Swiss biopharma company Rhizen Pharmaceuticals has signed an exclusive licensing agreement with Curon Biopharmaceutical to develop and commercialise Tenalisib for oncology in the Greater China region.

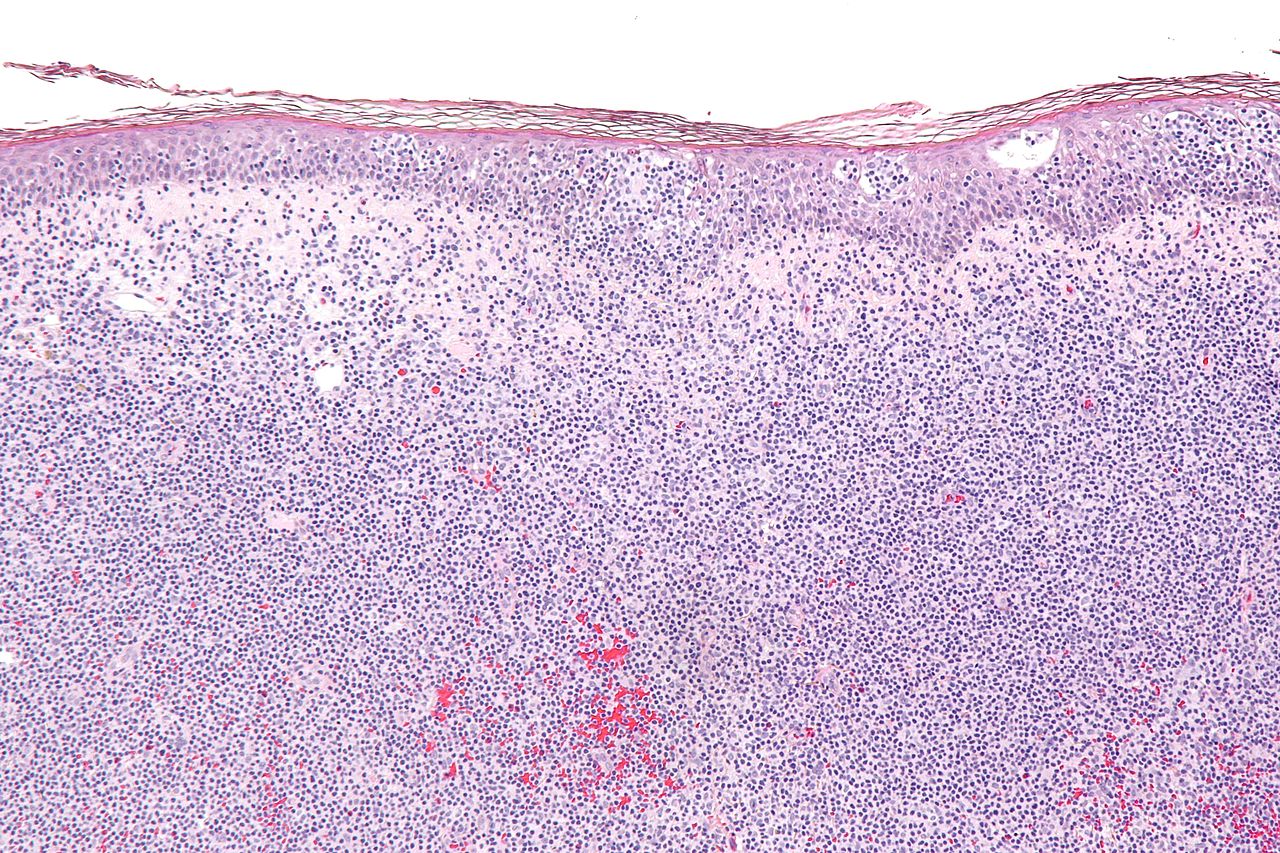

Tenalisib, a highly selective dual PI3K delta and gamma inhibitor, is currently in Phase II clinical development for haematological malignancies.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

The US Food and Drug Administration (FDA) granted fast track and orphan drug designations for the drug candidate Tenalisib as a treatment for relapsed / refractory peripheral T-cell lymphoma and cutaneous T-cell lymphoma (R / R PTCL and R / R CTCL).

Under the deal, Rhizen will receive an undisclosed upfront cash payment and is eligible for milestone payments.

The total deal value amounts to approximately $149.5m apart from royalties on annual net sales of Tenalisib.

Furthermore, Curon will gain exclusive development and commercialisation rights of Tenalisib for Greater China across all oncology indications.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataUtilising its expertise in translational research, clinical development and regulatory registration and research partnership knowledge, the company will carry forward the clinical development in the area.

This will help fast-track the development and regulatory approval of Tenalisib in the territory.

Rhizen Pharmaceuticals president and CEO Swaroop Vakkalanka said: “We believe, Tenalisib’s outstanding safety could allow rational combinations with other approved/investigational agents and enable us to unlock the true potential of this class of drugs.”

Kun Tao from Yafo Capital acted as the financial advisor for Rhizen.

Curon president Zhihong Chen said: “Tenalisib has demonstrated great efficacy in lymphoma patients with outstanding safety profile, in-licensing this product to China would bring more effective and additional treatment options to Chinese cancer patients and greatly benefit these patients.”

In September, Rhizen published the results from Phase I / Ib trial of Tenalisib demonstrating good overall response rate in patients with relapsed / refractory T-cell lymphoma (TCL).