“As a manufacturer, we are always optimistic, but we could not have predicted the demand and success that these products have had and the amount of money investors would put forward,” said Philip Ridley-Smith, sales and marketing director at Cobra Biologics, speaking at the Cell & Gene Therapies panel discussion at bioLIVE, a bio-processing and manufacturing event at Convention on Pharmaceutical Ingredients (CPhI) Worldwide conference in Madrid, Spain on October 12.

The panel also included Dan Leorda, Senior Director of Engineering, Procurement, Construction Management and Validation (EPCMV) at Integrated Project Services; and Peter Makowenskyj, Sales Engineer at G-Con Manufacturing. The panel was moderated by the author of this article.

The first topic of discussion was the question of contract manufacturing capacity for cell and gene therapy, and whether panelists are planning for capacity constraints. Leorda described the short shelf lives and short manufacturing timelines of many cell and gene therapies. Makowenskyj added that “Existing facilities are not necessarily suitable, and it is not easy to retrofit them” for cell and gene therapies. This poses a problem for contract manufacturing organisations (CMOs), as they often acquire facilities from the bio/pharma industry (GlobalData, 2017b). The logistics of shipping autologous therapies to and from patients also creates infrastructure problems, including potential shortages, due to the number of smaller and virtual bio/pharma companies, said Makowenskyj. These smaller companies are more likely to outsource their manufacturing (GlobalData, 2017a).

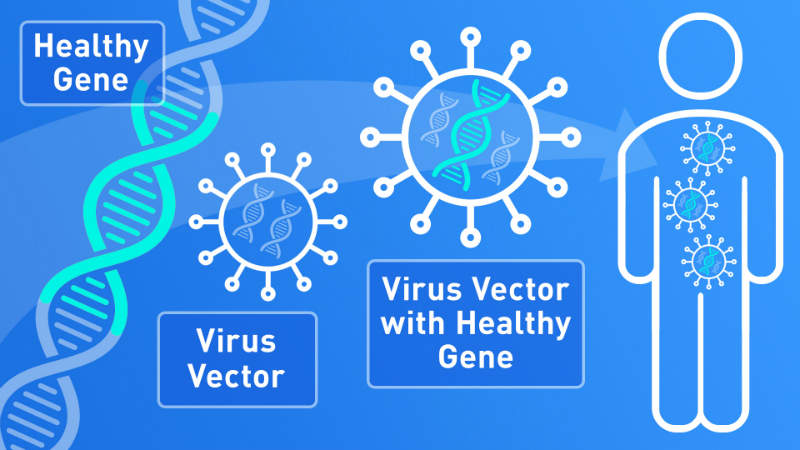

Production lead time in the US has been increasing; one year ago it took one year to begin manufacturing, and now it can take up to two years, the panel told the bioLive audience. Ridley-Smith stated that he “didn’t think anyone could have predicted the success of the [chimeric antigen receptor-T] CAR-T” and stated that from the manufacturing side, the industry was surprised by the strong demand for DNA and viral vectors. PharmSource, a GlobalData product, mentioned viral vectors as a pressure point in the supply chain in a recent report (GlobalData, 2018a).

Supply chain decentralisation, automation

The panel conversation continued around the supply chain for cell and gene therapies. Leorda described the nature of the current supply chain as being centralised, adding that there is a move to decentralise the supply chain into a hub with satellite delivery. The satellite would produce the therapy near to the patient’s location, while the hub would design the processes and train the satellites.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataPanelists agreed that automation would be necessary to decrease risk and produce a higher level of organisation in a decentralised supply chain. For autologous gene therapies, there is the possibility of using hospitals as satellite manufacturing centers, added Makowenskyj, echoing a point made by WuXi AppTec at CPhI North America in April this year. Ridley-Smith noted clients now use multiple CMOs to ensure they receive materials, with one client coordinating up to eight CMOs.

The panel was in broad agreement that greater automation is required to produce the volumes of these therapies that will be needed commercially, and that there is a need for greater flexibility in facilities as there will be continued fundamental changes in the cell and gene therapy space over the next five years. Ridley-Smith added that, additionally, “there are not good enough [analytic] assays”. He also noted the lack of a good assay to measure full versus empty capsids for gene therapy. Leorda also mentioned the need for modular manufacturing to make these systems both scalable and decentralised.

US regulation lags behind

The next topic of discussion was the regulatory environment for cell and gene therapy. Leorda stated that the regulators are not able to keep up with manufacturers and that the manufacturers are trying to work together to find new answers to current problems in the supply chain. Makowenskyj stated that until now, design of facilities has been based on European Medicines Agency (EMA) guidance, and while there are new FDA guidances, the US regulatory framework is lagging behind. Ridley-Smith stated that the regulatory process is very interactive and that he has observed “some differences in results due to how biotechs approach the regulators”. He also stated that the regulators are learning at the same pace as the rest of the industry.

Ridley-Smith also highlighted the role of UK government funding, saying “what we’ve seen in the last five years is more support and encouragement from the UK government, [which is] providing a grant scheme to find novel processes that, as individuals, we wouldn’t necessarily look for”. He stated that the industry is seeing benefits from that involvement. This is borne out by the dominance of the UK, which houses 48% of the cell therapy CMO facilities in the EU (GlobalData, 2018b).

While bioLIVE is a new event launched that this year, next year, bioLIVE will merge with BioProduction Congress to become BioProduction at CPhI.

More information about industry trends, such as those mentioned in this panel, are presented in Trend Reports from PharmSource, a GlobalData product. If you do not subscribe to PharmSource or the Pharma Intelligence Center, please contact a GlobalData sales representative to gain access.