As the pharmaceutical industry, along with the rest of the corporate sector, enters the last quarter of the year, all eyes are on identifying the companies that will end the year on a high note and what may happen to those which don’t.

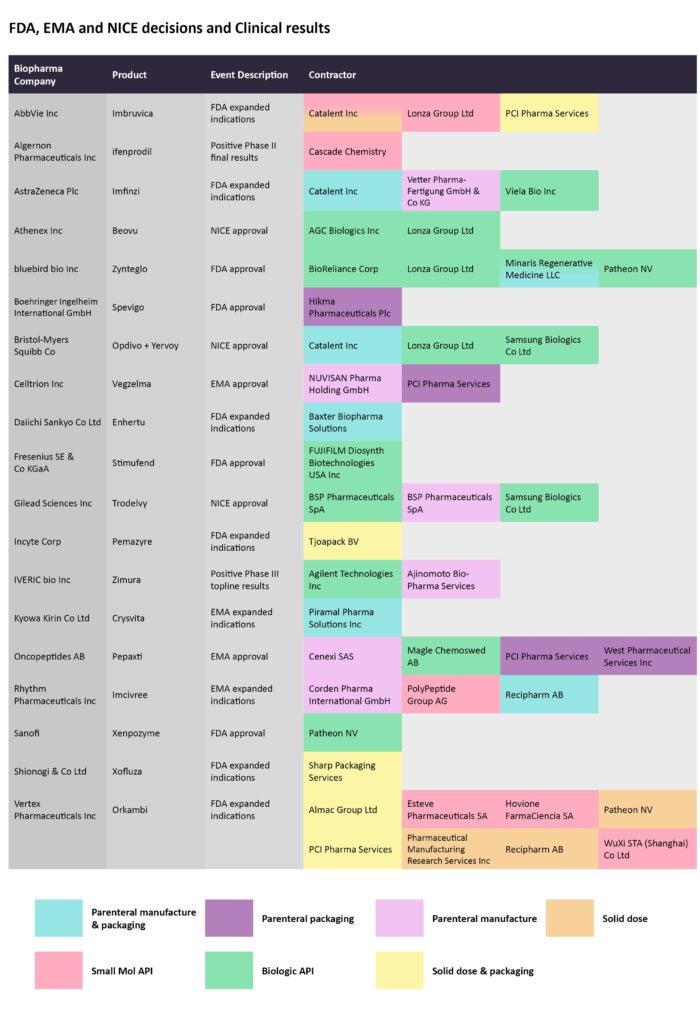

Regulatory decisions by agencies like the FDA, EMA, and the UK’s NICE are key for any company to market its product. But successfully manufacturing that product after approval is key to making any dent in a company’s balance sheet. This is where CMOs come in. Pharmaceutical Technology takes a look at such regulatory calls since late August and in the month of September and the CMOs contracted to manufacture the approved therapies.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

This analysis is based on the GlobalData Pharma Intelligence Center’s Deals database and PharmSource reports. These contracts are designated for parenteral manufacturing and packaging, manufacturing small molecule and biological APIs, and solid dose manufacturing among different functions.

