Recent advances in genome-editing technologies, also known as gene editing, has allowed for the sequence of the human genome to be manipulated precisely in order to achieve a clinical therapeutic effect, such as in gene and cell therapies. This can include correcting disease-causing mutations, adding therapeutic genes to specific genome sites, and removing deleterious genes or genome sequences that increase an individual’s susceptibility or predisposition to a certain disease. Gene editing is being explored in a wide range of diseases, including single-gene rare disorders such as sickle cell disease, hemophilia, and cystic fibrosis, as well as for the treatment and prevention of complex diseases including cancer, cardiovascular disease, and human immunodeficiency virus.

Gene editing involves the use of enzymes (or nucleases) to cleave genomic DNA in order to generate site-specific double-strand breaks (DSBs). These are predominantly repaired by non-homologous end joining (NHEJ) or homology-directed repair (HDR). NHEJ is a popular strategy and results in loss-of-function of targeted genes by introducing a frameshift in the open reading frame (gene knockout). HDR is used to a lesser extent and involves using additional DNA to create a desired sequence within the genome (gene knock-in).

The three main gene editing techniques used today include zinc finger nucleases (ZFNs), transcription activator-like effector nucleases (TALENs), and clustered regularly interspaced short palindromic repeats (CRISPR)/CRISPR-associated gene (Cas) systems. Earlier techniques like ZFNs and TALENs are not used as much as CRISPR due to their lower specificity from off-target side effects. The CRISPR-Cas9 system, which was first discovered about 10 years ago, has revolutionized gene editing as it is a faster, more efficient, more accurate, and cost-effective technology.

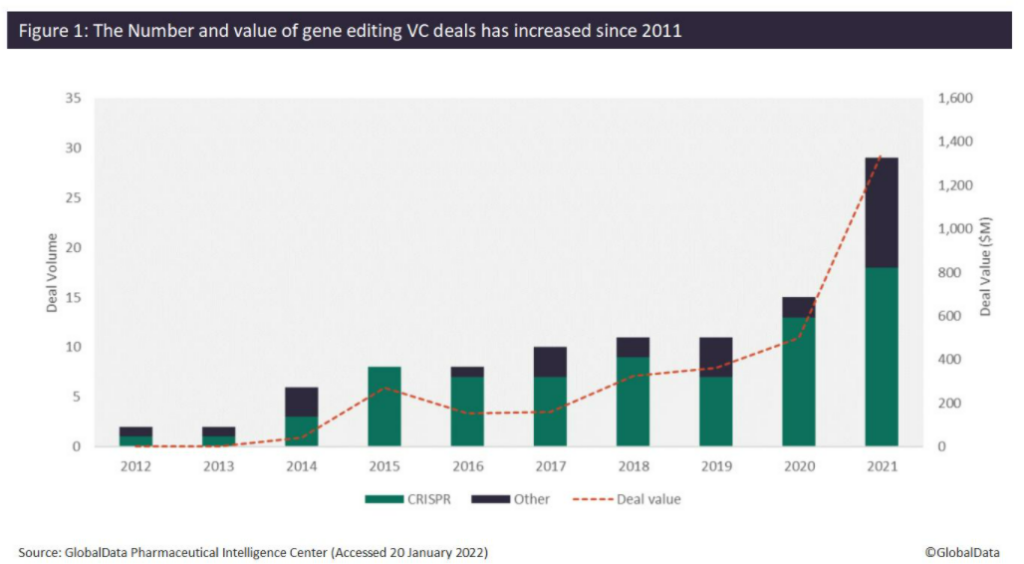

Since 2012, the number of venture capital (VC) deals for companies developing gene editing technologies has increased significantly. An analysis of GlobalData’s Pharma Intelligence Center shows that the number of VC deals increased from just one deal in 2012 to 29 deals in 2021, while the total value of VC deals since 2012 has reached over $3.2 billion. Over $1.3 billion was raised in 2021 alone, which is over 250% more than what was raised in 2020 ($500 million). Of the 97 VC deals identified since 2012, 74 of these have involved CRISPR technology, of which 31 were completed in 2020 (13 deals) and 2021 (18 deals), respectively (Figure 1).

