Last year saw signs that the tide is beginning to turn for the approval of innovative Alzheimer’s disease (AD) medicines, when the US Food and Drug Administration (FDA) approved Biogen’s Aduhelm (aducanumab). Despite winning first-to-market advantage, the months of controversy that followed Aduhelm’s authorisation marked a major setback, as did a European Medicines Agency (EMA) rejection late last year. Even so, for all its controversies, Aduhelm’s launch in the US prompted policymakers and health technology assessment (HTA) bodies to focus on what is in store for the AD market over the coming years. European horizon scanning initiatives have been at the forefront of these efforts to predict which medicines have the highest chances of regulatory success and which carry the largest potential cost challenges.

Last month, the BeneluxA cross-country alliance claimed the spotlight when it published forecasts catering to European regulatory and reimbursement systems. The emphasis is on potential new AD pharmaceuticals that could conceivably enter the market during a five-year period from later this year to 2027. The statuses of clinical trials, including their use of biomarkers, are summarised, as are possible challenges, both at HTA level and in terms of the expected burden on healthcare finances.

The BeneluxA horizon scanning instrument is intended to provide a complete picture of potential new product launches and create a repository of non-confidential information regarding future cost estimates to enable budget preparation. What is relatively unique about BeneluxA is that it employs a sliding scale to signify the chances of EU market authorization from ‘unlikely’ to ‘uncertain’. The analysis gives a forecast of the estimated date for commercial launch based on a typical average lead time of 13 months required for EMA evaluation, Committee for Medicinal Products for Human Use (CHMP) opinion and European Commission (EC) market authorisation. The market authorisation estimate is also based on filing after the earliest Phase III trial end date.

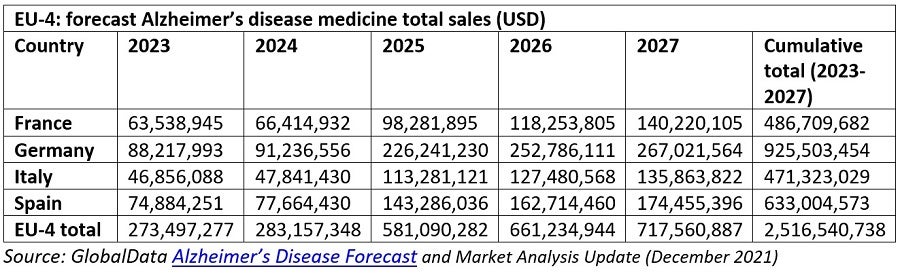

It is worth contextualising BeneluxA’s findings with GlobalData forecasts for the market entry of novel AD drugs and the market size in the four largest EU markets, namely France, Germany, Italy and Spain.

GlobalData recently updated its projections for the size of the AD market internationally. By the start of 2028, the worldwide market is expected to reach $11.9bn a year, compared with a previous market forecast of $12.9bn. The rationale for this downward adjustment is linked to lower anticipated uptake of Aduhelm, coupled with a 50% cut in annual US therapy costs for Aduhelm this year. Despite this, for the four largest EU markets, GlobalData still projects rapid growth during the forecast period. This will be driven by the anticipated market entry of the upcoming investigational candidates Aduhelm, Roche’s gantenerumab and Eisai/Biogen‘s lecanemab, for which BeneluxA estimates EU market authorisation dates sometime this year and next year respectively. In contrast to BeNeLuxA’s somewhat optimistic launch outlook, however, GlobalData forecasts that sales for both gantenerumab and lecanemab will not be generated in the largest EU markets until 2025 or 2026.

GlobalData AD market forecasts predict that pharmaceutical expenditure in the four largest EU markets will increase from $268.7m this year to a market size of $717.5m by 2027. Broadly speaking, the model’s average annual growth rate of 26.5% across the four largest EU markets from now to 2027 can be extrapolated to the situation in the smaller BeneluxA countries. In addition, based on GlobalData assessment of the four largest EU markets, the year 2025 is shaping up to be the most pivotal in terms of drug launches and sales growth. This would also be the case in the BeneluxA sphere, where a potential 105% annual increase in the value of the AD market could be inferred from the model.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataMore speculatively, the market-impacting events contained in the BeneluxA horizon scanning report may become a catalyst for the alliance to play a future role in voluntary joint HTA evaluations and price negotiations for some AD therapies between Austria, Belgium, Ireland, Luxembourg and the Netherlands. While not all member states may opt for this approach, at least some participating HTA agencies may prefer to leverage BeneluxA as a joint assessment and bargaining vehicle. Despite this, BeneluxA’s joint procurement model would still mean that pricing and reimbursement decisions remain at the sole discretion of national-level authorities in its member countries. A good indication that other sub-regional alliances of European countries, such as FINOSE or Valletta, may consider triggering their own joint HTA evaluations of AD medicines would be the preparation of parallel horizon scanning reports.