US-based biopharmaceutical company Alexion has signed a definitive agreement to acquire biotechnology firm Syntimmune for up to $1.2bn.

The terms of the agreement involve an upfront payment of $400m, as well as potential additional milestone-based payments of up to $800m.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Syntimmune primarily develops antibody therapeutics that target the neonatal Fc receptor (FcRn).

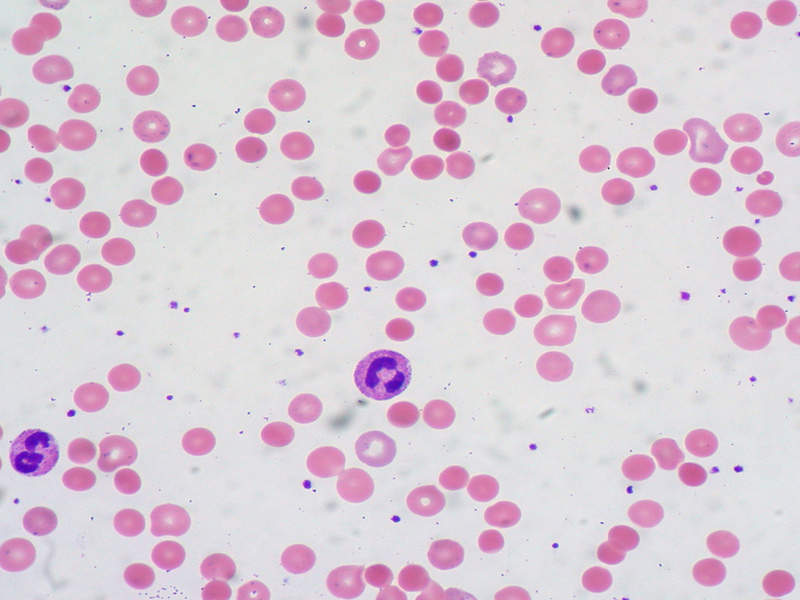

The company is currently working on an investigational, humanised monoclonal antibody called SYNT001 to treat a variety of rare immunoglobulin G (IgG)-mediated diseases.

SYNT001 is designed to block the interaction of FcRn with IgG and IgG immune complexes. It is undergoing Phase Ib/IIa clinical trials for warm autoimmune haemolytic anaemia (WAIHA) and pemphigus vulgaris (PV) or pemphigus foliaceus (PF).

SYNT001 is said to have caused a rapid decrease in IgG levels in early clinical studies.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe acquisition is expected to complement and expand Alexion’s rare disease portfolio and pipeline.

Alexion CEO Ludwig Hantson said: “The acquisition of Syntimmune represents a critical step in rebuilding Alexion’s pipeline and further diversifying the company’s clinical-stage rare disease portfolio.

“It offers a strong strategic fit with Alexion’s existing rare disease franchises and provides the opportunity to transform patient care in diseases like WAIHA, where SYNT001 is the first, and currently the only, anti-FcRn therapy in clinical development.”

Syntimmune chairman Seth Harrison said: “Alexion’s demonstrated rare disease expertise and development and commercial capabilities provide an ideal foundation for continued advancement of SYNT001 and, we believe, will ensure its broad potential is realised.”

The transaction, which is subject to customary closing conditions and regulatory approvals, is expected to be completed in the fourth quarter of this year.