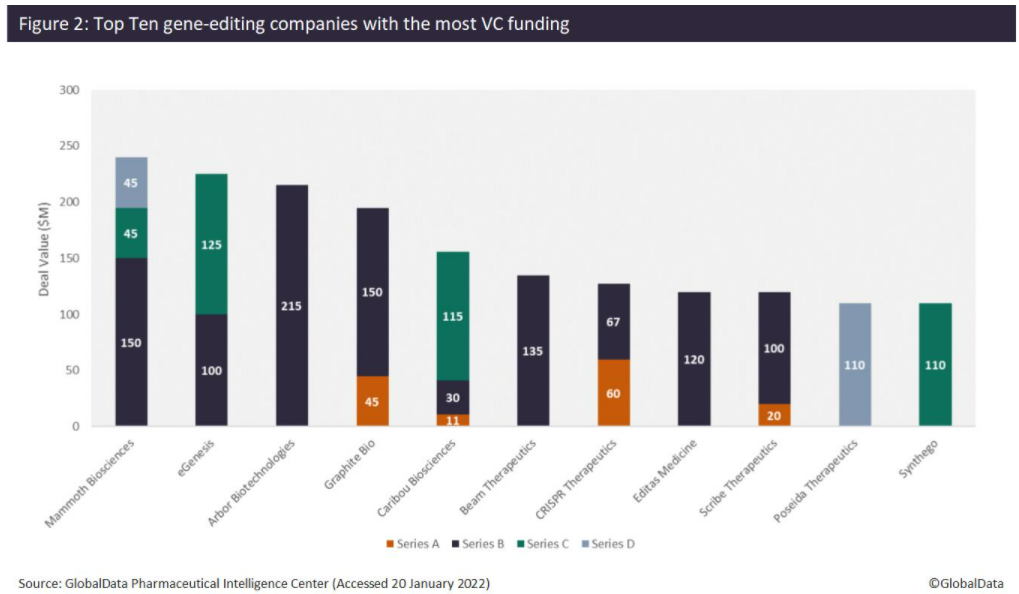

According to the analysis, Mammoth Biosciences has received the most VC funding, totaling $240 million, from three financing rounds since 2020. This includes a $150 million Series D, led by Redmile Group, which the company plans to use to broaden its toolkit of next-generation CRISPR systems, including proprietary, ultra-small Cas14 and Casɸ CRISPR systems for in vivo gene-editing therapeutics. This follows a $45 million Series C in December 2020, which included participation from Amazon, as well as a $45 million Series B in January 2020. The company has now reached unicorn status, with a valuation of more than $1 billion. Mammoth Biosciences has also forged several recent high-value strategic partnerships with pharma companies. For example, on January 10, in a deal thought to be worth over $1 billion, Bayer and Mammoth Biosciences announced a strategic collaboration and option agreement for the use of the latter’s CRISPR systems to develop in vivo gene-editing therapies. This will strengthen Bayer’s new cell and gene therapy platform, and the initial focus of the collaboration will be on liver-targeted diseases.

Other top companies that have raised the most VC funding include eGenesis ($225 million), Arbor Biotechnologies ($215 million), Graphite Bio ($195 million), Caribou Biosciences ($169 million), Beam Therapeutics ($135 million), and others (Figure 2). Arbor Biotechnologies’ $215 million Series B round in November 2021 is the largest VC funding round in gene editing to date. The company intends to use the funds to advance its liver and central nervous system programs into clinical trials and progress a pipeline of precision editing therapeutics, while continuing to invest in developing next-generation gene editing technology.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData

