With pipeline approvals of varying mechanisms of action and an influx of newly diagnosed patients, the heart failure (HF) market is expected to grow at a 5.2% compound annual growth rate (CAGR) from $31.9bn in 2022 to $53bn in 2032 in the seven major markets (7MM: France, Germany, Italy, Japan, Spain, UK and US).

GlobalData expects that the US will contribute the most to the growth of the HF market due to the higher prevalence of HF in this market, as well as the substantially higher cost of prescription medications in the US compared with Europe and Japan.

HF is defined as a clinical syndrome with signs and symptoms caused by a structural or functional cardiac abnormality and corroborated by elevated natriuretic peptide levels or objective evidence of pulmonary or systemic congestion. HF is a lifelong condition in which the heart muscle cannot pump enough blood to meet the body’s need for oxygen. Sudden or acute heart failure often occurs due to allergic reactions, blood clots in the lungs, severe infections, use of certain medicines, and viruses that attack the heart muscle. Major signs and symptoms include dyspnea, persistent coughing or wheezing, edema, fatigue even after rest, lack of appetite, nausea, confusion, increased heart rate, and weight changes.

HF strategies

The pressure for pharmaceutical companies to be more innovative with their therapies and tackle unmet needs is increasing. Companies are approaching the HF market with the strategies of optimizing treatment safety and compliance, as well as developing novel drug classes.

The use of angiotensin-converting enzyme (ACE) inhibitors and angiotensin II receptor blockers has remained relatively consistent, and the use of sodium-glucose transporter (SGLT) 2 inhibitors has become well established for HF. Over the forecast period of 2022–32, GlobalData expects the launches of promising pipeline drugs Tirzepatide, omecamtiv mecarbil, Neucardin, and Kerendia (finerenone) to increase market size and further promote growth.

Unmet needs

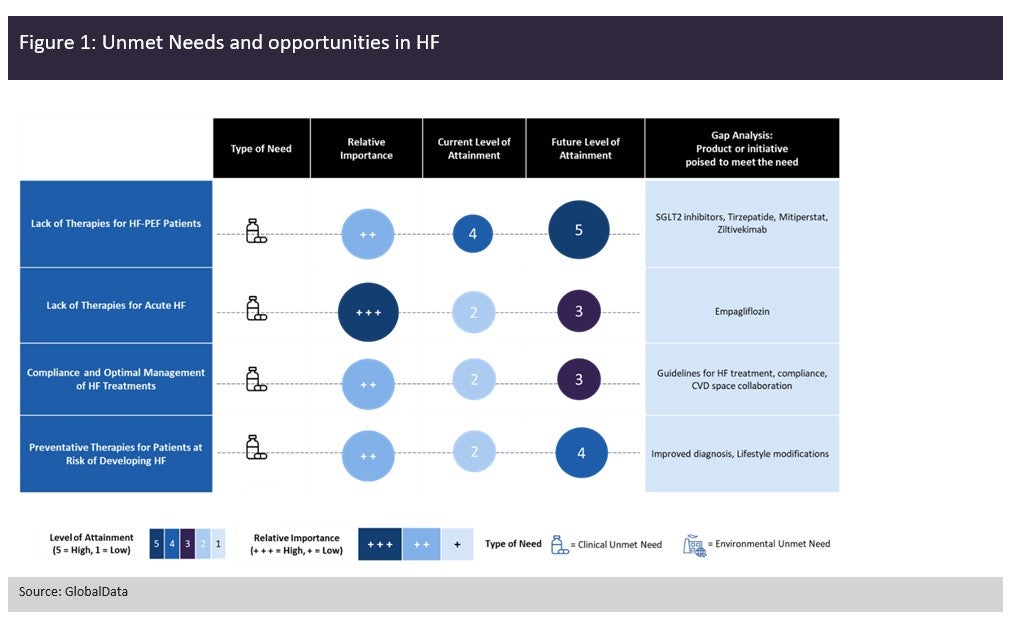

Overall, the level of unmet needs in the HF market is high. A major issue identified by some of the key opinion leaders (KOLs) interviewed by GlobalData is the dosing of HF therapies. A large proportion of chronic HF patients are taking suboptimal doses of relevant medications, leading to a worsening of symptoms and disease progression.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataFactors that contribute to this issue are not simply patient compliance and cost, but also difficulty in balancing comorbidities and adverse effects associated with the optimal dose of certain HF therapies. Interviewed KOLs recognize that better management of patients and increased patient and physician awareness would improve this issue. The figure below outlines the key unmet needs in the HF space and rates their level of attainment in the HF markets now and through the end of the forecast period (1 = low attainment and 5 = high attainment). The unmet needs are also stratified by level of importance (high, moderate, or low).

GlobalData believes that it will be easier for new drug entrants to capture HF market share if they offer a novel mechanism of action or help to improve compliance. KOLs hold mixed views on adding another drug on top of their patients’ complex treatment regimens.

Overall, cardiologists surveyed by GlobalData have indicated that the pipeline for HF is somewhat promising, but a significant improvement in efficacy would have to be demonstrated by any therapy for it to become either a replacement or add-on to existing therapies.