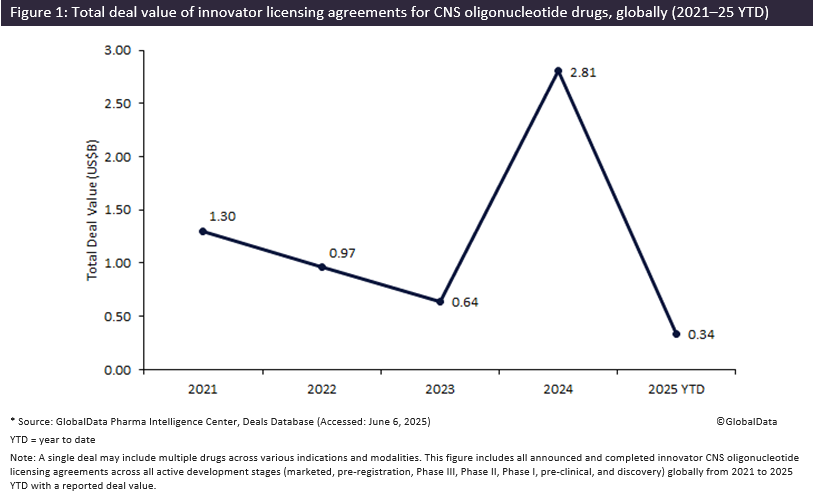

Innovator oligonucleotide-based drugs targeting central nervous system (CNS) indications witnessed a 339% ($2.17bn) increase in total licensing agreement deal value from 2023 to 2024, reaching a total deal value of $2.81bn, according to GlobalData’s Pharma Intelligence Center Deals Database.

Oligonucleotides are short synthetic strands of DNA or RNA used in precision medicine to bind selectively to disease-causing genetic sequences as targeted therapeutics in the treatment of complex diseases. The increase in licensing agreements involving innovator oligonucleotide-based therapeutics for CNS disorders reflects renewed interest in part due to the growing application of oligonucleotides, particularly antisense oligonucleotides (ASOs) and antisense RNAi oligonucleotides (siRNAs).

ASOs work by binding to messenger RNA (mRNA) to disrupt the production of disease-associated proteins, whereas siRNAs block protein production by triggering the degradation of specific mRNA molecules. Recent advancements in oligonucleotide synthesis technologies — such as liquid-phase and biocatalytic synthesis methods — are accelerating progress in the field by overcoming longstanding challenges, including issues with scaleability, purity and yield. These developments are paving the way for more efficient large-scale production and reinforcing the role of oligonucleotides as a cornerstone of precision medicine for complex conditions such as genetic and neurodegenerative disorders, and cancer.

According to GlobalData’s Pharma Intelligence Center Deals Database, licensing agreements for innovator oligonucleotides targeting CNS indications secured a cumulative total deal value of $6.05 billion from 2021 to 2025 year-to-date. ASOs accounted for more than half ($3.54 billion), while siRNAs made up more than a third ($2.51 billion) of these deals. Both modalities have emerged as the most used platform technologies in developing oligonucleotide-based drugs for CNS disorders since 2020.

Large pharmaceutical companies such as AbbVie, Lilly, Roche and Takeda have demonstrated strong interest in licensing innovator oligonucleotides for CNS indications, accounting for 63% of licensing deals between 2021 and 2025 year-to-date. Nonetheless, US-headquartered biotech Ionis Pharmaceuticals remains at the forefront of the growing field of oligonucleotide therapeutics, having out-licensed assets for a total of $13.4 billion over the past decade. Ionis currently has 135 oligonucleotide-based drugs in its pipeline — 32 of which target CNS disorders. Of these, two have reached the market: Spinraza (nusinersen) for spinal muscular atrophy and Qalsody (tofersen sodium), co-developed and licensed by Biogen for amyotrophic lateral sclerosis, according to GlobalData’s Pharma Intelligence Center Drugs Database.

Meanwhile, Arrowhead Pharmaceuticals has secured the largest deal of 2025 through an exclusive global licensing and collaborative agreement with Sarepta Therapeutics. This agreement, valued at up to $2.18 billion, grants Sarepta rights to multiple programmes across clinical, preclinical and discovery stages, focused on rare, genetic and CNS diseases.

Oligonucleotides are becoming an increasingly attractive focus for biopharmaceutical licensing, driven not only by advances in manufacturing and expanding therapeutic potential across a range of conditions, but also by the relative efficiency of their synthesis compared to small molecules or biologics. With momentum building around these advanced modalities, the oligonucleotide market is well-positioned to drive the next wave of personalised treatment in the coming years.

For further insights into the latest deal trends in the pharma sector, see our Venture Capital Investment Trends In Pharma - Q1 2025 and M&A Trends in Pharma - Q1 2025 reports.