Almost a year after the first announcement of the deal, AbbVie has completed its acquisition of Ireland-based Allergan.

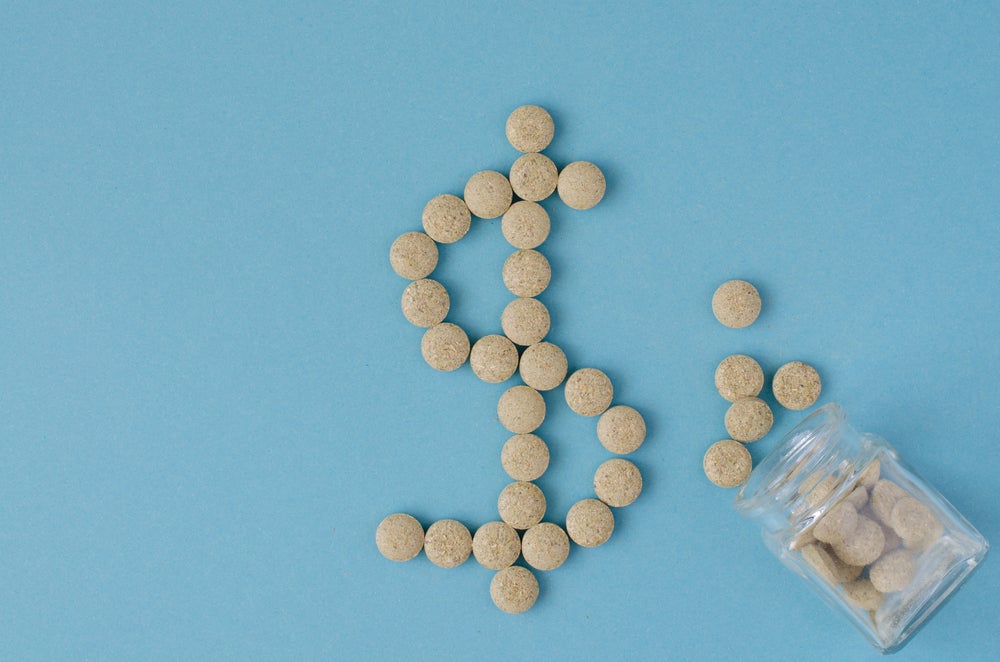

The cash and stock transaction is valued at $63bn based on the closing price of AbbVie’s common stock on 24 June 2019, a day before the deal was initially announced. Under the terms of the agreement, Allergan shareholders will receive 0.8660 AbbVie shares and $120.30 in cash for each Allergan share they hold.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

One member of Allergan’s board will join AbbVie’s board of directors now the transaction has been completed: retired executive vice-president Thomas C Freyman. Originally, Allergan CEO and chairman Brent Saunders was also going to join the board, but he decided against it so he could flexibly pursue other opportunities in the pharma sector.

Charting Allergan’s acquisition

On 25 June 2019, the two companies announced they had entered into a definite transaction agreement under which AbbVie would acquire Allergan. Four months later, in October 2019, Allergan’s shareholders officially approved the proposed deal with 99.64% voting in support.

The reason why it then took over six months for the deal to be officially closed was because it required regulatory approval both in the US and Ireland, where AbbVie and Allergan, respectively, are headquartered.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataTo meet the US Federal Trade Commission (FTC)’s anti-trust concerns about this mega-merger, the pair agreed to divest three drugs: two for exocrine pancreatic insufficiency (EPI) and an interleukin-23 (IL-23) inhibitor for gastrointestinal conditions, such as Crohn’s disease and ulcerative colitis (UC).

The FTC’s anti-competitive concerns were linked to AbbVie and Allergan accounting for more than 95% of the market for drugs to treat EPI. Also, the FTC believed the acquisition would also eliminate competition between the two in the other IL-23 drugs in clinical development for Crohn’s and UC.

In January this year, the two EPI drugs – Zenpep and Viokace – were divested to Nestlé, after the Bureau of Competition determined that Nestlé had the expertise, US sales infrastructure and resources to continue to provide the drugs to patients and maintain the competition that it deemed would have been lost by the acquisition.

To allow AbbVie’s psoriasis drug Skyriz to remain on the market without breaching anti-trust concerns around the IL-23 space, the company agreed to divest its investigational IL-23 drug brazikumab to AstraZeneca. It required the termination of a prior licensing deal between Allergan and AstraZeneca; although the deal was also agreed in January, it was only closed in mid-May a few days after the Allergan-AbbVie acquisition was completed.

Following these January divestitures, the FTC approved AbbVie’s acquisition on 5 May. Only one day later the High Court of Ireland also sanctioned the deal with a confirmation of a “related reduction of capital”; further detail on the terms set out by the court were not provided.

Strategic rationale behind the deal

Although best known for developing Botox, Allergan has a very strong portfolio in other areas, including ophthalmology, gastroenterology and the central nervous system (CNS). This acquisition expands, diversifies and strengthens AbbVie’s portfolio with durable franchises across a range of attractive therapeutic areas, including immunology and neuroscience.

This is particularly timely for AbbVie as its blockbuster product, Humira, lost its European Union patent exclusivity in 2019. And while AbbVie managed to extend Humira’s US patent from 2016, biosimilar competitors are now expected to launch from 2023. Humira consistently makes up almost 50% of AbbVie’s net revenues; in the 2019 financial year, the company’s total net revenues were $33.266bn and Humira made $19.169bn globally, despite taking a 31.1% hit on a reported basis outside the US.

AbbVie hopes its new diversified portfolio drives approximately $30bn in revenues in full year 2020. Other financial benefits of the deal include the generation of annual pre-tax synergies and cost reduction of at least $2bn by year three due to efficiencies in research and development resources, as well as sales and marketing capabilities.

Executives respond to the deal

In June 2019 when the deal was first announced, Allergan’s Saunders noted: “With 2019 annual combined revenue of approximately $48 billion, scale in more than 175 countries, an industry-leading R&D pipeline and robust cash flows, our combined company will have the opportunity to make even bigger contributions to global health than either can alone.

“Our fast-growing therapeutic areas, including our world-class medical aesthetics, eye care, CNS and gastrointestinal businesses, will enhance AbbVie’s strong growth platform and create substantial value for shareholders of both companies.”

Talking about the closing of the deal, AbbVie chairman and CEO Richard A Gonzalez added: “We are pleased to reach this important milestone for the company, its employees, shareholders and the patients we serve.

“Our new Allergan colleagues should be commended for all their efforts, along with those of our own employees, to achieve this turning point for our company.

“The new AbbVie will be a well-diversified leader in many important therapeutic categories, with both on-market and pipeline assets, and our financial strength will allow us to continue to invest in innovative science and continue to serve unmet medical needs of patients that rely upon us.

“I am proud of both organisations and look forward to the opportunities ahead.”

AbbVie share price and company overview

Headquartered in Chicago and listed on the New York Stock Exchange, AbbVie was founded in 2013 as a spin-off from Abbott. It has a strong history of acquisitions and deals – starting with ImmunVen in 2014 – however, this latest deal is its biggest to date since it abandoned its 2014 attempt to acquire UK-based Shire. Shire has since been acquired by Takeda, in Japan’s biggest foreign acquisition to date.