Thermo Fisher Scientific (TFS) has announced a definitive agreement to acquire clinical research organisation PPD for $47.50 per share for a total consideration of $17.4bn in cash.

The company also agreed to assume PPD’s net debt of approximately $3.5bn.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

On concluding the acquisition, PPD will become part of Thermo Fisher’s Laboratory Products and Services segment.

Thermo Fisher Scientific chairman, president and CEO Marc Casper said: “The acquisition of PPD is a natural extension for Thermo Fisher and will enable us to provide these customers with important clinical research services and partner with them in new and exciting ways as they move a scientific idea to an approved medicine quickly, reliably and cost-effectively.

“Longer term, we plan to continue to invest in and connect the capabilities across the combined company to further help our customers accelerate innovation and drive productivity while driving further value for our shareholders.”

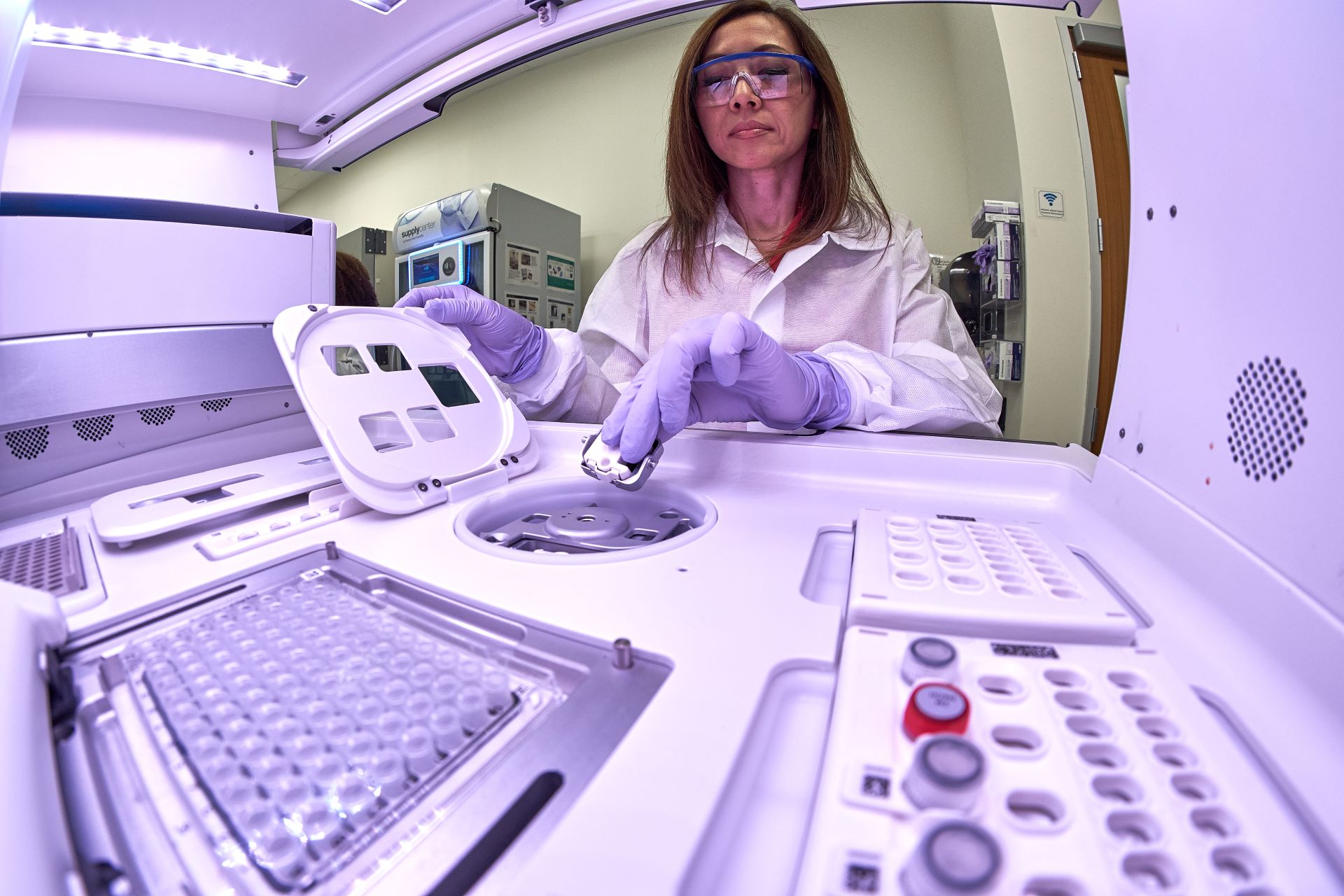

The acquisition of PPD will aid Thermo Fisher in expanding service offering to pharma and biotech customers and establish the company as a global leader in the clinical research services sector.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataFurthermore, the deal can boost Thermo Fisher’s offering, bringing a proven drug development platform, patient recruitment abilities and robust laboratory services.

PPD chairman and CEO David Simmons said: “This is a very exciting announcement for our shareholders and will provide customers with an even better opportunity to bring meaningful innovation to the market faster and more efficiently.

“Thermo Fisher is a world-class company with a very similar culture and values and will provide a great foundation for our colleagues to continue to deliver for our customers and to develop their own skills and careers.”

The extensive capabilities of the combined company and its knowledge in serving the pharma and biotech industry will enable new solutions for customers that create the potential to cut down the time and cost of the process involved in drug development.

The deal is subject to the satisfaction of customary closing conditions, including the receipt of applicable regulatory approvals, and is anticipated to close by the end of this year.