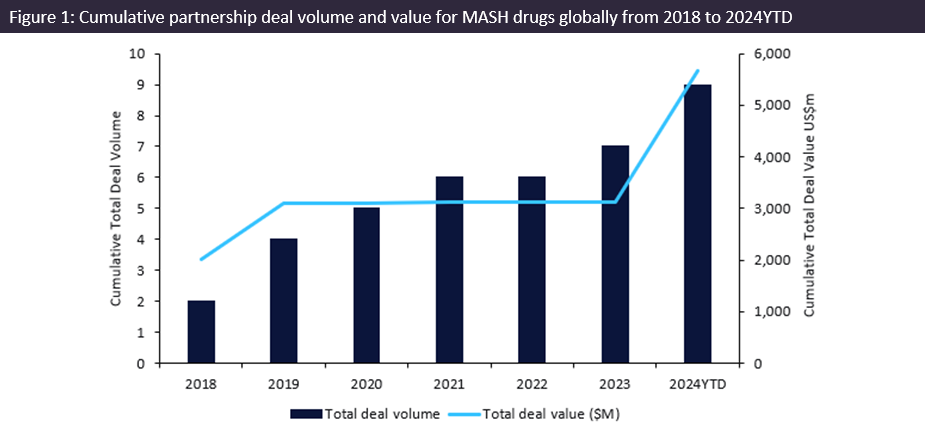

Metabolic dysfunction-associated steatohepatitis (MASH) innovator drugs witnessed an over $2.5bn increase in the total value of partnership deals from 2020 to 2024 year-to-date (YTD), with more than $2bn forged in Q1 2024 alone, according to GlobalData’s Pharma Intelligence Center Deals Database.

MASH, previously known as nonalcoholic steatohepatitis (NASH), is a disease characterised by liver inflammation and damage caused by the accumulation of fat. Madrigal Pharmaceuticals’s Rezdiffra (resmetirom), a small molecule THRB agonist, was the first drug approved by the FDA for MASH, in March 2024. Previous interest in MASH from biopharmaceutical companies has waned due to competitive pressures and failure to demonstrate efficacy in clinical trials, causing companies to discontinue development within MASH. In June 2023, Intercept Pharmaceuticals discontinued development of its Ocaliva (obeticholic acid) in MASH and all MASH-related investment following the FDA’s rejection of Ocaliva’s submission for regulatory approval. Other examples of discontinued development in MASH include Genfit’s oral NR1C1/NR1C2 dual agonist elafibranor in July 2020 and Bristol Myers Squibb’s pegbelfermin in November 2021, both due to failure to demonstrate clinical efficacy in their Phase III trial readouts. However, interest in MASH drug development has returned in light of the success of GLP-1 obesity drugs and their potential efficacy in MASH, as demonstrated by Eli Lilly’s Zepbound (tirzepatide; also known as Mounjaro for type 2 diabetes) in its Phase II SYNERGY-NASH trial readout.

Partnership deals for innovator drugs involved in MASH saw a resurgence in activity of over $2.5bn in deal value from 2023 to 2024YTD. Figure 1 (above) shows a cumulative deal value total of over $5.7bn from 2018 to 2024YTD, according to GlobalData’s Pharma Intelligence Center Deals Database, where 2024YTD already surpassed the total deal value reported for 2018, marking the highest total deal value in a year.

In January 2024, Boehringer Ingelheim signed a partnership deal with China-based biotech Suzhou Ruibo Biotechnology and its Sweden-based subsidiary Ribocure Pharmaceuticals to discover and develop siRNA therapeutics for MASH using Ribocure’s RIBO-GalSTAR platform. The “multi-target collaboration” is valued at over $2bn, representing the largest partnership deal for MASH drugs of all time. This reinforces Boehringer’s interest in MASH, with Boehringer’s GLP-1/GLU dual agonist survodutide—co-developed with Zealand Pharma—currently in Phase II trials for MASH.

Meanwhile, Novo Nordisk entered a co-development partnership deal with US-based Cellarity valued at over $500m, aimed at using Cellarity’s artificial intelligence (AI) platform to discover and develop a small molecule drug for MASH. This follows Novo Nordisk’s co-development deal with Gilead Sciences, forged in March 2021, to conduct a Phase II trial of its GLP1R agonist Ozempic (semaglutide) with Gilead’s fixed-dose combination of FXR agonist cilofexor and ACC inhibitor firsocostat for the treatment of patients with compensated cirrhosis due to MASH.

The recent increase in partnership deals involving innovative MASH drugs in 2024YTD involved large biopharmaceutical companies with a history of having previously engaged in MASH drug development, such as Boehringer and Novo Nordisk. Given the large number of MASH drugs in clinical development, including GLP-1 agonists, there may be an increase in partnership deals and mergers and acquisitions involving late-stage clinical MASH drugs over this year. Nonetheless, biopharmaceutical companies developing innovator MASH drugs will have to match the safety and efficacy benchmark established by Madrigal’s Rezdiffra or possess a differentiated value proposition to succeed in capturing market share from Madrigal.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData*Note: Includes all announced and completed partnership deals globally from 2018 to 2024YTD. Includes deals where at least one drug involved is developed for metabolic dysfunction-associated steatohepatitis (MASH) with innovator drug type, where stages of development discovery, preclinical, Phase I, Phase II, Phase III, pre-registration, and marketed are considered.