Manufacturing a drug therapy usually involves several different stakeholders. Contract manufacturing organizations (CMOs) not only produce the active pharmaceutical ingredient (API) at the heart of a therapy, but are also responsible for the sterile manufacturing and packaging of liquid and inhalational drug constituents and packaging, depending on the needs of the particular therapy.

The ongoing CMO Moves series is exploring the relationship between these CMOs and pharmaceutical and biotech companies that have recently received regulatory news concerning their pipeline assets. To identify key events from late December to late January, this news service collated manufacturing contract-related data from PharmSource reports, and news from GlobalData’s Pharma Intelligence Center, to identify participants that are likely to experience an impact following the news.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

GlobalData is the parent company of Pharmaceutical Technology.

EMA and NICE decisions come through

In late January, the EU expanded the approved use of Daiichi Sankyo’s and AstraZeneca’s antibody-drug conjugate (ADC) Enhertu (deruxtecan) as a monotherapy to include the treatment of unresectable or metastatic HER2-low breast cancer adult patients. The ADC is already approved in the metastatic setting after chemotherapy or in the case of disease recurrence during or in six months after adjuvant chemotherapy. Baxter Biopharma Solutions has been contracted for the ADC’s parenteral manufacture and packaging.

Source: GlobalData Pharmaceutical Intelligence Center

On January 30, the European Commission approved Regeneron Pharmaceuticals’ and Sanofi’s Dupixent (dupilumab) to treat eosinophilic esophagitis (EoE). The monoclonal antibody targeting IL-4 and IL-13 is approved in several chronic inflammatory conditions. The parenteral manufacturing and packaging for Dupixent are outsourced to Catalent.

Towards the end of 2022, the EC also awarded a conditional marketing authorization for another ADC—Sobi’s and ADC Therapeutics’ Zynlonta (loncastuximab tesirine) to treat relapsed or refractory (r/r) diffuse large B-cell lymphoma (DLBCL). In September, the EMA’s Committee for Medicinal Products for Human Use had given a positive opinion regarding this use. Avid Bioservices and Sterling Pharma Solutions are manufacturing Zynlonta’s biological API.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataIn the same month, the European agency also granted a marketing authorization for an off-the-shelf allogeneic T-cell immunotherapy—Atara Biotherapeutics’ Ebvallo (tabelecleucel)—to treat Epstein‑Barr virus-positive post‑transplant lymphoproliferative disease patients. Charles River Laboratories is manufacturing the biological API for Ebvallo.

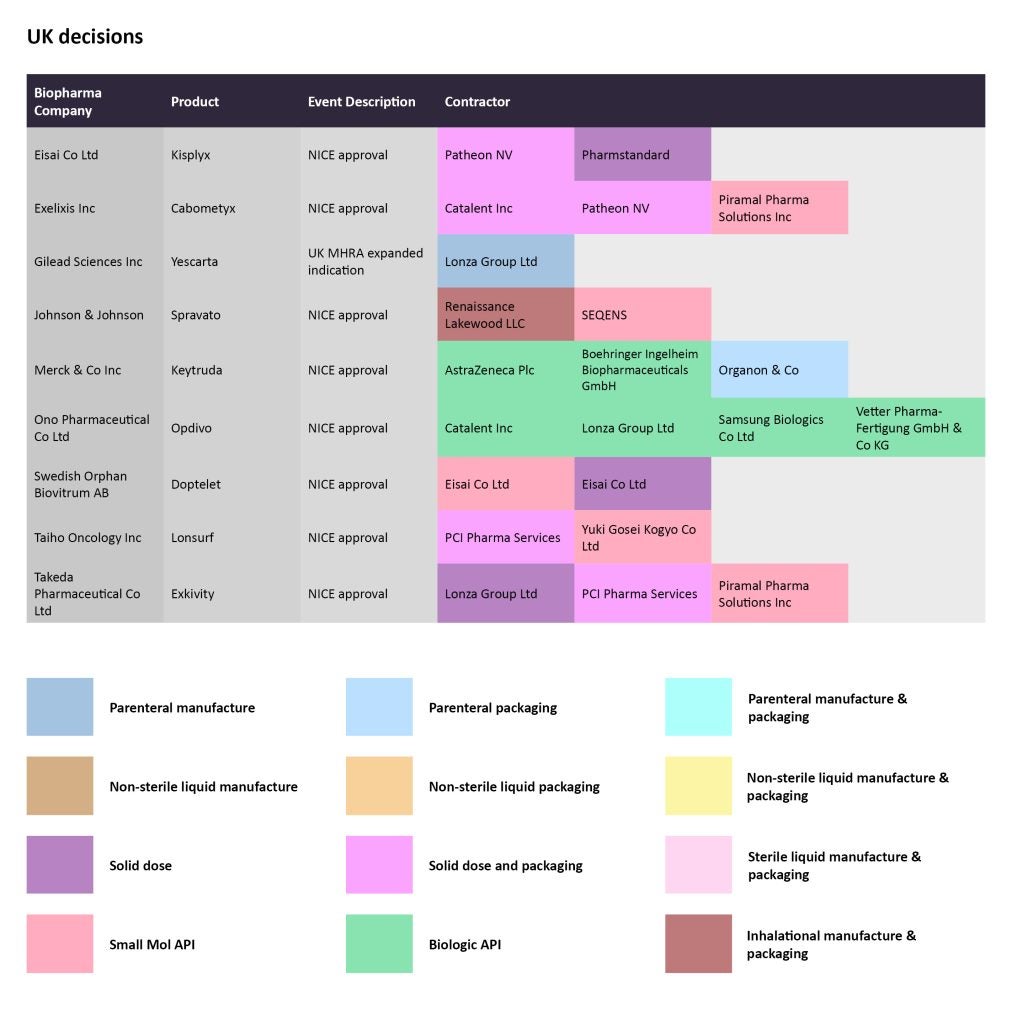

In the UK, the National Institute of Health and Care Excellence (NICE) recommended the use of Gilead Sciences’ chimeric antigen receptor (CAR)-T therapy Yescarta (axicabtagene ciloleucel) for patients with r/r DLBCL and primary mediastinal large B-cell lymphoma (PMBCL) who have had two or more lines of systemic therapy. Lonza is in charge of the parenteral manufacturing of Yescarta.

Source: GlobalData Pharmaceutical Intelligence Center

In January, NICE published the recommendation for the use of Takeda Pharmaceutical’s Exkivity (mobocertinib) for advanced or metastatic non-small-cell lung cancer (NSCLC) with epidermal growth factor receptor (EGFR) exon 20 insertion mutations, after platinum chemotherapy. While Lonza is responsible for the solid dose manufacturing, PCI Pharma Services is in charge of that along with packaging, and Piramal Pharma Solutions is manufacturing the small molecule API.

FDA decisions

In December 2022, the FDA expanded the label for Novo Nordisk’s Wegovy (semaglutide), to include its use as an anti-obesity drug in adolescents with an initial body mass index over a certain threshold. The demand for Wegovy has been rising in recent times, with several reports on the drug’s shortages. More recently, the company announced Wegovy will be made available at UK pharmacies. The parenteral manufacturing for Wegovy has been outsourced to Catalent.

Source: GlobalData Pharmaceutical Intelligence Center

To read the previous editions in this series, click here, and here.