Cell and gene therapies (CGTs) are gradually becoming an important focus within the healthcare industry. While this is a relatively new development—as the first autologous dendritic cell therapy, Dendreon Pharmaceuticals’s Provenge (sipuleucel-T), was approved in 2010 and the first CAR-T therapy was approved in 2017—the advancements in cell and gene therapy development have been exponential. Nevertheless, the full potential of CGTs has not yet been discovered as these therapies promise life-changing treatments for a broad spectrum of complex diseases ranging from genetic conditions to cancers.

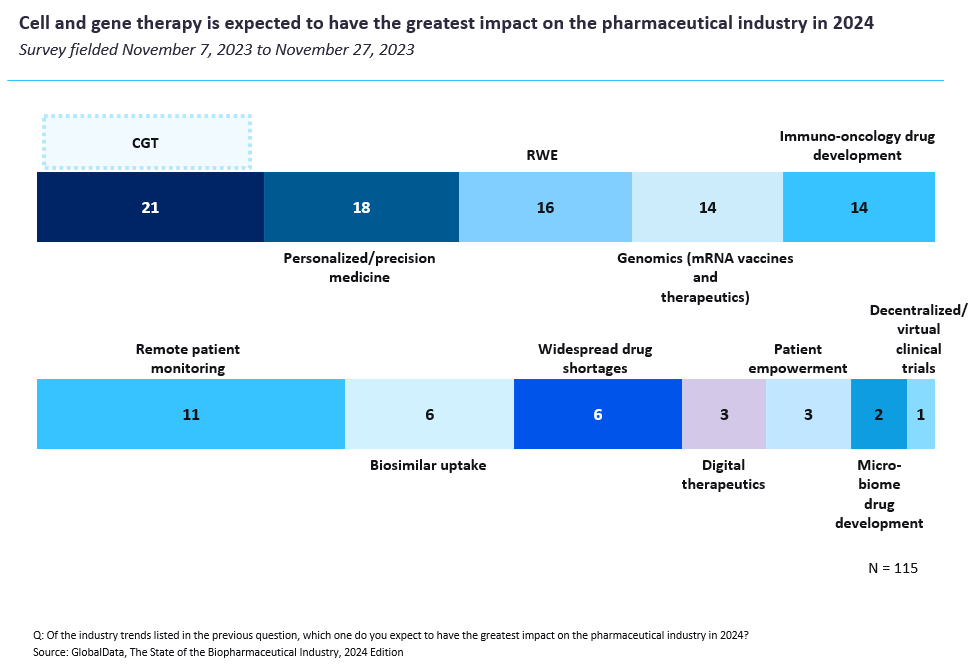

Survey data presented in GlobalData’s The State of the Biopharmaceutical Industry 2024 report (see above) revealed that 18% (N=21) of healthcare industry professionals believed that CGT will dominate as the industry trend to have the greatest impact on the pharmaceutical industry in 2024. This was followed by personalized/precision medicine with 16% (N=18) of respondents.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

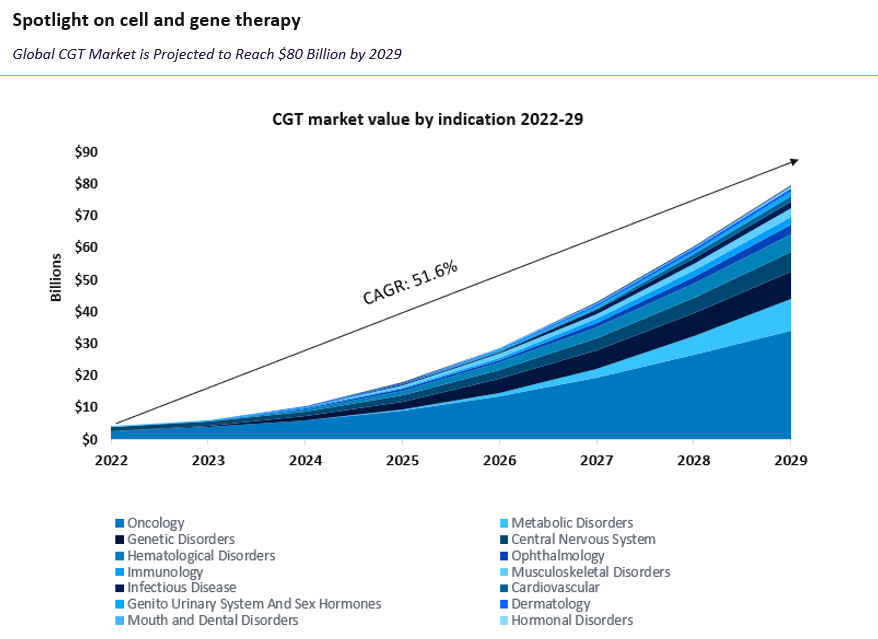

By GlobalDataOncology is the top area of the CGT development pipeline, and no changes are expected in the near future. However, there is an ongoing effort to translate the success of cell therapies within oncology to other indications, with clinical trials being conducted in areas including metabolic, genetic, and central nervous system disorders. Still, most of the trials being conducted outside oncology are in the pre-clinical or early developmental stages.

According to GlobalData’s estimates, the global CGT market is projected to reach sales of $80bn by 2029. Oncology is expected to continue its lead as the indication and area of major development for CGTs, accounting for 44% of the CGT market by 2029 (Figure 2). Within oncology, most of the revenue is expected to come from cell therapies, the other therapy areas prove to be stronger in gene therapies.

Overall, GlobalData anticipates CGTs to become an established treatment modality in the coming years. The higher development and production costs, risk of clinical trial failures, and intensifying pricing and reimbursement pressures will continue to place further stress on these innovations. The sooner these issues are addressed, the quicker CGTs can become a viable treatment option.