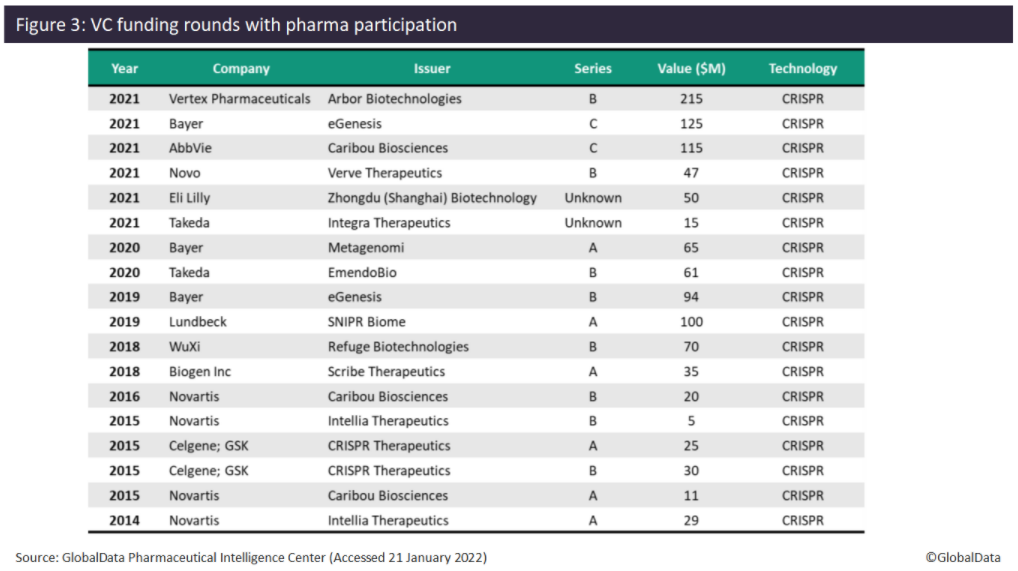

Investment by pharma in gene editing companies also increased in 2021, with six VC funding deals found. Since 2014, pharma has only participated in one to two VC funding deals each year, with the exception of 2015, where four VC deals involving pharma were found. In terms of the number of VC deals, Novartis and Bayer lead with four deals and three deals, respectively. Novartis appears to have been an early investor in gene editing technology, with four VC deals between 2014 and 2016, but does not appear to have participated in any such deals since then. Examples of pharma investing in gene editing companies in 2021 include Vertex (Arbor Biotechnologies, $215 million Series B), Bayer (eGenesis, $125 million Series C), and AbbVie (Caribou Biosciences, $115 million Series C). Other companies that have invested in gene editing companies include Novo Nordisk, Eli Lilly, Takeda, Lundbeck, WuXi AppTec, Biogen, Celgene, and GlaxoSmithKline (GSK). All deals with pharma participation have involved companies developing CRISPR-based gene-editing technology.

In 2021, there were several major clinical milestones in gene editing. For example, Intellia Therapeutics announced the first data from an in vivo CRISPR therapy for treating transthyretin (ATTR) amyloidosis. NTLA-2001 reduced serum levels of transthyretin, a harmful liver protein, by 87%, whereas standard treatment typically achieves an 80% reduction. CRISPR Therapeutics and Vertex Pharmaceuticals announced data for their gene-editing therapy for sickle cell disease, which showed that all 15 beta thalassemia patients treated were transfusion independent and all seven sickle cell disease patients were free of vaso-occlusive crises. Additionally, in July 2021, the World Health Organization released a series of reports that provide the first global recommendations to help establish genome editing as a tool to address public health concerns, with a focus on safety, effectiveness, and ethics.

Advancements in gene editing technologies have opened up new and exciting avenues in drug discovery and medicine. The enormous potential of gene editing techniques, like CRISPR, are beginning to be realized in terms of treating rare and complex diseases. GlobalData expects to see increased activity in this space in the coming years, including further investment in companies developing gene-editing technologies.