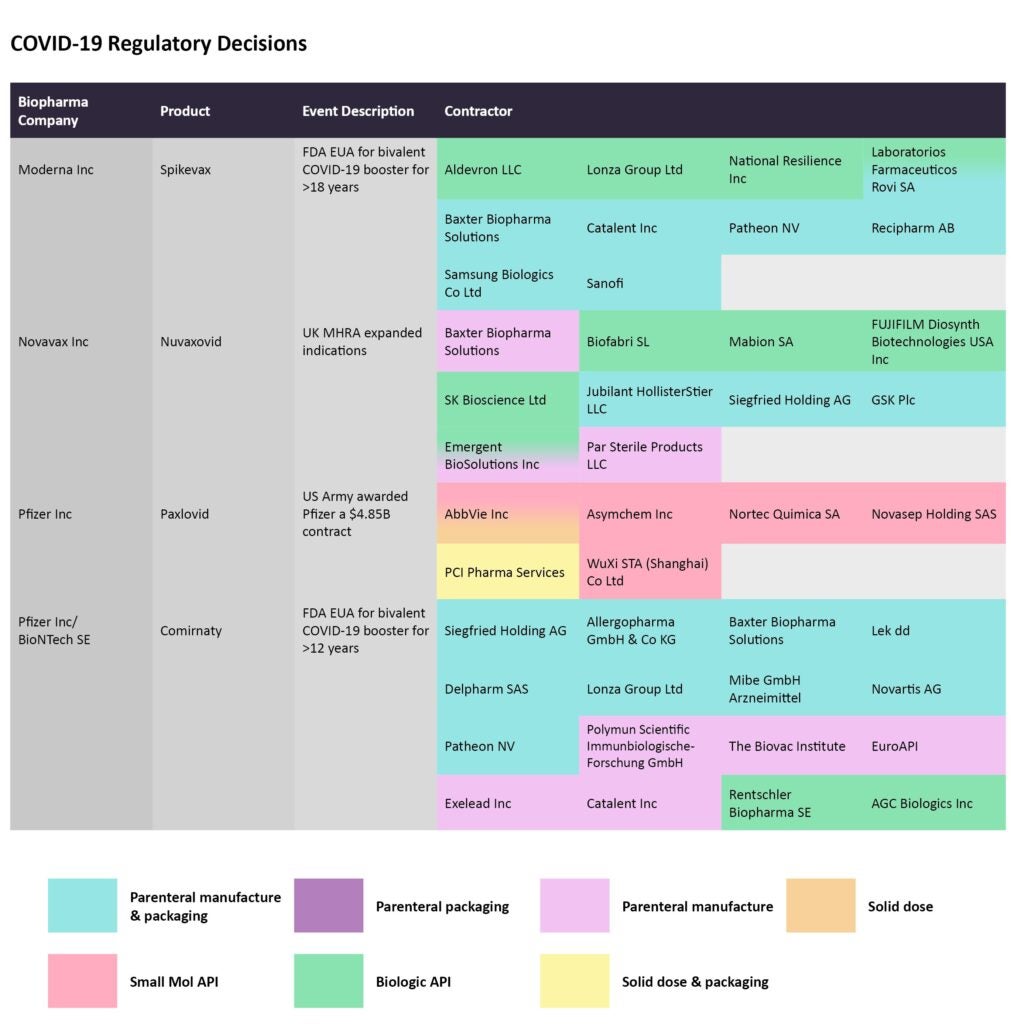

Covid-19 regulatory decisions

After being delayed by manufacturing hurdles, Novavax’s Covid-19 vaccine Nuvaxovid has hit its stride with successive authorizations. Most recently, the vaccine was approved by the UK’s Medicines and Healthcare products Regulatory Agency (MHRA) for use in adolescents aged 12-17 years of age. Biofabri SL, Mabion SA, Fujifilm Diosynth Biotechnologies USA, SK Bioscience, and Emergent BioSolutions are enlisted to manufacture the biological API.

Source: GlobalData Pharmaceutical Intelligence Center

Pfizer bagged a $4.85 billion contract to supply the oral Paxlovid (nirmatrelvir/ritonavir) to the US Department of Defense (DoD). On September 7, this modification to the supply contract was announced by the DoD. Several entities are contracted to manufacture the Covid-19 antiviral. AbbVie, Asymchem, Nortec Quimica SA, Novasep Holding SAS, and Wuxi STA Co,a subsidiary of WuXi AppTec are all in charge of manufacturing the small molecule API.

Bivalent formulations of Covid-19 vaccines from both Moderna and Pfizer/BioNTech received FDA emergency use authorizations for use as boosters. The updated boosters consist of the initial SARS-CoV-2 strain and another strain that is common between the BA.4 and BA.5 lineage of the Omicron variant.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataIn the case of Pfizer/BioNTech’s Comirnaty, Rentschler Biopharma SE and AGC Biologics are manufacturing the biologic API, while Aldevron, Lonza, National Resilience Inc, and Laboratorios Farmaceuticos Rovi are producing the biologic API for Moderna’s Spikevax.

FDA and EMA decisions drive manufacturing volumes

Imbruvica, marketed by AbbVie and Janssen Biotech, is a kinase inhibitor that is approved to treat several types of cancer, including mantle cell lymphoma and chronic lymphocytic leukemia, among others. On August 24, the FDA expanded its label to include its use as a treatment of pediatric patients with graft versus host disease (GvHD), after the failure of one or more lines of systemic therapy. Catalent and Lonza are contracted to manufacture the small molecule API, while PCI Pharma Services is responsible for the solid dose and packaging. Catalent is also contracted for solid dose production.

Source: GlobalData Pharmaceutical Intelligence Center

Bluebird bio was in the news for its successive approvals in the last two months. In August, Zynteglo was approved to treat beta-thalassemia, while in mid-September, the gene therapy Skysona was approved as a treatment for cerebral adrenoleukodystrophy. Both were considered as landmark decisions given the first-in-class nature of these gene therapies.

BioReliance Corp, Lonza, Minaris Regenerative Medicine, and Patheon, by Thermo Fisher Scientific, are contracted to manufacture Zynteglo.

The FDA also expanded the scope of Incyte’s Pemazyre, a targeted therapy, to also treat relapsed or refractory myeloid/lymphoid neoplasms with fibroblast growth factor receptor 1 (FGFR1) rearrangement. The Dutch pharmaceutical packaging company Tjoapack BV is contracted for the solid dose and packaging of this drug.

On August 18, Celltrion Healthcare won an EMA approval for its bevacizumab biosimilar Vegzelma to treat metastatic breast cancer and non-small cell lung cancer, among different cancer types. PCI Pharma Services is enlisted for the parenteral packaging while Nuvisan Pharma Holding is responsible for the parenteral manufacturing.

To read the previous editions in this series, click here, here and here.