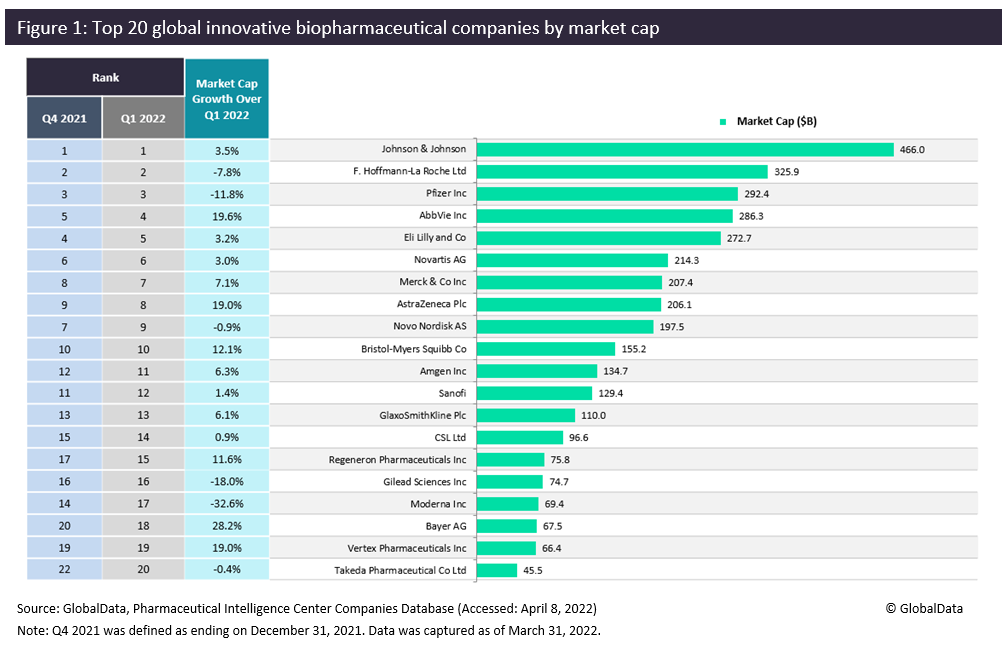

The majority of the top 20 global biopharmaceutical companies continued their growth and experienced a favorable Q1 2022, retaining their position from Q4 2021. An overall 2.1% growth in aggregate market cap was reported over Q4, from $3.4 trillion on December 31, 2021 to $3.5 trillion on March 31, 2022. This led to a positive market cap growth for 14 of the top players. Only four companies have demonstrated more than 15% growth in market cap: Bayer (28.2%), AbbVie (19.6%), Vertex Pharmaceuticals (19.0%), and AstraZeneca (19.0%).

Johnson & Johnson maintained its top position, with its market cap for Q1 2022 growing by 3.5% from $450.4 billion to $466.0 billion as of March 31, 2022. The limited success of Johnson & Johnson’s COVID-19 vaccine following concerns of a possible link to thromboembolic events has led the company to further diversify its pipeline with oncology therapies for multiple myeloma and leukemia. Carvykti (ciltacabtagene autoleucel), the company’s cell therapy for adults with relapsed or refractory multiple myeloma, received regulatory approval from the FDA in Q1 2022 following positive pivotal Phase II trial data. Carvykti is set to become a blockbuster drug with the analyst consensus global sales forecast of $4.2 billion by 2028, according to GlobalData’s Drugs Database Pharma Intelligence Center.

Moderna, which previously reaped success from its COVID-19 mRNA-1273 vaccine, dropped four places after experiencing the largest decrease of -32.6% in market cap over Q1 2022, with its share price plummeting from $103 on December 31, 2021 to $69.4 on March 31, 2022.

Despite remaining in the top three spots alongside Johnson & Johnson and Roche, Pfizer saw an 11.8% decrease in market cap in Q1 2022.

BioNTech, which saw significant market cap growth in Q4 2021 after dominating the COVID-19 market alongside Pfizer and Moderna, did not make the list after experiencing a 32.6% market cap setback in Q1 2022. A potential decrease in market cap for some COVID-19 drug biopharmaceutical companies may persist due to current uncertainty in financial markets with a waning vaccine demand as the pandemic continues to ease.

AstraZeneca showed a strong stock market performance in Q1 2022, with its market cap for Q1 2022 growing by 19.0% from $173.2 billion to $206.1 billion as of March 31, 2022. This growth was largely due to the sales of Tagrisso (osimertinib), its treatment for patients with non-small cell lung cancer, and a 40.6% growth in revenue. Tagrisso was AstraZeneca’s top-selling product in 2021 with analyst consensus global sales of $5.0 billion in 2021, according to GlobalData’s Drugs Database Pharma Intelligence Center, making up for the potential decline in sales of COVID-19 products amid diminishing demand and growing competition.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataAbbVie reported a significant increase in its market cap during the same period, with a 19.6% market cap growth to $286 billion in Q1 2022. This was fueled by its 22.7% growth in revenue in 2021 and a robust pipeline, with Humira (adalimumab) reaching more than $20 billion in sales in 2021, according to GlobalData’s Drugs Database Pharma Intelligence Center. Upcoming biosimilar competition for Humira means AbbVie’s focus may turn to Rinvoq (upadacitinib), which was approved in the US for atopic dermatitis, psoriatic arthritis, rheumatoid arthritis, and ulcerative colitis, and Skyrizi (risankizumab-rzaa), which was approved in the US for psoriatic arthritis and plaque psoriasis. Rinvoq and Skyrizi combined are forecast to hit the analyst consensus global sales of over $20 billion by 2028, according to GlobalData’s Drugs Database Pharma Intelligence Center.

Bayer’s share price grew from $52.6 on December 31, 2021 to $67.5 on March 31, 2022 as a result of a strong pipeline and product launches, including Kerendia (finerenone), a mineralocorticoid receptor antagonist. The drug demonstrated positive outcomes in patients with chronic kidney disease, with the analyst consensus global sales forecast of $206 million for 2022, according to GlobalData’s Drugs Database Pharma Intelligence Center. Bayer’s late-stage pipeline also includes copanlisib hydrochloride, currently in pre-registration for nodal marginal zone b-cell lymphoma, lymphoplasmacytic lymphoma, and chronic lymphocytic leukemia.

Vertex Pharmaceuticals experienced a decline in market cap in 2021 but jumped back with a significant 18.9% increase in market cap from December 31, 2021 to March 31, 2022. This steady growth can be attributed to its dominance of the cystic fibrosis (CF) therapeutic space and the European Medicines Agency (EMA) approval of Trifakta/Kaftrio (elexacaftor + tezacaftor + ivacaftor), a triple-combination regimen for patients with CF.

The Japanese biopharmaceutical company Takeda Pharmaceutical is a new entrant in the top 20 list despite experiencing a slight decline in market cap, with a 0.4% decrease in market cap from Q4 2021 to Q1 2022.

Overall, the majority of the biopharmaceutical companies maintained their ranking in Q4 2021 and Q1 2021. However, the list saw the absence of BioNTech and entry of Takeda Pharmaceuticals. Johnson & Johnson retained its top position, followed by Roche and then Pfizer, with AbbVie closing in on the latter. Moderna dropped four places to 17th place, with Bayer climbing two places to 18th place.

Q1 2022 saw the top biopharmaceutical companies that developed COVID-19 vaccines in 2021 experience a possible decrease in market demand as COVID-19 infections are seemingly waning. Although it is likely that BioNTech, Pfizer, Moderna, and AstraZeneca COVID-19 vaccines will continue to dominate, the companies may now turn their focus toward developing therapies to address the growing burden of non-communicable diseases.