grow US manufacturing operations. Combined with the surge of ADC demand for oncology indications, clinical and commercial manufacturing contracts for ADCs are anticipated to increase. Although only 6% of the current ADC landscape is made up of marketed drugs, the ADC addressable market is expected to grow over the next decade, with 268 drugs currently in clinical stages of development (Figure 2).

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData