Type 1 diabetes (T1D) is an autoimmune disease that permanently destroys beta cells of the pancreatic islet, which means that the body can no longer produce insulin. The disease is the seventh most investigated indication within metabolic diseases by number of clinical trials, accounting for 8% of all clinical trials initiated since 1995.

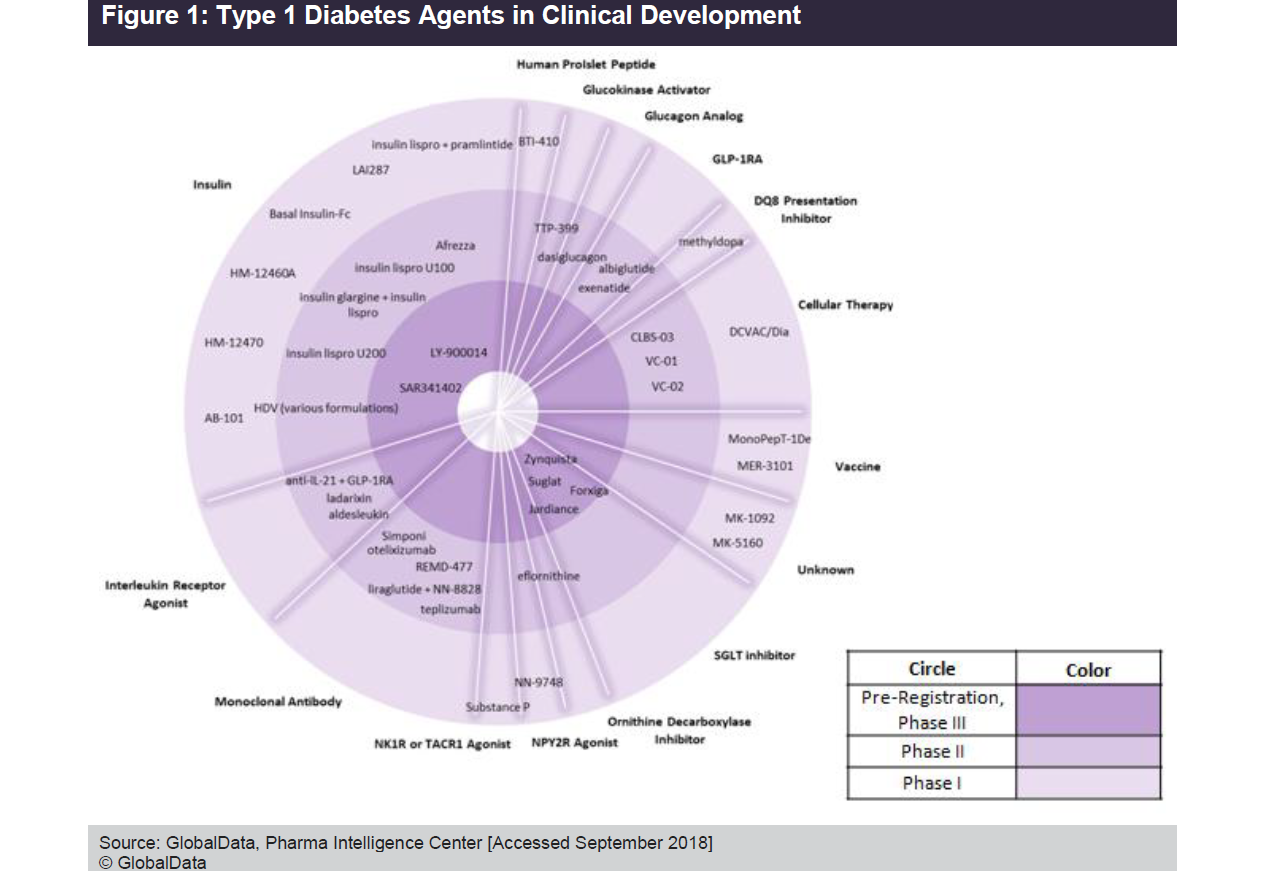

As seen in the Figure below, the current late-stage T1D pipeline consists mostly of sodium-glucose co-transporter (SGLT) inhibitors and insulin. Marketed SGLT inhibitors are only indicated for T2D patients, but both marketed and pipeline varieties are pursuing a T1D indication. The figure indicates that the insulin space will become increasingly crowded if late-stage rapid-acting insulin candidates, Sanofi’s SAR341402 and Eli Lilly’s LY-900014, are approved.

At the other end of the spectrum, the early to mid-stage pipeline comprises a number of novel monoclonal antibodies (approximately 13% of the T1D pipeline agents), cellular therapies (about 10% of the T1D pipeline agents), interleukin receptor agonists (approximately 8% of the T1D pipeline agents), vaccines (approximately 5% of the T1D pipeline agents), and glucagon-like peptide 1 receptor agonists (about 5% of the T1D pipeline agents).

GlobalData anticipates that SGLT inhibitors in the T1D pipeline—Astellas’ Suglat (ipragliflozin), Sanofi/Lexicon’s Zynquista (sotagliflozin), AstraZeneca’s Farxiga/Forxiga (dapagliflozin), and Eli Lilly/Boehringer Ingelheim’s Jardiance (empagliflozin)—will receive FDA, European Medicines Agency (EMA), and Pharmaceuticals and Medical Devices Agency (PMDA) approvals during 2019–2020. If approved, SGLT Inhibitors will be the first oral antidiabetic medications used in combination with insulin in patients diagnosed with T1D. GlobalData also anticipates that rapid-acting insulins, SAR341402 and LY-900014 will receive FDA, EMA, and PMDA approvals during 2020–2021.

Despite the variety of marketed insulins available and the modest number of candidates in the T1D pipeline, the need for a therapeutic agent that either addresses the underlying cause of the disease or, at the minimum, confers a significantly superior efficacy and decreases the risk of hypoglycemia compared to currently available treatments still remains. In addition to some of the promising candidates listed in the figure (including vaccines and cellular therapies), there are also promising agents that are still in early R&D. Smart insulin is one such example, as multiple big pharma developers (Novo Nordisk, Eli Lilly, and Sanofi) are investigating insulin that can detect and respond to glucose levels. A glucose-responsive insulin would provide significant improvements in glycemic control, while also reducing the risk of hypoglycemia and diabetic complications.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData

Related Company Profiles

Novo Nordisk AS

AstraZeneca Plc

Eli Lilly Holdings Limited

European Medicines Agency