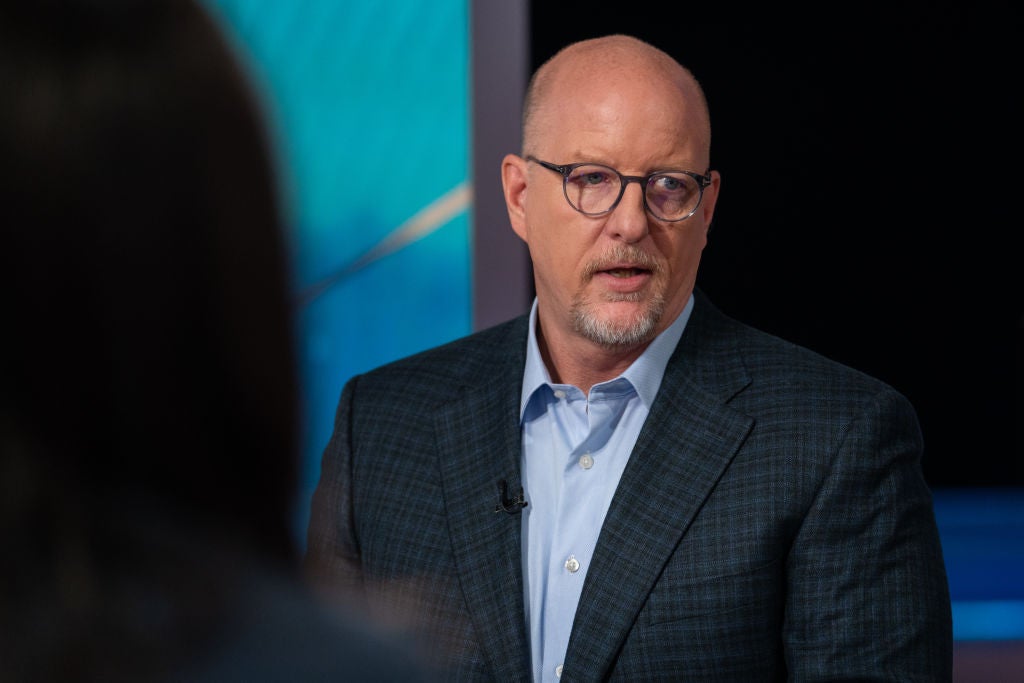

Pfizer is gearing up for a consumer-driven obesity drug market, drawing parallels to the demand surge it experienced with the launch of Viagra (sildenafil), CEO Albert Bourla said at the 44th Annual J.P. Morgan Healthcare conference on January 12, 2026.

In a presentation at the JP Morgan Healthcare Conference 2026, taking place January 12-15 in San Francisco, Bourla outlined Pfizer’s 2026 priorities, including maximising the value of key transactions and delivering a catalyst‑rich R&D agenda. Metsera is central to Pfizer’s strategy to re‑enter the obesity space after discontinuing its in‑house oral glucagon like peptide (GLP)‑1 receptor agonist, danuglipron, in April 2025 due to liver enzyme elevations.

Strategically, Pfizer’s $10bn Metsera acquisition, which was announced in September 2025 and took place in November 2025, transforms Pfizer from a failed oral GLP‑1 story to a broad obesity platform built around monthly injectables and oral combination therapies. This gives Pfizer a credible differentiation angle in a market currently dominated by Eli Lilly and Novo Nordisk, focusing on monthly dosing, incretin/amylin combinations, and a tolerability‑focused design aimed squarely at adherence and real‑world persistence. Overall, this places Pfizer in a highly competitive position in the obesity space.

Pfizer’s acquisition of Metsera has added several candidates to Pfizer’s portfolio; the ultra-long-Acting GLP-1 (PF’3944 / MET-097i), which is in a Phase IIb trial for monthly chronic weight management, and the ultra-long-acting GLP-1 + Amylin (PF’3945 / MET-233i) combo, which is in a Phase I/II trial for chronic weight management. Both were highlighted in the 12 January presentation. Phase II data for ultra-long-acting GLP-1 (PF’3944 / MET-097i) are expected this year, covering six to eight months of treatment. Bourla noted that he is “very confident” in the therapy, describing early results as “very encouraging”. As for ultra-long-acting GLP-1 + Amylin (PF’3945 / MET-233i) combo, Bourla highlighted previously presented weekly Amylin monotherapy data from Metsera; at 36 days, 8.4% placebo-adjusted weight loss was recorded in patients treated with the drug, and strong tolerability supported its potential when combined with a GLP-1 receptor agonist. Bourla noted that these therapies are expected to launch by 2028.

Looking ahead, Bourla announced that for the ultra-long-acting GLP-1 (PF’3944 / MET-097i), ten Phase III studies are anticipated to initiate this year. Pfizer initiated the first of these within weeks of closing the deal, ahead of Metsera’s own timelines. Bourla characterised the Metsera portfolio as highly differentiated, adding that internal data for its therapies suggest that they are expected to make a huge difference, and are anticipated to be best-in-class in regard to placebo-adjusted weight loss and tolerability profile, in obesity.

When asked about his views on the future of the obesity market, Bourla anticipates that the obesity market will “grow very fast”, reaching $150bn by 2030, noting the huge cash-pay segment of around 30% in the obesity market, and likened it to the consumer willingness to pay out of pocket for a treatment that was seen with Viagra, which Pfizer launched in 1998.

Against this backdrop, Metsera’s portfolio gives Pfizer something it previously lacked after its own oral GLP‑1 setbacks: a clearly differentiated, late‑stage, multi‑modality obesity platform.

Sign up here to receive daily updates on the latest healthcare industry trends emerging from the JP Morgan Healthcare conference 2026. Sign up here to receive a comprehensive report after the conference.