On July 24, Nabriva Therapeutics announced the acquisition of Zavante Therapeutics, a biotechnology company developing treatments for the infections that threaten hospitalized patients. The deal includes an upfront consideration of 8.2 million of Nabriva’s ordinary shares and around $100M in milestones, as well as a leadership overhaul that places Zavante’s CEO, Ted Schroeder, into the same position at Nabriva. With this move, Nabriva adds Zavante’s late-stage product Contepo (fosfomycin for injection) to its pipeline of experimental drugs targeting multiple drug-resistant (MDR) bacteria. Along with Nabriva’s own Phase III product lefamulin, Contepo gives Nabriva the rare opportunity to bring two first-in-class antibiotics to the US market in 2019.

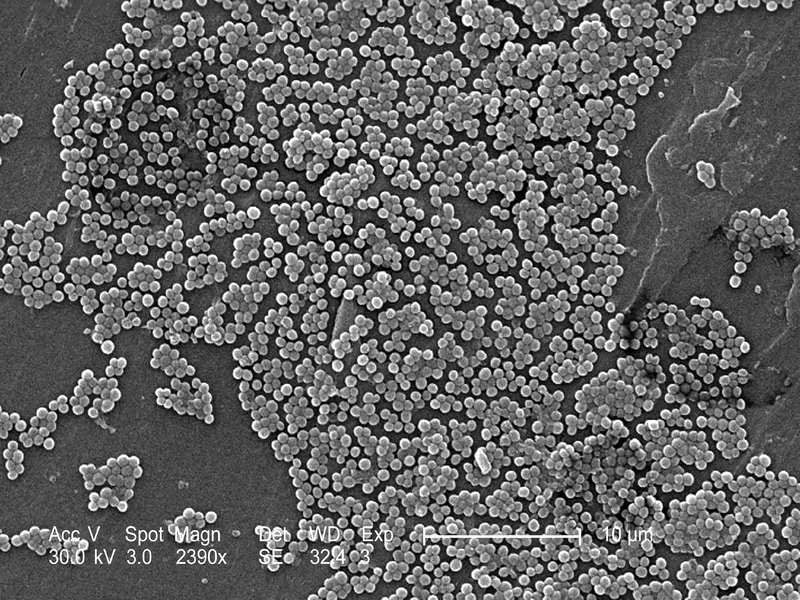

Contepo is the registered trademark name for fosfomycin, an epoxide antibiotic with broad activity against Gram-negative and Gram-positive bacteria. Fosfomycin is an old drug, first discovered in 1969 and investigated as an oral treatment for complicated urinary tract infections (cUTIs). The intravenous formulation has been available for clinical use in Europe for several decades. In preparation for the first FDA approval for fosfomycin, Zavante reformulated the drug and entered it into clinical investigation for cUTI and acute pyelonephritis (AP). In spring of 2017, Contepo met its primary endpoints in a pivotal Phase II/III trial comparing the drug to piperacillin/tazobactam. Based on an extensive history of usage in Europe and well-established dosing parameters, GlobalData believes it is likely that Contepo will soon be added to the roster of licensed antibiotics in the US.

In contrast, Nabriva’s other late-stage product, lefamulin, is an entirely original therapy from the pleuromutilin class of antibiotics. Pleuromutilins are natural products that target bacterial ribosomes to prevent protein synthesis through a novel mechanism. Prior to the development of lefamulin, pleuromutilins had mostly been used for veterinary medicine, including for treatment of swine dysentery and enzootic pneumonia. In May 2018, Nabriva announced positive results from its second pivotal Phase III trial (LEAP2), demonstrating that oral lefamulin was non-inferior to oral moxifloxacin with or without linezolid for treatment of community-acquired bacterial pneumonia (CABP). GlobalData projects that lefamulin will be approved in late 2019, becoming the first antibiotic with a novel mechanism to be commercialized in the US in nearly a decade. Label expansions for lefamulin are also on the horizon, including for acute bacterial skin and skin structure infection (ABSSSI) and cUTI.

If Contepo and lefamulin are approved, Nabriva will face commercial challenges that are inherent to the antibiotics space, which include convincing physicians and payers to switch from less-expensive, more-familiar drugs, such as generic linezolid or vancomycin. Moreover, pharmaceutical companies must consider markets that may be limited by antimicrobial stewardship efforts. These challenges will be best addressed by coordinated efforts between clinicians, drug developers, and federal agencies. By acquiring Zavante, Nabriva is doubling its chances of bringing a new antibiotic for MDR bacteria to market. On the regulatory side, FDA commissioner Scott Gottlieb has proposed new incentives for antibiotics innovation, such as licensing antibiotics to hospitals instead of reimbursing by individual prescriptions. This plan would theoretically create a natural market for newly approved antibiotics, allowing companies like Nabriva to have more predictable revenues based on fixed licensing fees.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData