Despite the continued success of prophylactic vaccines such as Pfizer/BioNTech’s messenger RNA (mRNA) vaccine Comirnaty and spikes in COVID-19 case numbers over the winter, prophylactic COVID-19 vaccines sales forecasts have seen an average decline between H1 2022 and H2 2022 of 7% in their predicted total forecast sales between 2022 and 2028, according to GlobalData’s Coronavirus Disease 2019 (COVID-19) Sector Forecast: H2 2022 Global Analyst Consensus Sales Forecast report.

According to GlobalData’s Drugs database, there were 22 prophylactic vaccines in development for COVID-19 with sales forecasts available in H2 2022. These are forecast to generate $264 billion in sales between 2021 and 2028. Of these 22 vaccines, mRNA-derived vaccines dominate, with Comirnaty and Moderna’s Spikvax accounting for 88% of 2022 sales, with 58% and 30%, respectively. Comirnaty, which was first approved in the UK by an Emergency Use Approval (EUA) from the Medicines and Healthcare products Regulatory Agency (MHRA) on December 2, 2020, is currently the leading prophylactic vaccine with 2021 sales of $41.5 billion.

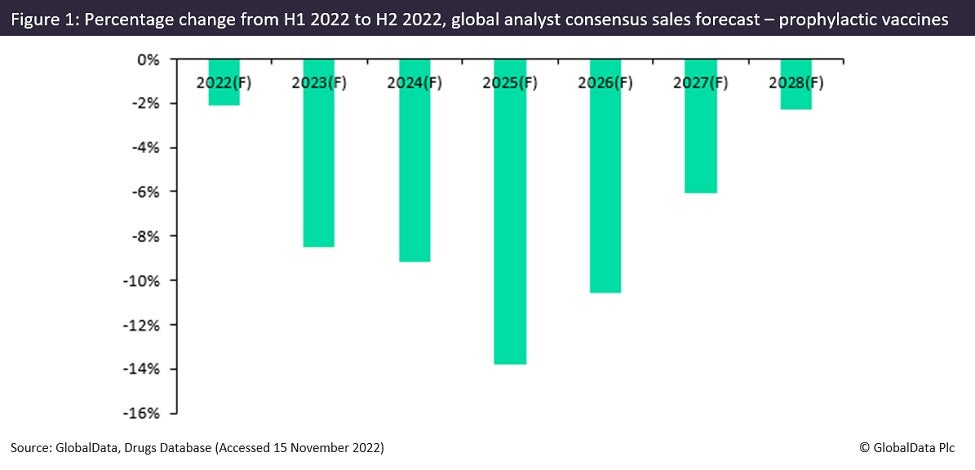

Figure 1 shows that of the 22 prophylactic vaccines, there was a significant decline between the H1 and H2 2022 forecasts, with the greatest decrease expected to occur in 2025. The forecast across the seven years between 2022 and 2028 saw an average decline of 7%, resulting in a $10 billion drop in the total forecast sales between 2021 and 2028. This large drop is a result of a decline in nearly all currently marketed prophylactic vaccines, with AstraZeneca’s recombinant vector vaccine, Vaxzevria, recording an average 47% decrease in its forecast sales from 2022–28 on average. Likewise, Moderna’s Spikevax, the second leading COVID-19 vaccine with 19.5 billion sales, had its forecast for 2022 decreased by 23% on average between the H1 2022 and H2 2022 forecasts.

This significant decline can be attributed to the increased competition in the second half of the year with three new COVID-19 prophylactic vaccines approved, Sanofi’s VidPrevtyn Beta, SK Bioscience’s SKYCovione, and HDT Bio Corp’s Gemcovac. This is combined with the overall decline in vaccine usage due to the decline in COVID-19 cases and the global success of mass vaccination campaigns, as well as the increasing number of oral therapeutics that can be administered at home to combat a COVID-19 infection.

The significant decline in prophylactic vaccine forecast sales between 2022 and 2028 is indicative of the shift away from vaccination as the means to combat COVID-19, as mass vaccination campaigns wind down or cease as countries continue to open. Despite outliers such as Comirnaty recording an average 19% increase in forecast sales between the H1 2022 and H2 2022, this downward trend is likely to continue as the need for vaccines becomes less urgent.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData