Pharmaceutical startups are at the cutting edge of developing novel platforms in the treatment of a range of therapeutic indications. CRISPR Therapeutics is one of many companies using pioneering gene-editing techniques to treat genetic conditions such as cystic fibrosis and Duchenne muscular dystrophy.

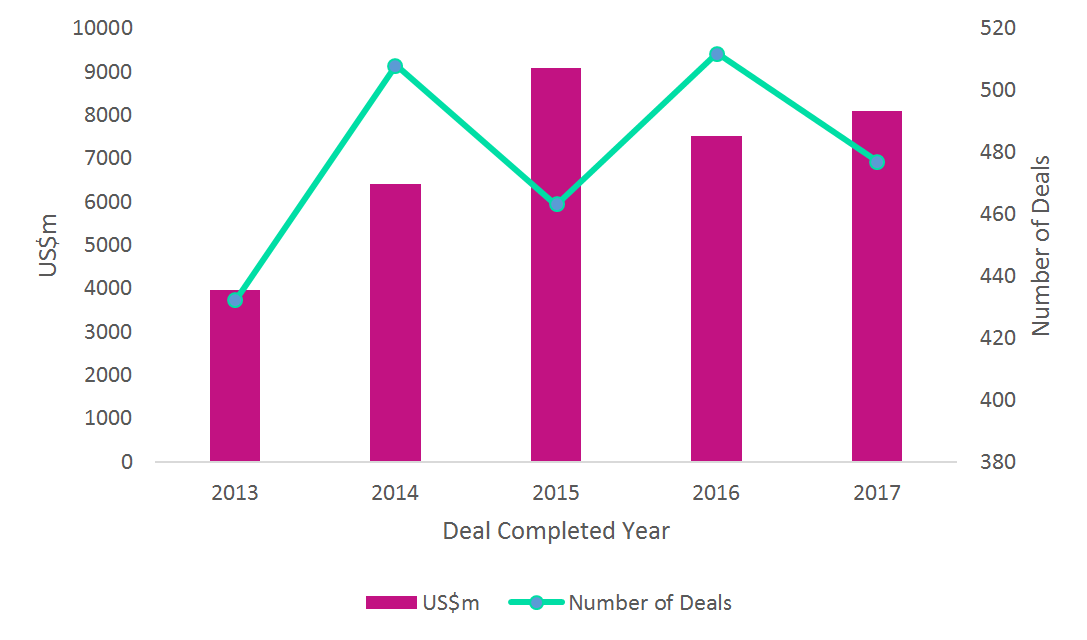

Figure 1 shows funding deals through venture financing where the deal involves pipeline drugs. While there has been a strong increase in venture funding deal values from 2013 to 2015, a 17% drop was seen from 2015 to 2016. Although there was an 8% increase in venture financing deal values from 2016 to 2017, this was relatively small in comparison to before 2015.

Figure 1: Venture financing deals for pipeline drugs, completed 2013 – 2017

Source: GlobalData, Pharma Intelligence Center, Deals Database [Accessed Dec, 2017]

However, if the venture financing is broken down further, a real growth trend can be seen for the venture financing that is provided for start-ups from 2013 to 2017. Investing in early-stage biotechs is providing an avenue for enhancing drug development through these novel platforms, which in return is helping bring drugs to market faster and more cheaply.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData